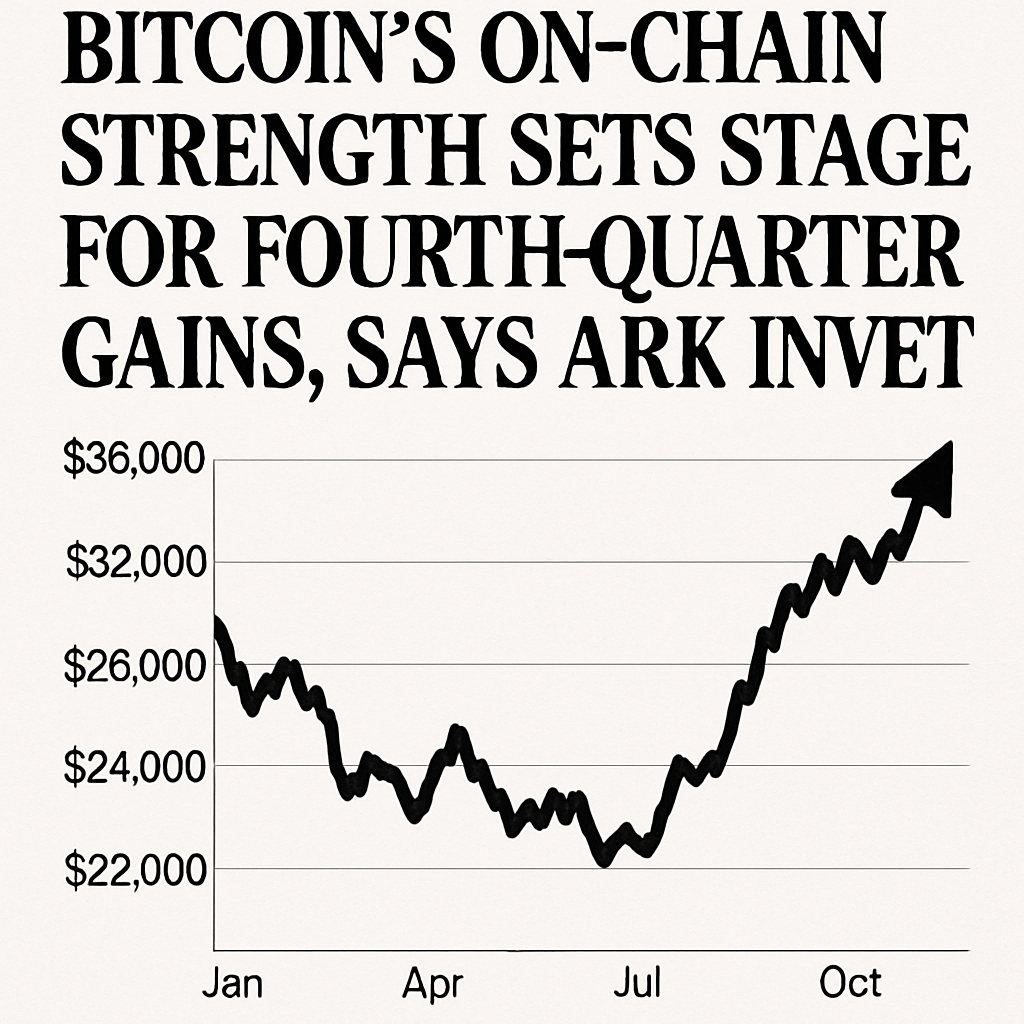

ARK Invest’s latest analysis identifies robust on-chain fundamentals as drivers for potential Bitcoin appreciation in the fourth quarter. Key metrics include a 12 percent month-over-month increase in daily active addresses and a 7 percent decline in exchange-held supply, suggesting strengthened demand and reduced sell-pressure.

Institutional participation via spot Bitcoin ETFs has contributed over $3 billion in net inflows since September, with asset managers reporting record creation units. ETF premium spreads have narrowed to 0.5 percent, indicating efficient price discovery and growing acceptance of regulated crypto products in traditional portfolios.

Network security remains at all-time highs, with hash rate surpassing 200 exahashes per second, reflecting continued investment in mining infrastructure and reinforcing the resilience of the Bitcoin protocol against potential attacks. On-chain fee revenue also climbed 18 percent over the past month, highlighting sustained user engagement.

ARK Invest projects that seasonal market patterns, combined with macroeconomic tailwinds and regulatory clarity around digital asset custody, could propel Bitcoin toward $135,000 by year-end. The firm cautions that short-term volatility may persist, particularly amid shifting monetary policy and geopolitical risks.

Strategic recommendations include phased accumulation strategies and monitoring of derivative skew metrics to assess risk sentiment. ARK Invest emphasizes the value of data-driven frameworks when navigating nascent digital markets, suggesting that on-chain transparency offers unique insights into asset health and investor behavior.

Comments (0)