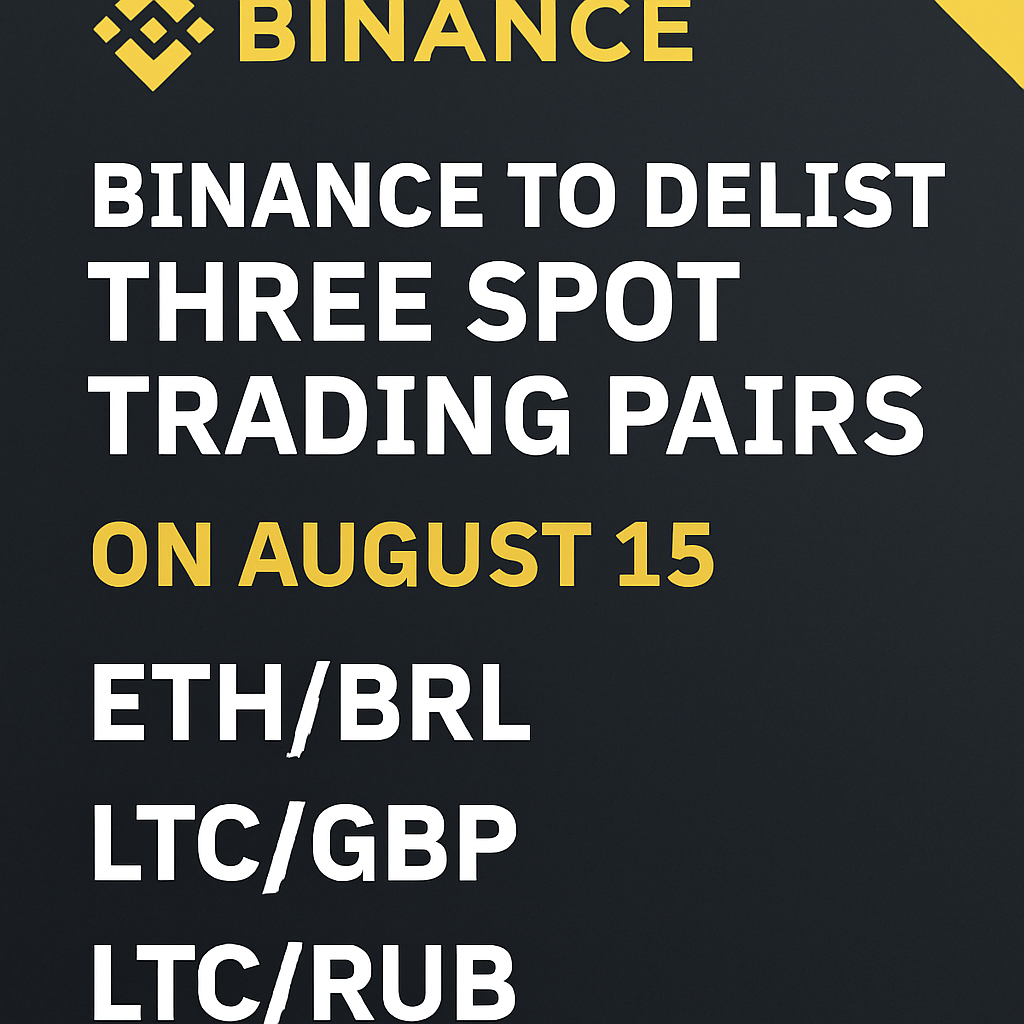

Binance has scheduled the delisting of three underperforming spot trading pairs—ANIME/FDUSD, HYPER/FDUSD, and STO/BNB—effective August 15 at 03:00 UTC. The exchange cited insufficient liquidity metrics and a lack of active trading interest as primary factors. Removal of these pairs aligns with ongoing efforts to optimize market quality and ensure capital efficiency across trading venues.

Post-delisting procedures will automatically cancel any open orders for the affected pairs at the specified time. Traders holding positions in these markets must close orders manually beforehand or risk involuntary termination. Underlying tokens—ANIME, HYPER, STO, FDUSD, and BNB—will remain supported within Binance’s ecosystem for withdrawal and conversion against other listed pairs or fiat gateways.

Historic data showed that average daily trading volumes for the delisted pairs consistently fell below the minimum threshold set by the platform’s listing criteria. Ongoing asset reviews assess factors such as price stability, community engagement, smart contract audits, and regulatory compliance. The decision reflects the dynamic nature of digital asset markets and the necessity of maintaining robust trading environments.

Communication channels will deliver real-time alerts to affected users via platform notifications and email. Traders are advised to review portfolio dashboards and leverage alternative liquidity paths before the deadline. In cases where no replacement pair exists, direct withdrawals to external wallets are recommended to avoid exposure to market risk following delisting.

Industry observers note that periodic pair removal helps prevent spread widening and slippage issues in low-volume contexts. Institutional participants often rely on select liquid pairs to facilitate algorithmic strategies and high-frequency execution. Streamlining the trading book through delisting underutilized markets can concentrate liquidity in primary trading corridors.

Binance maintains a transparent delisting policy, publishing regular updates and criteria for asset evaluation. Future delistings will adhere to predetermined governance frameworks, incorporating community feedback and compliance requirements. Traders are encouraged to monitor Binance’s official announcements page for additional changes to the listing roster.

Comments (0)