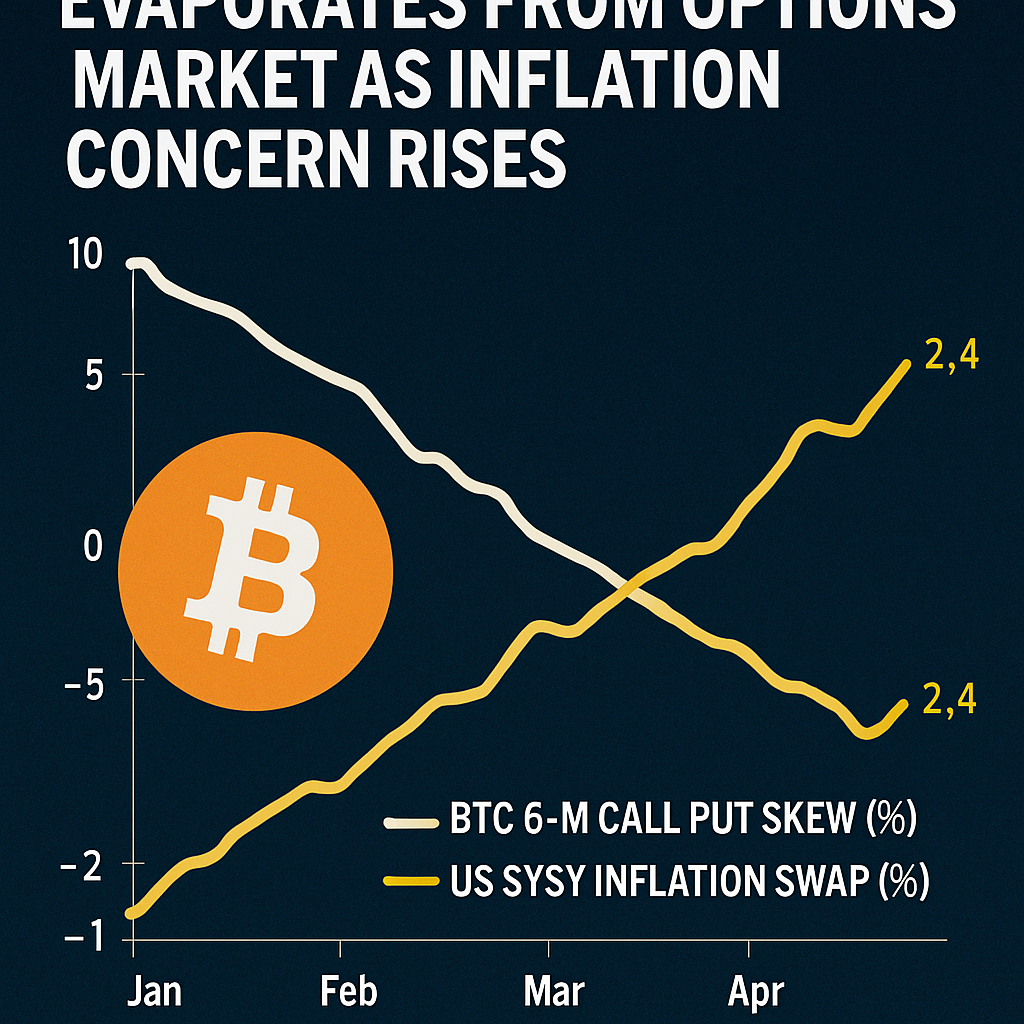

Recent data from Deribit-listed Bitcoin options revealed that the 180-day implied volatility skew—measuring the premium of out-of-the-money calls over puts—has collapsed toward zero, marking a departure from extended bullish positioning that dominated much of the year. This shift reflects a neutral outlook for Bitcoin’s price beyond the next six months, suggesting market participants are hedging against unexpected downside risks rather than seeking asymmetric upside exposure. Historically, similar resets have preceded major trend reversals, underscoring the importance of monitoring skew dynamics as a barometer of long-term sentiment.

Market analysts at BloFin and Amberdata pointed to a confluence of macro factors driving the sentiment change. Core Personal Consumption Expenditures rose more than anticipated in June, while recent nonfarm payroll data disappointed, fueling concerns that persistent inflation may delay Federal Reserve rate cuts. Additional supply chain pressures—stemming from renewed trade tensions and tariff measures—have introduced further uncertainty, prompting professional traders to seek protective put options or reduce bullish call exposures. According to JPMorgan research, elevated inflation projections could extend tightened monetary policy through late 2025, complicating traditional risk-on flows into high-beta assets like Bitcoin.

On the options trading floor, activity in structured products has also influenced skew behavior. Covered call strategies, popular among yield-seeking funds, involve selling call options above key strike levels to generate premium income, thereby suppressing call implied volatility relative to puts. This mechanical selling pressure, combined with selective put buying by risk-averse allocators, has neutralized the skew. Notably, open interest for far-dated put options spiked by 20% on the week, indicating increasing demand for downside protection beyond the three-month horizon.

Technical indicators on the spot market have mirrored the options market’s caution. Bitcoin tested support near $112,000, its three-month low, before rebounding to around $114,000 on mixed volume. Market participants highlighted that such pullbacks often provide buying opportunities if macro headwinds stabilize. Key events on the horizon include July Consumer Price Index and Producer Price Index releases, as well as the upcoming ISM non-manufacturing PMI, which could prompt renewed volatility. Traders will scrutinize these data points for clues on the Fed’s policy trajectory, determining whether Bitcoin can regain sustained upward momentum or face extended consolidation in the months ahead.

Comments (0)