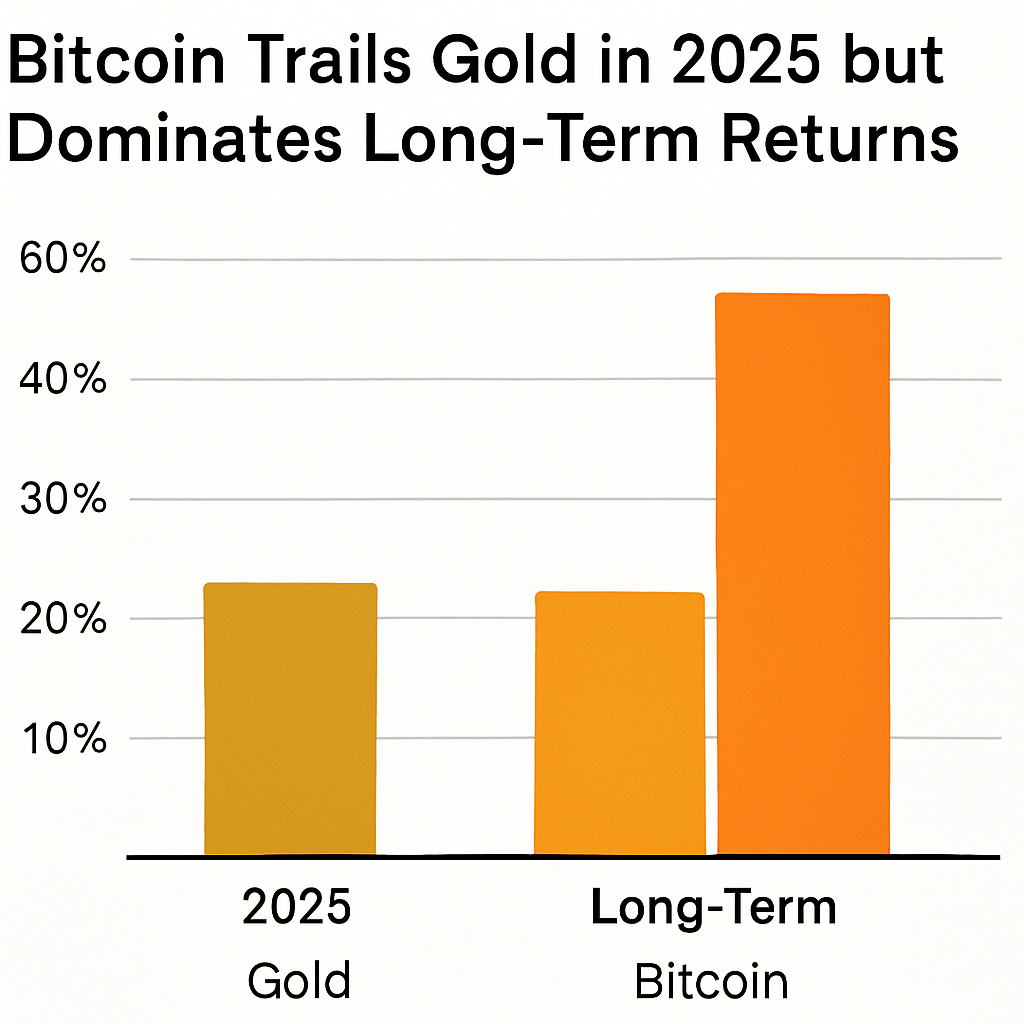

Year-to-Date Performance Comparison

Bitcoin has surged 25.2% through August 8, 2025, trailing gold’s 29.3% advance only by a narrow margin. Other major asset classes lag significantly, with emerging market stocks up 15.6%, the Nasdaq 100 up 12.7%, and U.S. large-cap equities rising 9.4%. This marked the first time bitcoin and gold held the top two spots in annual performance rankings, underscoring bitcoin’s growing role as a leading risk asset.

Cumulative Returns Since Inception

Over the fourteen-year span from 2011 to 2025, bitcoin delivered an astounding 38,897,420% total return. In contrast, gold achieved a 126% gain over the same period, placing it mid-rank among other benchmarks. Key equity indices achieved more modest results: the Nasdaq 100 climbed 1,101%, U.S. large caps 559%, mid caps 316%, small caps 244%, and emerging markets 57%. Bitcoin’s return eclipsed gold by over 308,000 times, illustrating its exponential growth trajectory.

Annualized Returns Highlight Dominance

Measured on an annualized basis, bitcoin averaged 141.7% per year since 2011. Gold delivered a 5.7% annualized gain, while the Nasdaq 100, U.S. large-cap equities, mid-cap, and small-cap indices delivered 18.6%, 13.8%, and between 4.4% and 16.4% respectively. Bitcoin’s compounded growth rate outstrips traditional stores of value and equity markets, positioning it as the leading performance leader across all asset classes.

Expert Commentary on Bitcoin as Store of Value

Renowned trader Peter Brandt contrasted gold’s stability with bitcoin’s scarcity and decentralized nature. Brandt highlighted bitcoin’s potential to become the ultimate store of value, noting that its fixed supply and global network support its long-term appreciation. This narrative aligns with growing institutional adoption, as major funds and corporate treasuries increasingly allocate to bitcoin for diversification and alpha generation.

Technical Analysis and Market Context

Technical indicators revealed a tight intraday trading range between $116,352 and $117,886, with significant volume spikes near support and resistance levels. Bitcoin tested resistance around $117,900 before consolidating, while support at $116,400–$116,500 held firm amid low volatility. On-chain metrics show sustained institutional flows and declining volatility, signaling a maturing market environment supportive of further price discovery.

Comments (0)