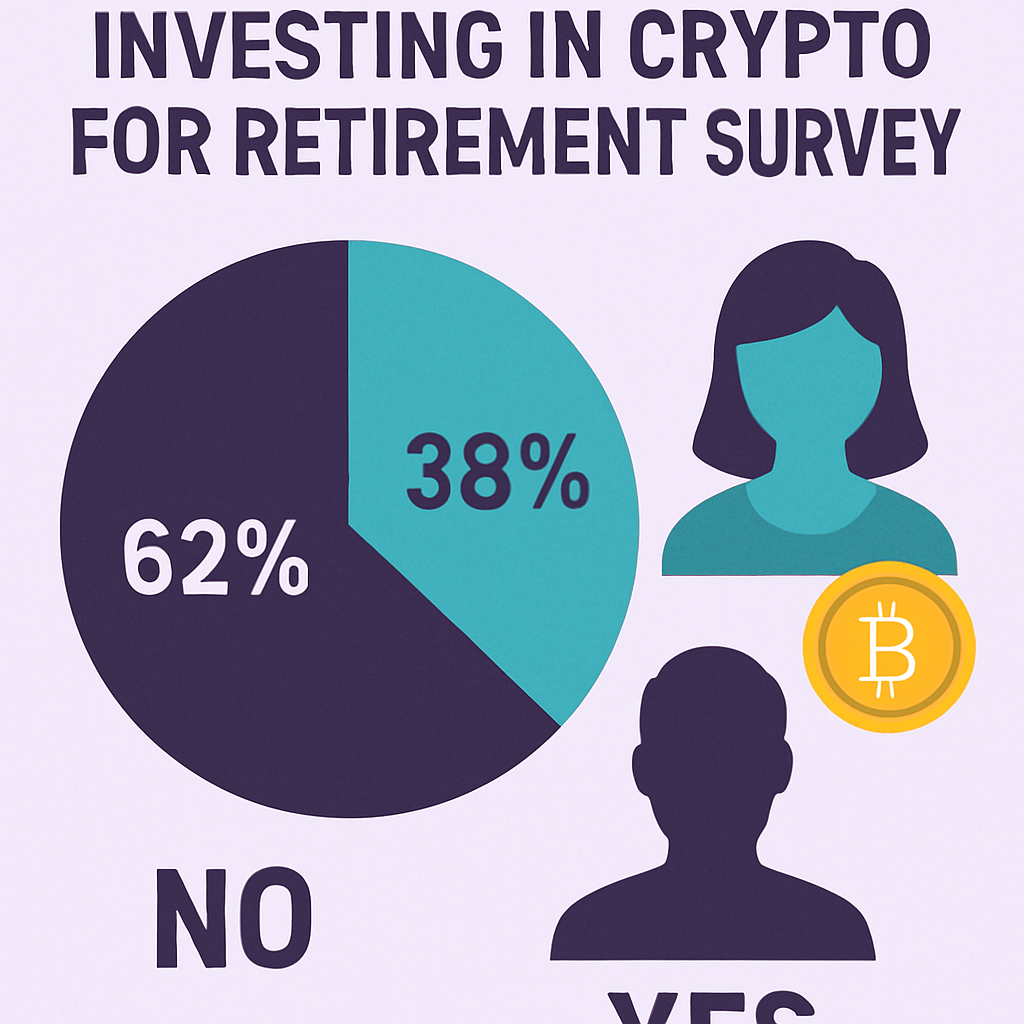

Survey Findings

UK insurance firm Aviva commissioned a poll of 2,000 British adults between June 4 and 6. Results indicate that 27% would consider adding crypto assets to retirement funds, while 23% would withdraw existing pension holdings to invest in digital tokens.

Pension Market Implications

UK pension assets total approximately £3.8 trillion ($5.12 trillion), suggesting meaningful capital flows if adoption scales. Industry analysts note that even marginal pension allocations could inject billions into crypto markets, fueling further growth in sector infrastructure and product offerings.

Demographic Breakdown

- Age 25–34: Highest interest in pension withdrawals (23%).

- Overall Crypto Holders: 20% of respondents had prior crypto exposure.

- Risk Awareness: 41% flagged security risks, 37% cited regulatory uncertainty, and 30% noted volatility concerns.

Regulatory Landscape

The UK government unveiled a proposed crypto framework in May, focusing on exchange licensing, compliance, and consumer protection. Sector stakeholders await further clarity on tax treatment and fiduciary guidelines for retirement account inclusion.

Industry Commentary

“We mustn’t forget the value of the good old pension. Employer contributions and tax relief remain powerful long-term drivers of retirement outcomes.”

— Michele Golunska, Aviva MD of Wealth & Advice

Next Steps

Pension fund managers and platform operators are evaluating integration pathways, including risk-adjusted crypto-linked products and advisory services. Widespread adoption hinges on robust custody solutions and transparent regulatory guardrails.

Comments (0)