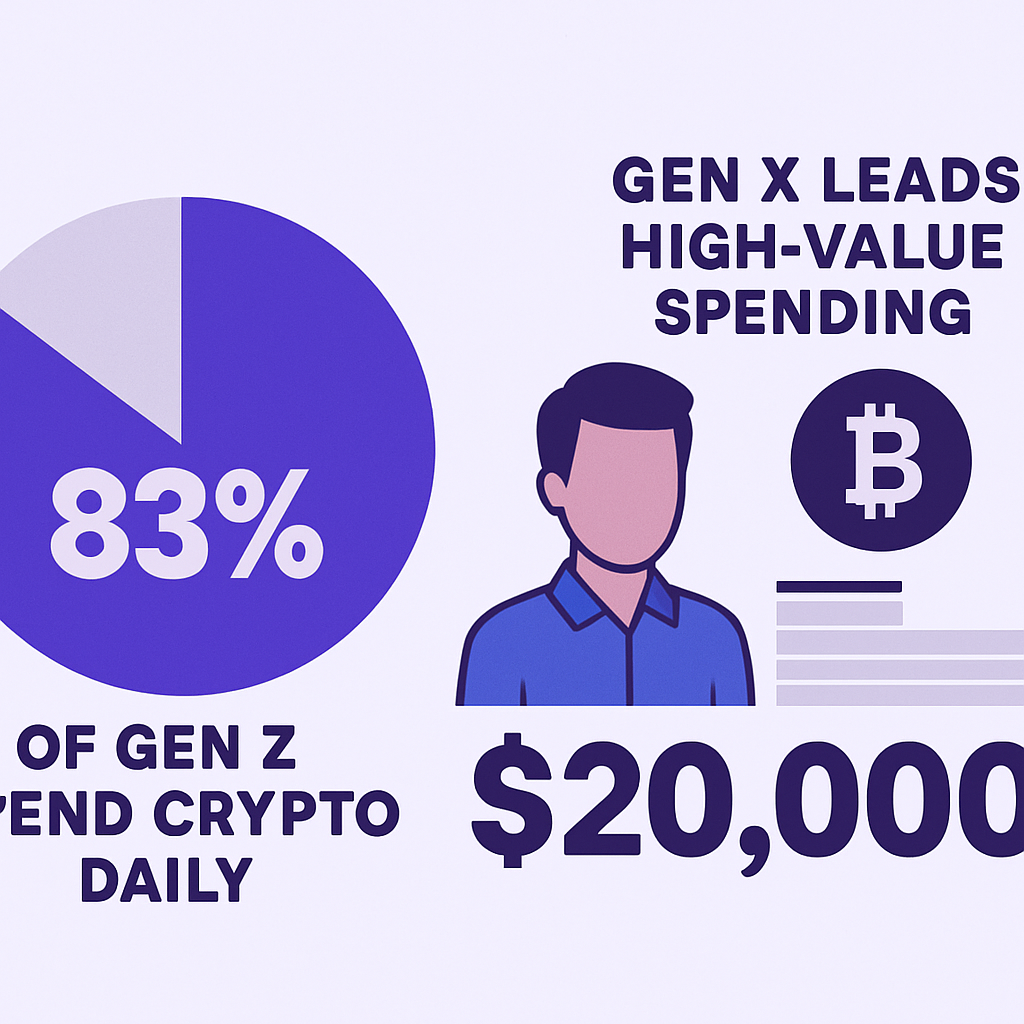

A global survey conducted by Bitget Wallet among 4,599 cryptocurrency wallet users revealed generational differences in spending patterns, with 36% of Gen Z respondents reporting the use of digital assets for everyday purchases like gaming, subscriptions and travel bookings. Gen Z’s preference for crypto payments reflects increased merchant acceptance and seamless integration via QR codes and card interfaces, enabling small-ticket transactions without the need to navigate centralized exchanges. In contrast, Gen X participants led high-value spending, with 40% using crypto for larger transactions including real estate, luxury goods and international remittances, suggesting a shift toward digital asset utilization for wealth preservation and cross-border capital movement.

The survey highlighted regional variations: Southeast Asian users demonstrated the highest adoption for gaming and gifting at 41%, while East Asia saw 41% of daily purchase usage. In underbanked regions such as Africa, 38% utilized crypto for educational and cross-border payments, bypassing traditional remittance channels and lowering transaction costs. Latin American respondents favored crypto for online shopping, reflecting a growing digital economy, and Middle Eastern users exhibited strong demand for luxury purchases via digital assets. Merchant integration across these regions was driven by platforms like Crypto.com Pay, following a recent MOU with Emirates airline to enable inflight crypto payments.

Bitget Wallet’s chief marketing officer, Jamie Elkaleh, noted that enhanced user experience features—such as stablecoin payout options, multi-currency on-ramp support and low-fee micropayment rails—are key enablers of regular crypto usage. The findings underscore the maturation of digital assets beyond speculative instruments, illustrating how diverse demographics are leveraging blockchain technology to address real-world financial needs. As merchant ecosystems continue to expand and regulatory frameworks evolve, consumer crypto spending is poised to grow further, reshaping payment infrastructures and consumer finance globally.

Comments (0)