Record Outflows Across Bitcoin and Ether ETFs

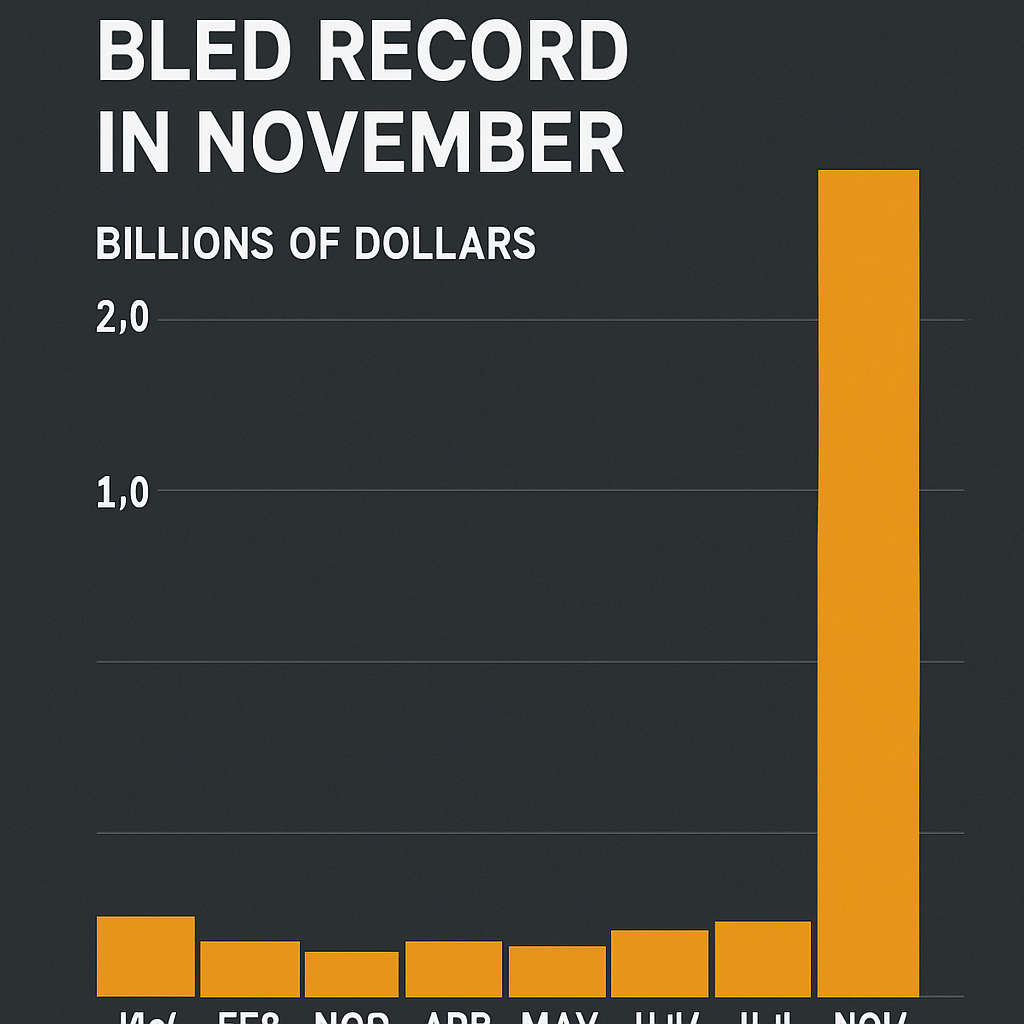

Data for November 2025 reveal that U.S.-listed spot bitcoin exchange-traded funds (ETFs) have registered collective net outflows of $3.79 billion, setting a new monthly record and surpassing the previous high of $3.56 billion posted in February 2025. The phenomenon reflects a broad investor rotation out of digital asset funds amid heightened market volatility and risk-off sentiment. Notably, BlackRock’s iShares Bitcoin Trust (IBIT), currently the largest spot bitcoin ETF by assets under management, experienced redemptions exceeding $2 billion this month, indicating a significant reallocation of institutional and retail capital.

Ether ETF Dynamics

Parallel to bitcoin’s outflows, ether-focused ETFs have suffered net redemptions totaling $1.79 billion during the same period. The outflows occurred despite recent on-chain metrics suggesting robust network activity and growing decentralized finance use cases. Investors appear to be prioritizing liquidity preservation and risk mitigation over speculative upside potential. Flow data indicate that ether ETF selling pressure peaked midway through November, correlating with broader downturns in both equity markets and alternative risk assets.

Secondary Uptake in Solana and XRP Funds

Amid the sell-off in primary bitcoin and ether funds, newly launched spot ETFs tied to Solana (SOL) and XRP have observed net inflows of approximately $300.46 million and $410 million, respectively. The relative resilience of these alternative asset products may reflect a diversification strategy among digital asset investors seeking exposure to high-throughput smart contract platforms and on-ramp liquidity tokens. Solana and XRP inflows have been attributed to targeted allocations by hedge funds and algorithmic trading desks betting on technical recovery amid oversold conditions.

Market Implications and Investor Sentiment

The record ETF outflows underscore a shift in investor sentiment from risk accumulation toward liquidity management. The outflow trend aligns with broader macroeconomic uncertainties, including ambiguous Federal Reserve rate paths and the onset of year-end portfolio rebalancing. ETF flows are often viewed as a proxy for institutional demand, and the November data suggest a temporary pullback from digital asset allocations, potentially pressuring spot prices in the near term.

Future Outlook for ETF Flows

Analysts anticipate that record outflows may set the stage for contrarian inflows if market stress subsides and volatility moderates. Historical patterns indicate that extreme outflow events can precede opportunistic buying by long-term holders and liquidity providers. Monitoring ETF flow reversals, alongside on-chain adoption metrics and derivatives market positioning, will be critical for gauging the potential durability of this sell-off and identifying inflection points for renewed capital inflows.

Conclusion

November’s unprecedented ETF outflows highlight the evolving dynamics of institutional crypto demand and the sensitivity of digital asset funds to macro and market-driven headwinds. While spot bitcoin and ether have borne the brunt of investor redemptions, emerging spot funds for alternative tokens have captured a portion of redistributed capital. Market participants will closely observe December flow trends as a barometer for year-end risk tolerances and the resilience of institutional digital asset strategies.

Comments (0)