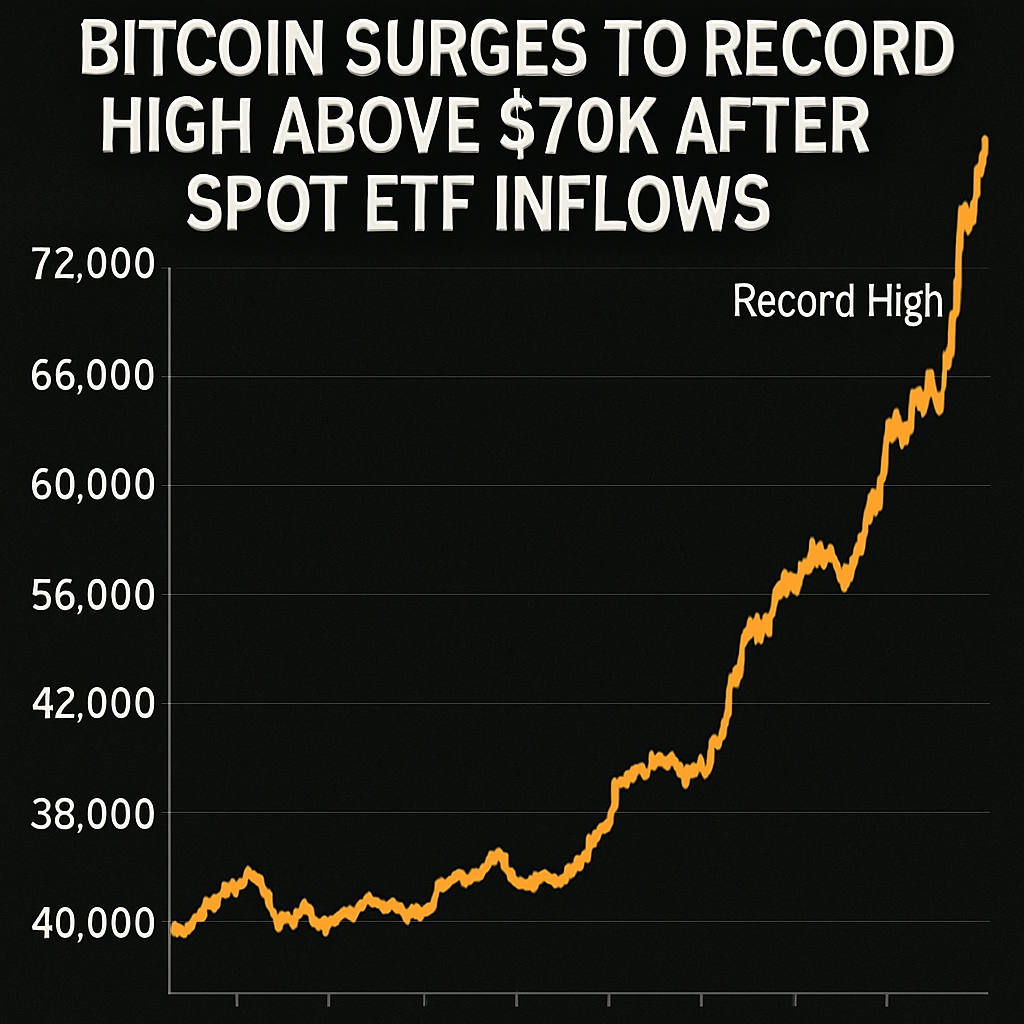

Bitcoin achieved a new all-time high above $125,000 early on Oct. 5 following massive inflows into U.S.-listed spot exchange-traded funds (ETFs). According to CoinDesk data, spot ETFs registered a net inflow of $3.24 billion in the week ended Oct. 3, marking the second-largest weekly demand on record. The surge in ETF buying served as the primary catalyst for bitcoin’s 11% weekly gain, extending a historically bullish October.

The ongoing U.S. government shutdown has amplified safe-haven demand for digital assets. With non-essential federal workers furloughed and key economic data delayed, investors have flocked to bitcoin as a hedge against market uncertainty. Jeff Dorman, CIO of Arca, told CoinDesk that bitcoin rallies typically coincide with waning confidence in government institutions.

Other major cryptocurrencies mirrored bitcoin’s advance during the Asian session. XRP, ether, Solana and Dogecoin each gained between 1% and 3% as traders repositioned ahead of the Fed’s Oct. 28–29 meeting. Market watchers noted that bitcoin’s climb has coincided with renewed optimism for rate cuts later this year, alongside expectations that the Federal Reserve may signal further accommodation.

While bitcoin’s record price has spurred excitement among bulls, some analysts caution that elevated valuations and the potential for Fed surprises could trigger sharp corrections. On-chain data show that exchange balances remain at multi-year lows, underscoring sustained off-exchange demand, but open interest in futures contracts has also climbed, suggesting higher leverage risk. Traders and institutions alike are now monitoring critical support levels around $120,000, where concentrated liquidation orders could shape the next leg of price action.

As the crypto market enters a seasonally strong period, participants are watching for catalysts such as ETF approvals, the outcome of shutdown negotiations, and incoming economic reports. Industry observers warn that any unexpected shifts in Fed commentary or macroeconomic surprises may elicit rapid volatility in both crypto and traditional markets. For now, bitcoin’s record‐setting run reflects a confluence of institutional inflows, safe‐haven demand and positive October seasonality.

Comments (0)