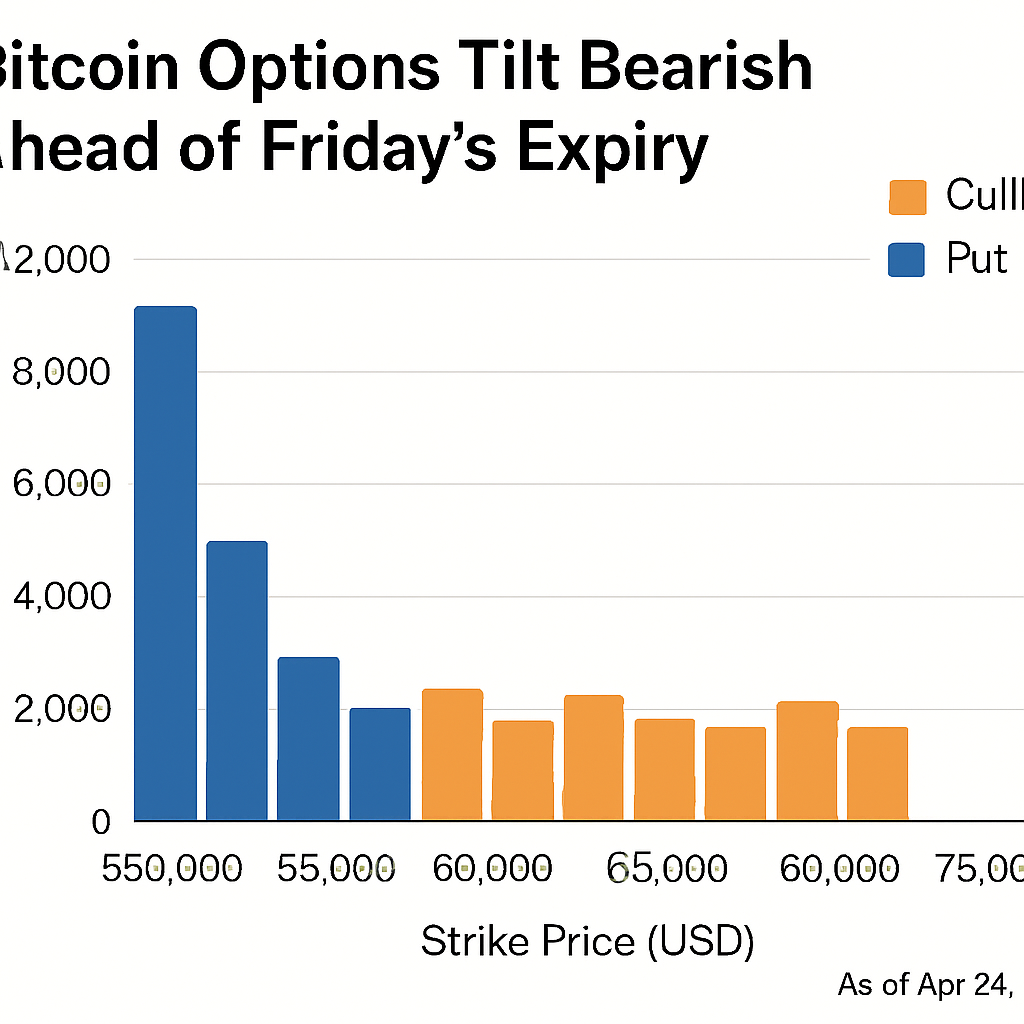

Crypto options open interest tilts toward bearish positions ahead of the Friday expiry on Deribit, with more than $4.5 billion in notional value scheduled to expire.

Bitcoin options account for approximately $3.28 billion of that total, dominated by put contracts clustered between $105,000 and $110,000 strikes, placing maximum pain near $112,000.

Ether options open interest totals around $1.27 billion, exhibiting a put-call ratio near 0.78 and maximum pain at $4,400, while call flows above $4,500 strikes indicate growing demand for upside optionality.

Expiry coincides with U.S. nonfarm payroll data, with timing that can amplify directional biases and elevate price sensitivity around concentrated strike clusters.

Surges in put option volumes may reflect hedging activity by market makers and institutional participants seeking downside protection amid macro uncertainty.

Post-expiry analysis of realized volatility and skew metrics will reveal shifts in risk positioning and potential adjustments to gamma exposures for arbitrage desks.

Concentration of derivatives flows around specific strike levels underscores importance of liquidity depth and order book structure in managing post-expiry rebalancing.

Protocol events such as Polygon’s token migration to POL and launch of the Nexus layer-2 network may influence hedging demands as onchain liquidity redistributes.

Traders preparing for post-expiry sessions are calibrating delta-neutral strategies and monitoring open interest changes across major expiries to gauge sentiment and plan directional or hedging plays.

Comments (0)