Background of Sanctions

Belarus has faced multiple waves of international sanctions in response to political actions and human rights concerns. Financial restrictions imposed by European Union and United States authorities have limited access to banking services and foreign currency inflows.

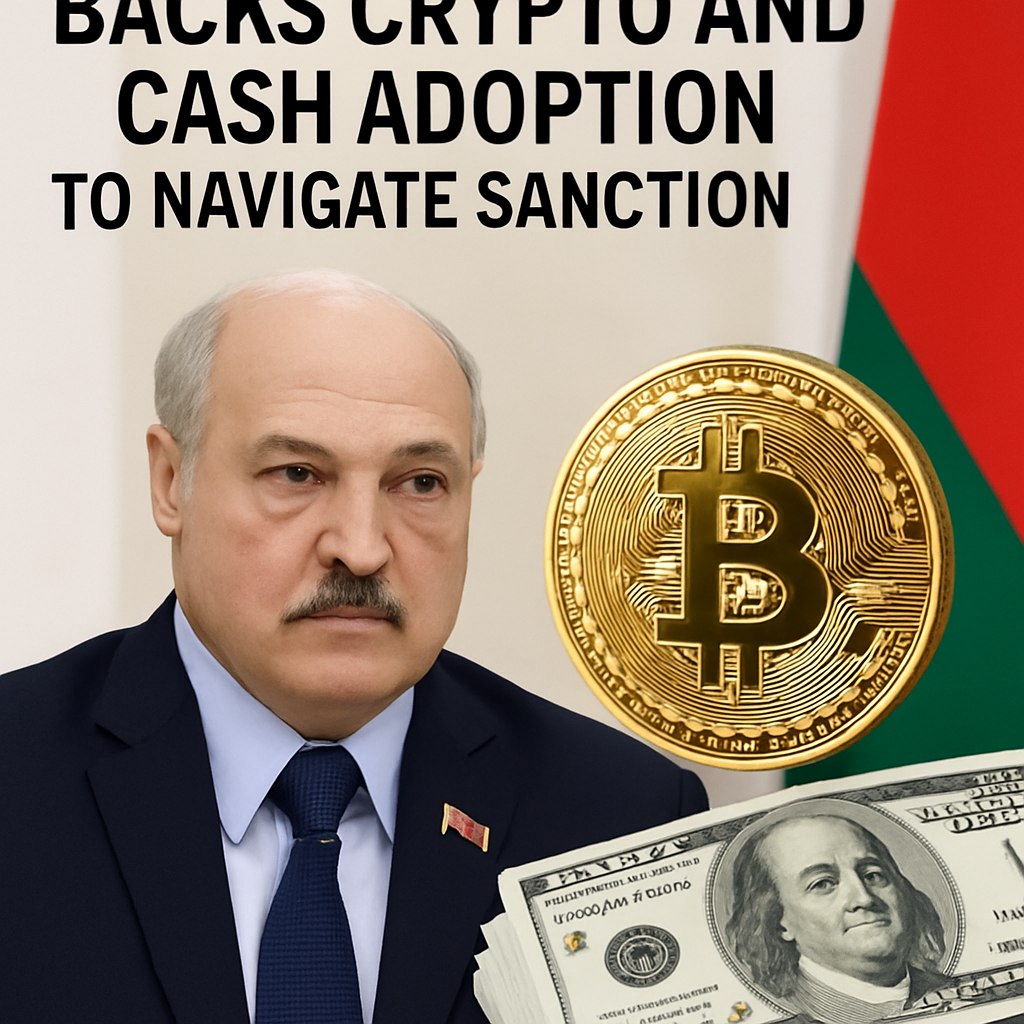

Government Advocacy for Crypto

At a high-level meeting with central bank officials and commercial banking leaders, President Aleksandr Lukashenko urged acceleration of cryptocurrency and cash payment adoption. Regulatory oversight was described as necessary measure to ensure transparent market operations and prevent abusive banking practices.

Instruction for an instant payment system rollout by year-end targets enhancement of real-time transfer capabilities and improvement of domestic liquidity conditions. Use of cryptocurrency-based solutions was presented as vital tool for maintenance of trade flows amid external financial pressure.

Banking Sector Criticism

Criticism leveled at banking institutions focused on mandatory insurance protocols and refusal to accept old currency notes. Disciplinary action threats for abusive practices were outlined with a timeline set to 2026 for enforcement of corrective measures.

Economic Resilience Measures

Gold and foreign exchange reserves reached record levels of $12.5 billion, buoyed by rising gold prices. National de-dollarization strategy involved daily sales of $30 million in foreign cash to stabilize reserves and mitigate currency depreciation risks.

Regulatory Framework Development

Regulator agenda included finalization of cryptocurrency framework to position Belarus as regional hub for digital asset innovation. Acceleration of legal clarity for digital asset operations was linked to sustained growth of fintech sector and attraction of investment.

Potential risks identified within market integration efforts included volatility management, cybersecurity safeguards and client protection. Oversight committees were directed to draft guidelines for licensing of crypto service providers and develop monitoring protocols for AML/CFT compliance.

Future Prospects for CBDC and Private Crypto

Consideration of central bank digital currency issuance interacts with private crypto adoption. Potential development of Belarus Digital Ruble concept was mentioned in earlier state drafts. Integration of central bank digital currency with private crypto infrastructure may offer hybrid solution for cross-border settlement and retail payment facilitation.

International Implications

Adoption of cryptocurrency within sanctioned economy may inspire similar strategies in other jurisdictions experiencing financial isolation. Use of decentralized payment channels could influence global discussions on digital currency regulation and central bank digital currency development.

Conclusion

Recent government directive signals shift toward diversified payment infrastructure and regulatory modernization. Acceleration of cryptocurrency adoption alongside cash payments aims to enhance economic resilience and support strategic objectives amid geopolitical constraints.

.

Comments (0)