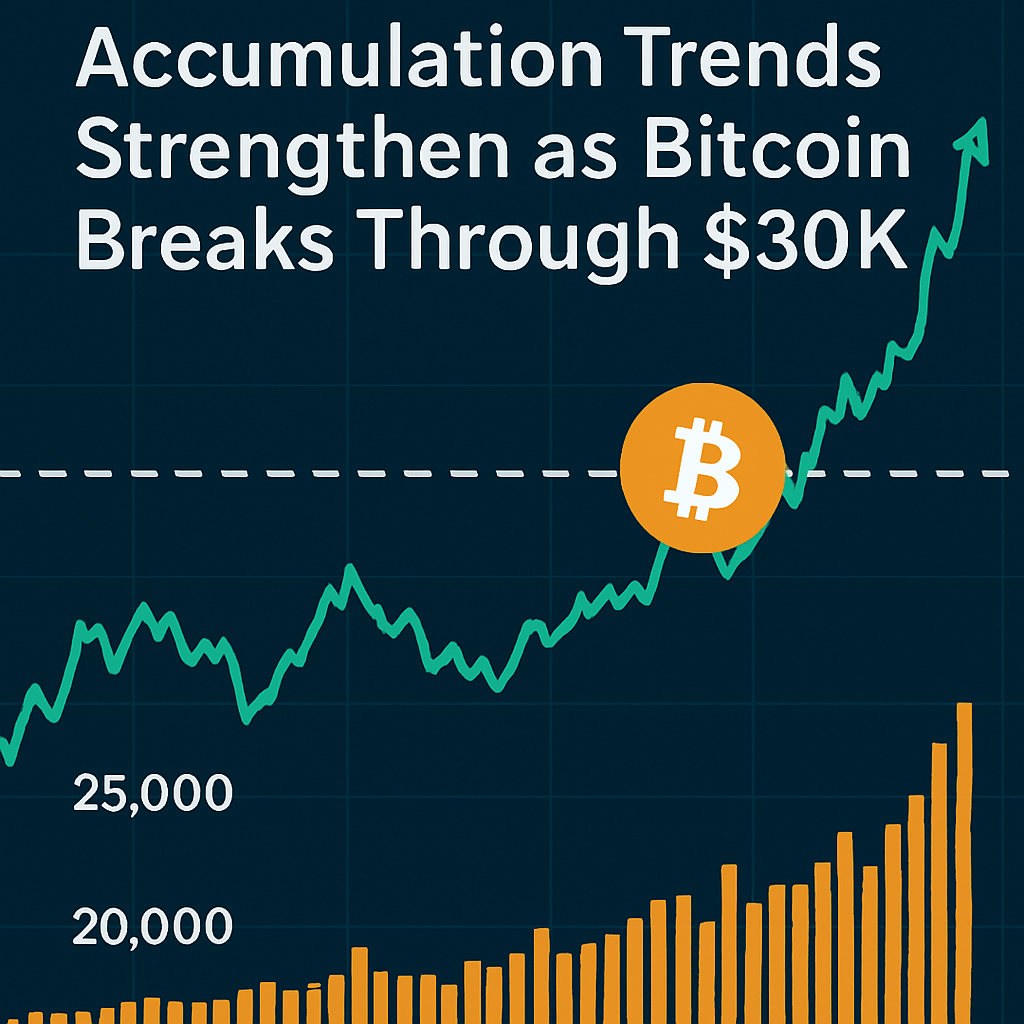

Shift from Distribution to Accumulation

The Accumulation Trend Score, a 15-day moving metric tracking the balance between buying and selling pressure, climbed to 0.62, surpassing the neutral 0.5 threshold for the first sustained period since August. This shift indicates that aggregate market demand has begun to outweigh selling pressure across multiple wallet cohorts. Mid-size holders, defined as addresses holding between 10 and 1,000 BTC, have shown the most pronounced change, with notable inflows reversing prior weeks of coin distribution. Retail participants, holding fewer than 10 BTC, have also slowed net outflows and begun incremental accumulation, marking a broader participation in the rally.

Whale Behavior and Institutional Influence

Despite the overall bullish trend, wallets with balances above 10,000 BTC remained net distributors, extending a selling pattern that has persisted since late summer. The continued distribution by large holders suggests profit-taking at elevated price levels and highlights a divergence between institutional and retail sentiment. On-chain data indicates that realized profit by whales has reached multiweek highs, while mid-size and retail cohorts maintain fresh cost bases near current price levels, creating a floor for potential support.

Price Performance During U.S. Sessions

During the U.S. market open from Monday through Thursday, Bitcoin recorded an 8% gain, rising above $121,000 and touching its highest level since August. The consistent intraday performance reflects increased participation from American trading desks and highlights the growing sensitivity of Bitcoin to U.S. macroeconomic catalysts. The confluence of liquidity expectations from potential Fed rate cuts and renewed ETF inflows has underpinned the price advance.

Outlook and Risks

Market participants are monitoring upcoming catalysts including ETF decision deadlines for major altcoins and the approach of Ethereum’s Fusaka network upgrade. Sustained on-chain demand growth hinges on ETF allocations and renewed institutional commitments. However, potential headwinds include profit-taking by large holders and macro uncertainty if economic data releases resume following the government shutdown. The balance between distribution by whales and accumulation by mid-size and retail cohorts will be critical in determining the sustainability of the current rally.

Comments (0)