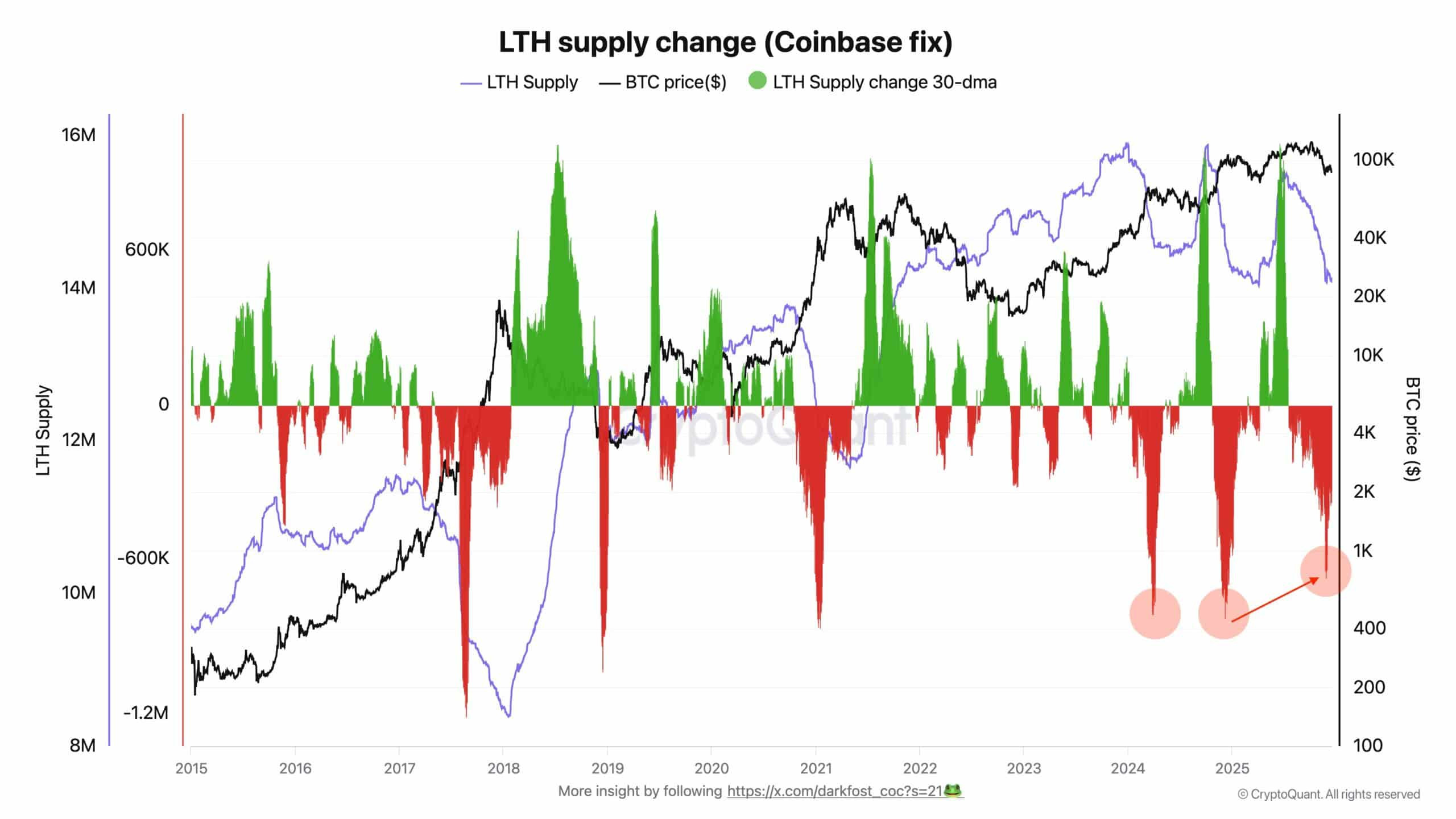

Initial on-chain data appeared to show a significant uptick in Bitcoin long-term holder (LTH) sell-off, raising concerns about waning investor conviction. However, further analysis indicates that much of this movement stemmed from Coinbase’s internal reshuffling of UTXOs, not genuine liquidation of positions.

In late November, Coinbase reportedly moved nearly 800 000 BTC between cold storage and active wallets, effectively resetting UTXO timestamps. This process artificially inflated metrics tracking coins held beyond one year, leading to a misinterpretation of LTH behavior.

When exchange-related transfers are removed from the dataset, LTH sell rates revert to levels consistent with prior market cycles. This normalization underscores steady, rather than panic-driven, selling patterns among long-term investors.

On-chain indicators further support a narrative of accumulation. The NVT Golden Cross has recently signaled that network value outpaces transactional activity, a historical precursor to price inflection points favoring accumulation phases. Meanwhile, Bitcoin’s Relative Strength Index approached oversold territory before rebounding, indicating potential near-term recovery.

Analysts note that these trends reflect a maturing market with increasing institutional involvement and strategic treasuries reallocations. While short-term volatility may persist, the absence of large-scale LTH panic selling bodes well for Bitcoin’s stability and potential price growth toward late 2026 targets.

Comments (0)