Index Shift Signals U.S. Buying Strength

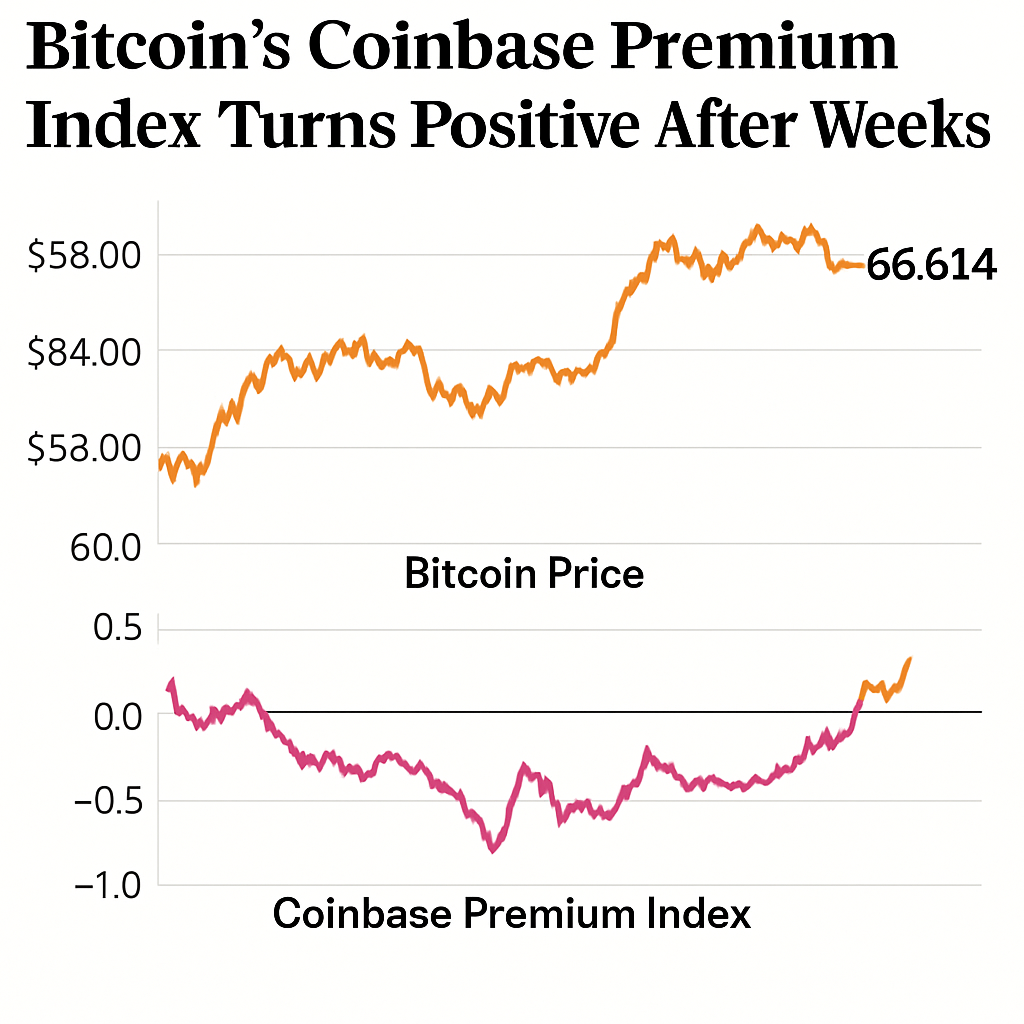

Bitcoin’s Coinbase Premium Index, which tracks the price differential between Coinbase spot prices and global benchmarks, turned positive after spending nearly a month in negative territory. The shift occurred as BTC hovered around $91,000 in early Asian trading hours, marking the first sustained U.S. capital inflow signal since late October. A positive premium typically coincides with renewed demand from domestic institutions and retail investors, reflecting growing confidence amid a broader market rebound. Negative readings had indicated periods of domestic risk aversion, during which U.S. sellers pressured local prices below global averages.

Stablecoin Reserves and Market Positioning

Flows data reveal that stablecoin reserves on Binance reached a record $51.1 billion in November, suggesting a substantial war chest of potential buying power resident on centralized platforms. Options market participants reported a reset in positioning as speculative long liquidations eased, skew metrics normalized and downside demand tapered from local extremes. Research from Kronos and Presto characterized the recent price bounce as an oversold recovery following leveraged wipeouts across major exchanges. The convergence of stablecoin liquidity and premium reversal points to a market environment more conducive to upward momentum, provided resistance levels can be cleared.

Technical and Sentiment Analysis

FxPro strategist Alex Kuptsikevich cautioned that resistance at $90,000—once a reaction zone—may now hinder advances, with bulls requiring a decisive break above $95,000 to reclaim an upward trend. Conversely, a drop below $87,000 could reopen the path toward $80,000, extending November’s capitulation phase. The Crypto Fear & Greed Index rose to 25, signaling an exit from extreme fear but not yet a full optimism shift. Only one in seven major tokens posted gains over the past day, underlining the narrow breadth of the recovery despite a total crypto market capitalization near $3.1 trillion.

Outlook and Key Levels

Market participants will monitor premium readings as a barometer of U.S. demand alongside ETF flow reports from major issuers. A sustained positive premium aligned with stablecoin deposit growth may indicate deeper institutional engagement. Traders should watch for clear movement above $95,000 to validate the bullish argument, while maintaining risk controls around key support at $87,000 and charting evolving liquidity conditions on major platforms.

Comments (0)