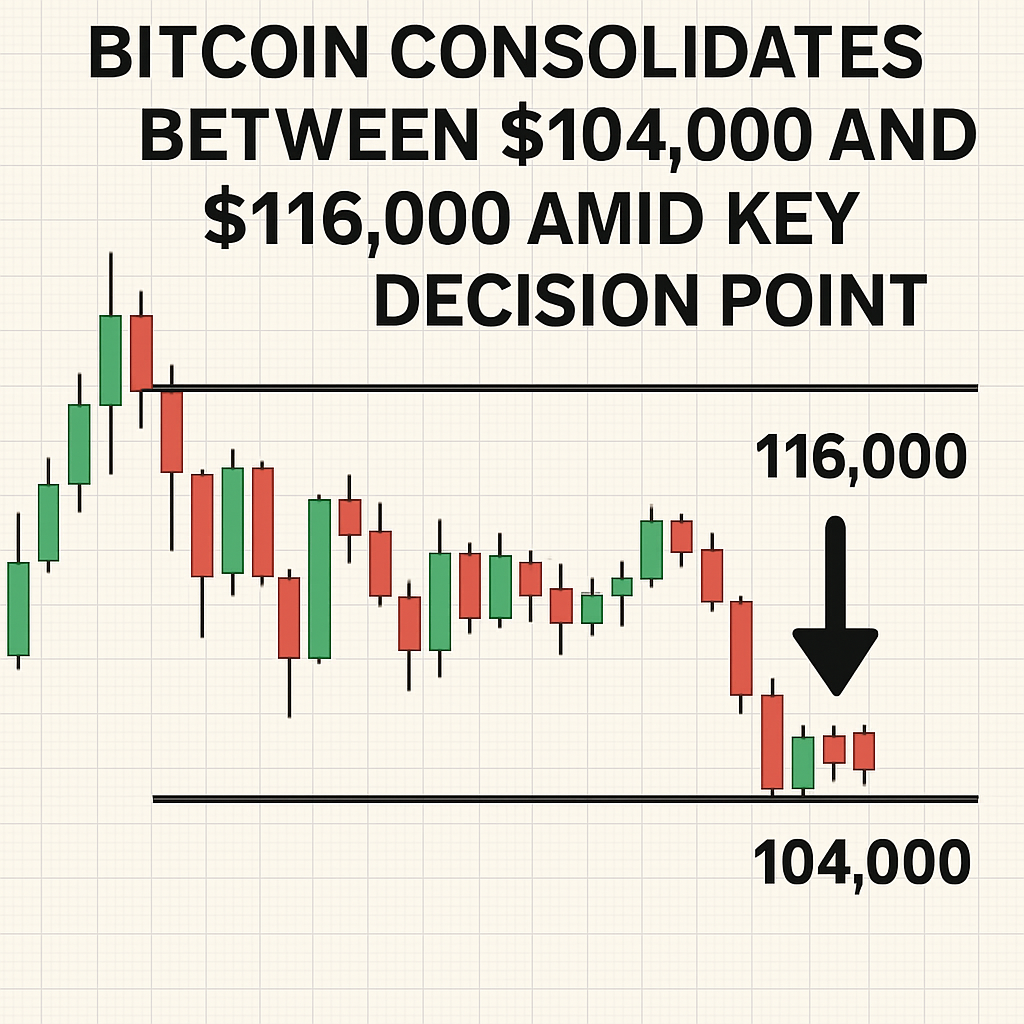

Bitcoin price action has entered a consolidation phase, oscillating within defined support and resistance levels between $104,000 and $116,000. This range forms after a recent high near $124,000, marking a notable corrective interval following intense market enthusiasm. On-chain analytics reveal that investors accumulated heavily during the pullback, particularly around the $108,000 price band. This accumulation filled a pronounced cost-basis gap, suggesting that dip buyers were active in maintaining market stability.

Analysis of the UTXO Realized Price Distribution shows the 0.85 and 0.95 quantile cost basis levels correspond to approximately $104,100 and $114,300, respectively. Historically, these quantile regions act as consolidation corridors following euphoric peaks, often resulting in choppy sideways trading rather than decisive breakouts. If price breaches below the lower quantile at $104,100, the market may replay post-all-time-high exhaustion phases observed earlier in the cycle. Conversely, a sustained move above $114,300 would indicate renewed demand control and could catalyze a return toward recent highs.

Short-term holders face rising pressure, with profit percentages plummeting from above 90% to closer to 42% as prices declined to $108,000. Such profit compression typically leads to fear-driven selling before seller exhaustion enables a rebound. Currently, over 60% of short-term holders remain in profit, indicating a neutral positioning that could support either further consolidation or a directional breakout.

Market participants and institutions are closely monitoring these levels for clues to the next directional leg. Technical indicators, funding rates, and derivatives positioning should be observed in tandem with on-chain metrics to gauge potential shifts in momentum. A decisive break from this consolidation range may shape market sentiment for the coming weeks, defining whether Bitcoin resumes its bullish trend or enters a deeper corrective phase.

Comments (0)