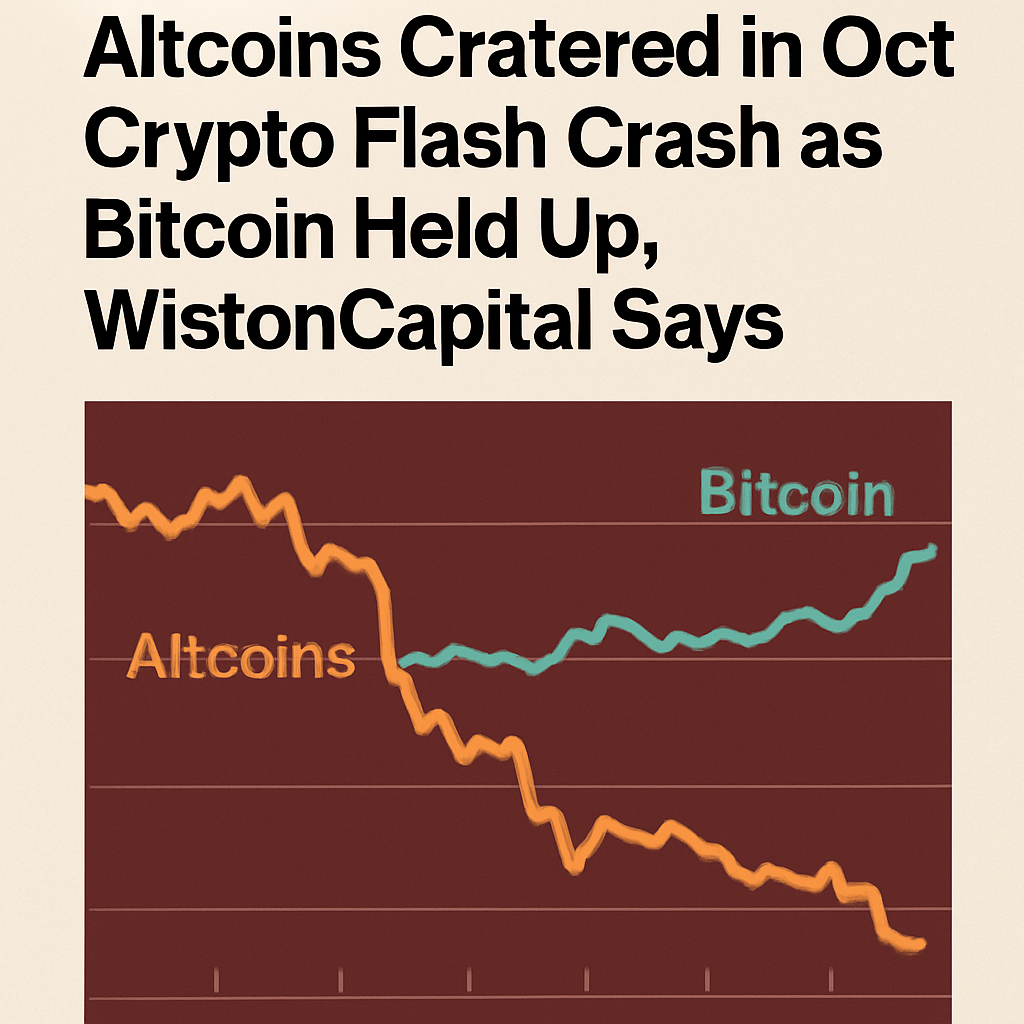

Friday’s crypto flash crash on Oct. 10 triggered a rapid, leverage-driven sell-off that sent altcoins tumbling approximately 33% in under half an hour, resulting in over $18.7 billion in liquidations across the market. Bitcoin displayed relative resilience, declining modestly compared to its broader altcoin counterparts.

Charlie Erith, Founder of Wiston Capital, quantified the total market value wiped out since Oct. 6 at around $560 billion, representing 13.1% of combined crypto market cap. The sharp dislocation underscored systemic vulnerabilities linked to leveraged positions and concentrated margin calls.

In his post titled “Crypto Crumble,” Erith highlighted that the primary trigger coincided with President Trump’s announcement of a prospective 100% tariff on Chinese imports, though he emphasized that broader market frailties had already set the stage for an abrupt downturn.

Erith identified key technical signals to monitor: bitcoin’s 365-day exponential moving average (EMA), a long-term trend indicator delineating bullish from corrective regimes; market breadth, proxied by bitcoin’s share of total crypto value; and the VIX, reflecting broader equity-market fear sentiment.

The crash saw non-bitcoin tokens experiencing “immense technical damage,” while bitcoin’s steadier performance reinforced its narrative as a digital safe-haven asset, with its dominance rising amid the scramble for liquidity.

Erith noted that brief rotations into high-liquidity assets like bitcoin typically precede deeper market resets when breadth indicators weaken persistently. He advocates caution in high-beta tokens until non-bitcoin charts demonstrate structural repair.

Positioning strategies at Wiston Capital remained defensively tilted, avoiding leverage and maintaining cash on hand to weather volatility spikes. Erith stressed that volatility clusters often precede better entry points post-crash, advising patience over immediate re-leveraging.

The episode bore resemblance to historical “portfolio insurance” breakdowns, where hedging mechanisms designed for normal markets become procyclical accelerants in extreme stress conditions. Arbitrage channels broke down as market makers lost access to primary venues amid infrastructure constraints.

Looking ahead, support at bitcoin’s EMA near $100 000 will be critical; a sustained breach could signal a deeper drawdown, while a successful bounce may reaffirm the broader uptrend.

Meanwhile, the VIX’s trajectory will provide insights into cross-asset sentiment, as rising volatility in equities often correlates with cautious stance in crypto, reinforcing the role of macro factors in shaping digital asset risk premiums.

For altcoin stakeholders, structural rebuilds in token-specific charts and improved on-chain fundamentals will be necessary to restore confidence. Until then, heightened caution and focus on proven, liquid assets remain prudent.

Erith’s analysis underscores the persistent importance of technical frameworks and macro overlays in navigating crypto markets, especially during periods of rapid deleveraging.

As market participants digest the crash’s implications, risk management protocols and position sizing strategies will likely evolve to mitigate the impact of future volatility cascades.

In sum, the Oct. 10 flash crash accentuated the need for robust liquidity reserves and disciplined exposure limits, with bitcoin’s relative outperformance reaffirming its role as a cornerstone asset in diversified crypto portfolios.

Comments (0)