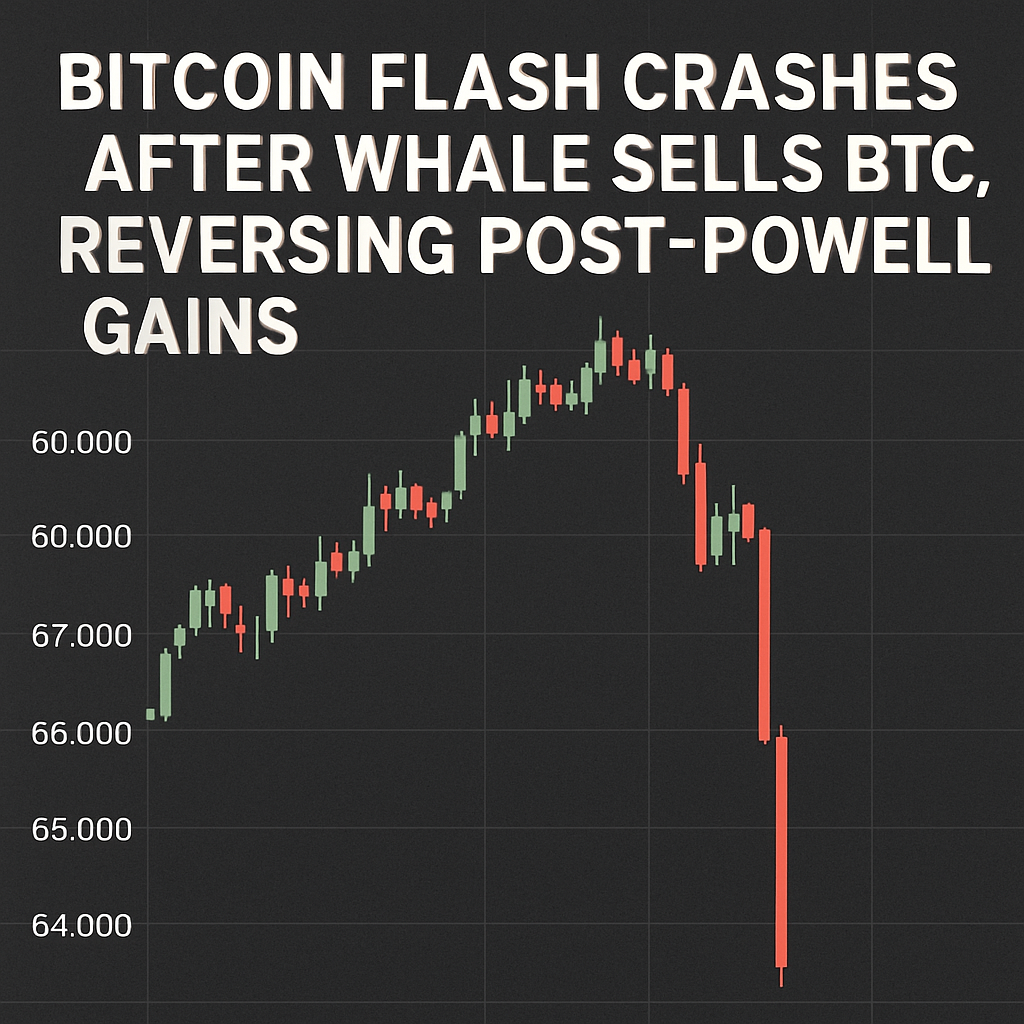

Bitcoin experienced a sudden flash crash on Sunday morning, as on-chain data firm Timechainindex.com reported that an entity sold approximately 24,000 BTC, valued at over $300 million, into thin order books. The sell-off occurred between 07:30 and 07:40 UTC, causing Bitcoin’s price to plunge from $114,666 to a low of $112,430 within ten minutes, before a partial recovery pushed the price back above $112,800. The incident reversed gains spurred by Federal Reserve Chair Jerome Powell’s Jackson Hole speech on Friday, which had initially lifted Bitcoin by nearly 4% when dovish comments on future rate cuts fueled risk-on sentiment across digital assets and equities.

Blockchain analytics show that the whale in question transferred 12,000 BTC earlier in the day and continued to offload the remaining balance throughout the morning session, moving coins through multiple wallet addresses before routing them to Hyperunite, a lesser-known trading venue. Data from Deribit indicates that Bitcoin futures funding rates and options risk reversals turned bearish in response to the abrupt drop, with 25-delta risk reversals shifting deeper into negative territory as put option premiums rose. Traders and market makers scrambled to hedge exposure, driving implied volatilities higher across short-dated contracts, signaling heightened uncertainty about near-term price direction.

The flash crash highlighted the vulnerability of deep market liquidity during off-peak trading hours, especially when a single large sell order hits an order book with limited resting bids. Analysts from Amberdata noted that similar events often occur when institutional players execute block trades without sufficient pre-trade coordination. Despite the initial sell pressure, on-chain flows to centralized exchanges did not spike dramatically post-crash, suggesting that the majority of coins sold were absorbed by over-the-counter desks or internal liquidity pools. Following the crash, Bitcoin rebounded to trade near $112,800 at 09:00 UTC, with market participants watching macroeconomic cues and on-chain signals for indications of further volatility.

Comments (0)