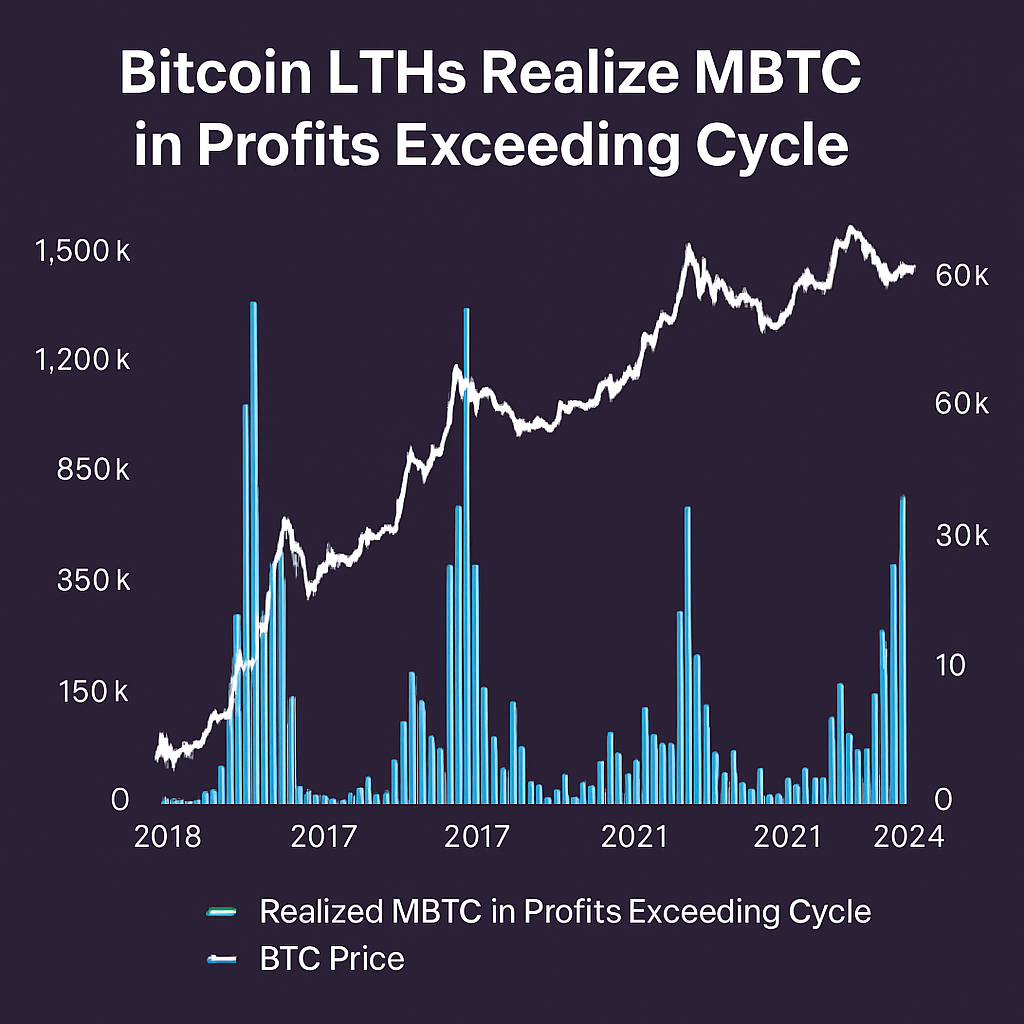

Long-term holders (LTHs) of Bitcoin, defined as wallets which have held positions uninterrupted for at least 155 days, have realized 3.27 million BTC in profits since early 2024. According to on-chain analytics platform Glassnode, this tally surpasses the total realized profits of the entire 2021 bull cycle and ranks as the second highest in Bitcoin’s history after the 3.93 million BTC realized in the 2016–2017 rally. This level of profit-taking underscores a significant rotation of capital from long-dormant addresses into market liquidity as prices climbed above previous resistance levels, marking a pivotal shift in seller behavior.

The methodology for identifying LTHs segments addresses by coin age, excluding wallets that have moved BTC within the past 155 days. This approach isolates investors with durable convictions and captures profit events driven by longer-term accumulation strategies. Over the measurement period, roughly 80,000 BTC emerged from dormant holdings and were tendered to major trading platforms, while an additional 26,000 BTC surfaced in legacy wallets, reflecting a deliberate supply release from seasoned holders. These reactivations have coincided with record flows into spot BTC ETFs, which have now exceeded $4.16 billion in AUM globally, further highlighting institutional channels for profit realization.

Comparative analysis across cycle dynamics reveals evolving market depth and volatility profiles. In 2021, realized profits aggregated around 3.0 million BTC but were followed by sharper, more abrupt price corrections as concentrated sell-side events overwhelmed liquidity pools. By contrast, the current distribution of realized BTC appears more evenly paced, aided by broader on-chain market participation and the expansion of regulated derivatives and ETF vehicles. This maturation has tempered extreme drawdowns, suggesting an emerging trend of smoother price consolidation phases rather than acute capitulation events.

Exchange-traded funds have played a dual role in this cycle, both absorbing selling pressure and providing structured exit ramps. ETF-enabled liquidity injections have mitigated immediate downward impact on spot markets, even as LTHs released coins for profit. Additionally, high-frequency on-chain data indicates that net exchange reserves remain near multi-year lows, supporting a thesis that institutional demand continues to offset realized supply. Market sentiment metrics, including funding rates and open interest in perpetual futures, further corroborate sustained bullish positioning despite elevated profit-taking.

Looking ahead, monitoring the ratio of realized to unrealized profits, often referred to as MVRV, will be critical in anticipating turning points. A sustained rise in realized profit beyond historical cycle norms could signal late-stage distribution, whereas stabilization or decline may indicate exhaustion of profit-taking and the onset of renewed accumulation. Investors and analysts are closely watching on-chain indicators such as the Spent Output Profit Ratio (SOPR) and net position change of LTH cohorts to gauge whether Bitcoin is entering a phase of consolidation or preparing for further upside.

In summary, the unprecedented level of profits realized by long-term holders this cycle confirms both the scale of Bitcoin’s price appreciation and the market’s capacity to absorb significant supply through diversified liquidity mechanisms. As the industry continues to innovate with new financial instruments and deepen institutional involvement, the interplay between profit-taking behaviors and emerging demand channels will shape Bitcoin’s evolving market structure and inform strategic positioning for all participants.

Comments (0)