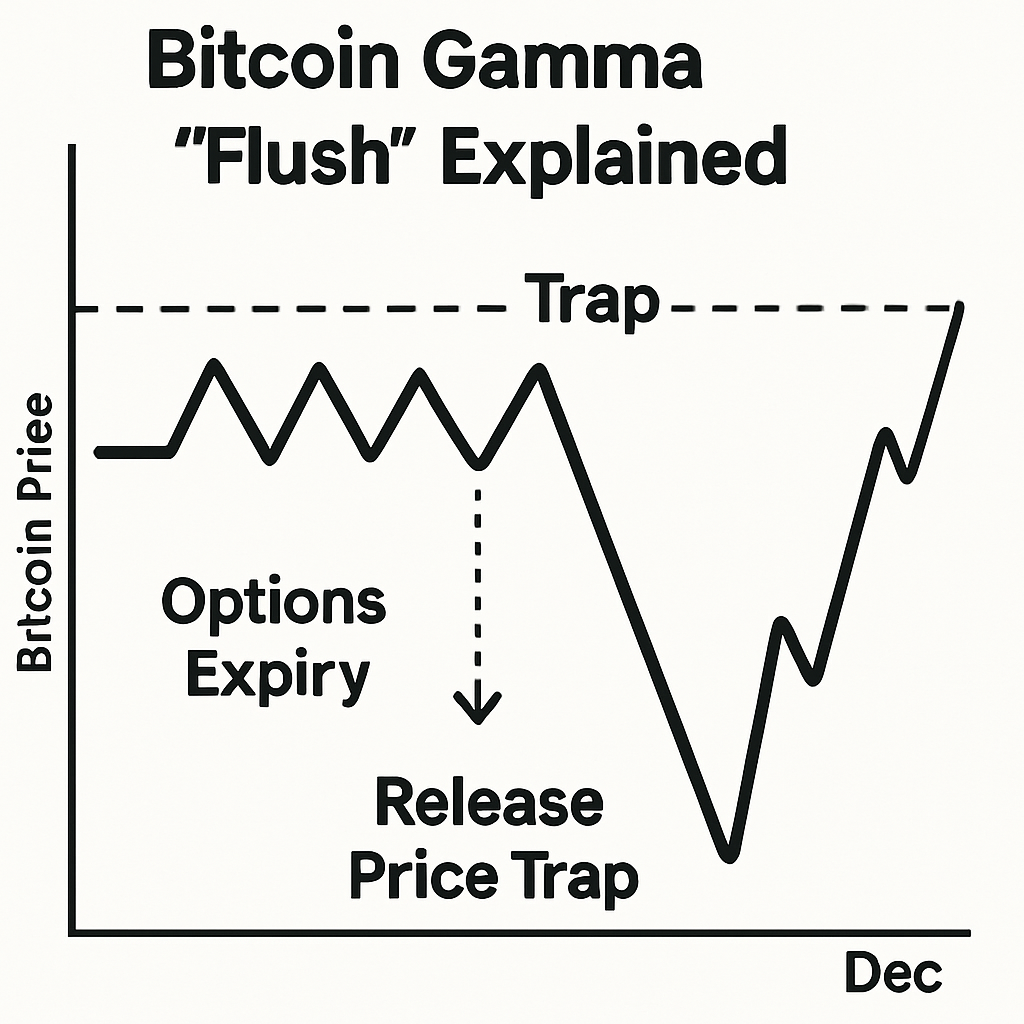

The final week of 2025 brings a historic “gamma flush,” triggered by the December 26 expiration of $23.7 billion in Bitcoin options on Deribit. This event follows a smaller $128 million expiry on December 19 and represents nearly half of total market structure influence through dealer hedging. By eliminating deep out-of-the-money hedges, the gamma flush can unpin Bitcoin from the $85K–$90K range, allowing natural supply-demand forces to dictate price direction.

Dealer gamma refers to the hedging activity market makers undertake to remain delta-neutral, involving dynamic buying and selling of Bitcoin to offset options exposure. As large blocks of options vanish upon expiry, these hedges unwind en masse, potentially causing rapid inflows or outflows. Stage 1 was the appetizer—a mild flush on December 19—while Stage 2 on December 26 is the main course, unleashing the “boss level” gamma that can liberate Bitcoin price from mechanical range constraints.

Technical analysis points to critical omega: support clusters around $85K–$88K that held during low-liquidity holiday sessions, a flip threshold at $90,616 where momentum could swing bullish, and a discretionary target around $118K based on historical power-law uptrends. Traders should prepare for transient, high-volatility moves as order books respond to reversed hedging flows, with stop-hunts and short squeezes possible if key levels break decisively.

While expiry-driven volatility does not guarantee sustained trend changes, it offers both breakout and breakdown scenarios within compressed timeframes. Monitoring open interest, funding rates, and delta skew market-wide will provide early signals of directional bias. Post-expiry liquidity recovery patterns will then indicate whether traditional market conditions allow continuation of any resulting directional move. The December 26 gamma flush thus stands as a potential catalyst amid year-end positioning and thin holiday order books, spotlighting derivatives mechanics as a driver of price discovery.

Comments (0)