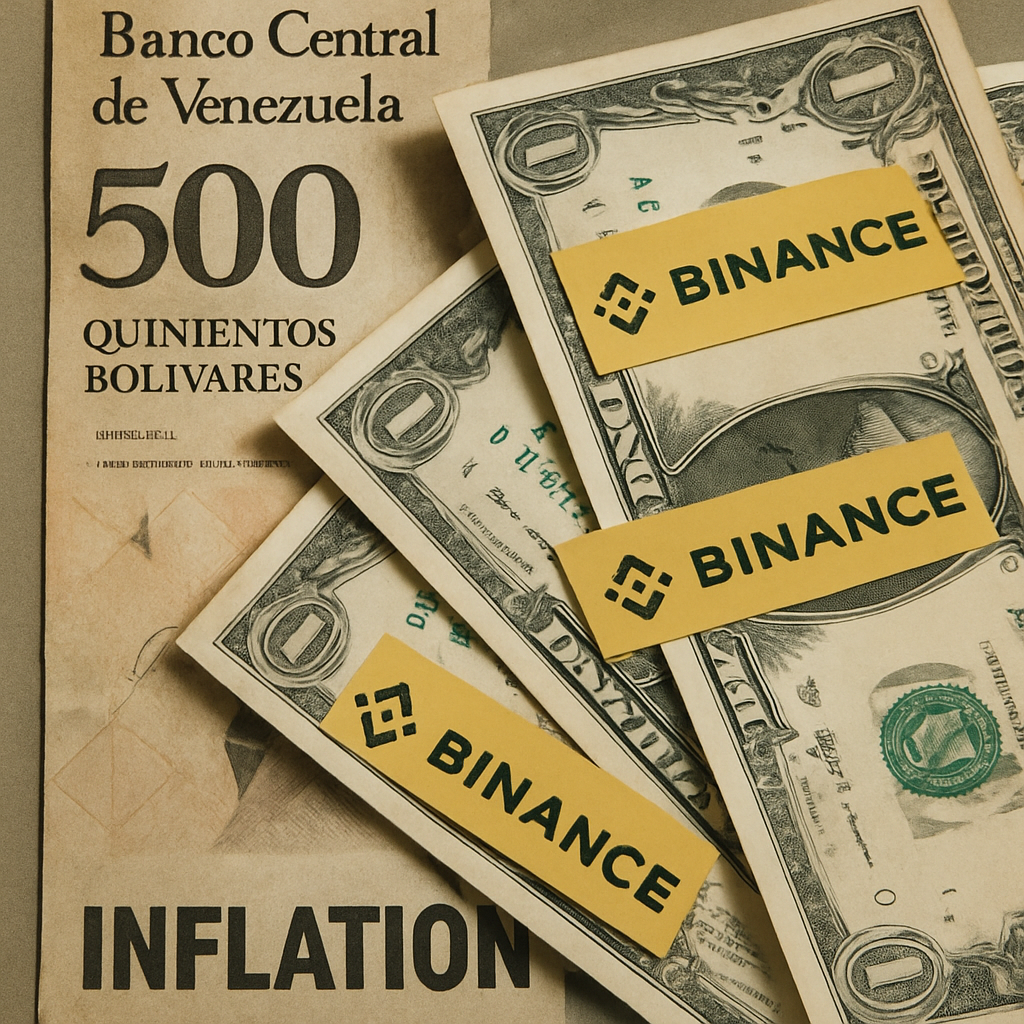

As Venezuela’s annual inflation rate soared to 229 percent, stablecoins like Tether USDt have become the preferred medium of exchange for millions of residents. Known locally as “Binance dollars,” USDt is widely used for groceries, rent, salaries and vendor payments, offering a stable store of value compared with the bolívar. Mauricio Di Bartolomeo, co-founder of Ledn, noted that stablecoins have shifted from niche crypto tools to mainstream financial instruments.

Venezuela’s bolívar has collapsed under hyperinflation, eroding trust in cash and prompting businesses of all sizes to adopt stablecoins. Official and parallel market exchange rates for the U.S. dollar stand at 151.57 and 231.76 bolívars, respectively, while USDt trades on Binance at 219.62. USDt’s liquidity and accessibility have made it the settlement method of choice across social classes, effectively functioning as a parallel currency.

Chainalysis’ 2025 Global Crypto Adoption Index ranks Venezuela 18th globally and ninth when adjusted for population, highlighting robust crypto usage under extreme economic stress. Stablecoins accounted for 47 percent of all transactions under $10 000 in 2024, with overall crypto activity up 110 percent year-on-year. Di Bartolomeo said even routine expenses such as condominium fees and security services are now quoted and paid in USDt.

Venezuela’s capital controls and fractured exchange rate landscape have driven parallel markets for foreign currency and digital assets. Official U.S. dollar allocations are typically granted to regime-connected entities, which resell dollars at higher rates. This dynamic has reinforced stablecoins’ role as a financial equalizer and hedge against government-imposed currency restrictions.

Other emerging economies with high inflation—such as Argentina, Turkey and Nigeria—are experiencing similar upticks in stablecoin adoption. Central banks in these regions are exploring digital currency pilots, but lack of clear regulatory frameworks has left stablecoins as the leading de facto solution for preserving purchasing power.

Despite regulatory uncertainty, stablecoins are becoming embedded in Venezuela’s payment infrastructure. From small street vendors to corporate payrolls, USDt offers near-instant settlement, minimal fees and transparent on-chain records. As monetary instability persists, stablecoins may continue to displace failing fiat currencies, reshaping financial practices in hyperinflationary environments.

Comments (0)