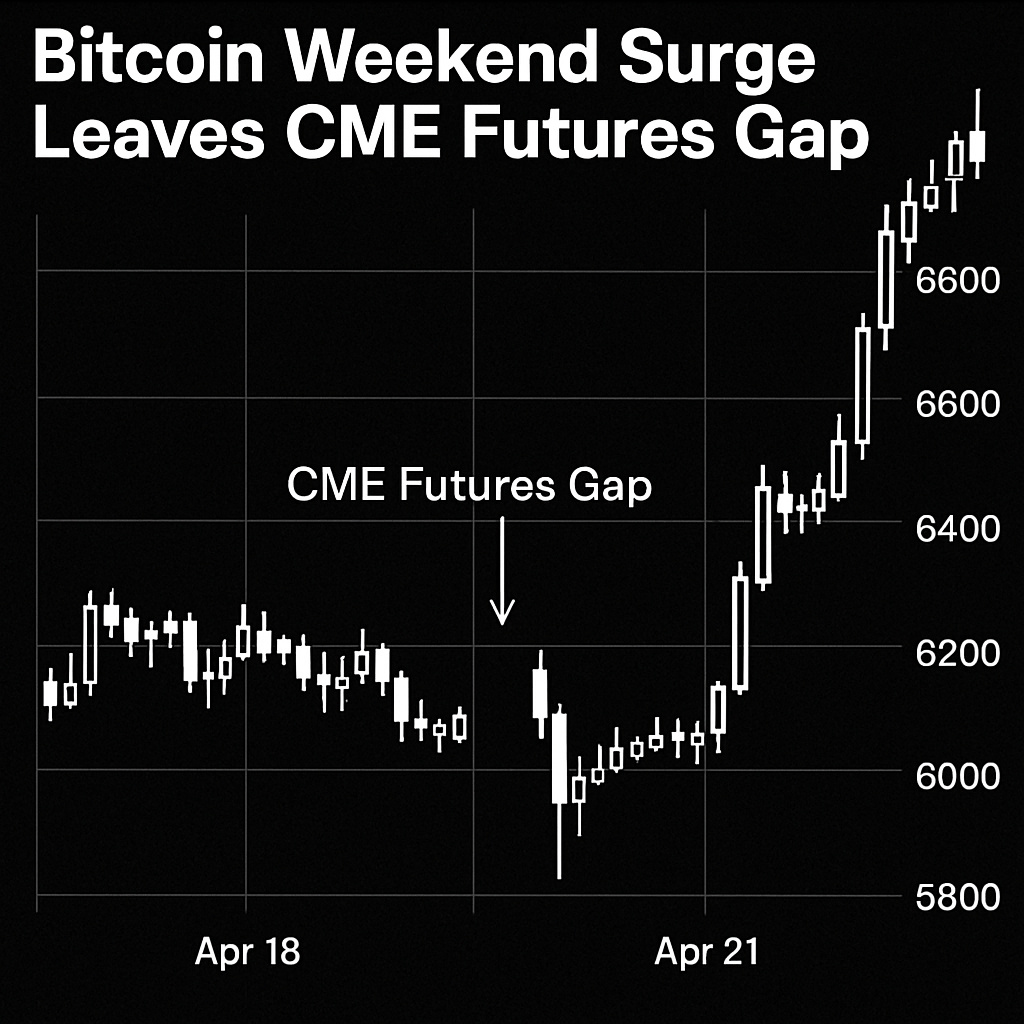

Gap Formation Details

CME bitcoin futures settled at $117,430 on Friday, then opened at $119,000 on Monday, leaving a $1,570 gap. These gaps occur during the daily one-hour pause and over the weekend, as CME contracts resume trading while spot markets have traded continuously.

Historical Gap Behavior

Historically, most CME gaps have been filled within hours or days, with prices retracing to cover the difference. However, when an asset enters price discovery above its previous all-time high, “runaway gaps” can occur, where momentum drives prices further without backtracking.

Trader Perspectives

Crypto traders on social platforms noted that a gap fill below $120,000 could serve as a reversal area. Others cautioned against betting on an immediate fill given bitcoin’s current bullish trend and momentum indicators pointing to continued upside.

Market Context

Bitcoin’s weekend rally brought it within striking distance of its $123,000 all-time high, with spot and futures volumes supporting the move. Open interest levels remained robust, suggesting a balanced mix of bullish bets and hedging activities among institutional participants.

Risk Management

Risk-averse traders may set stop orders below the gap threshold to guard against a sudden reversal if the gap fills. Meanwhile, momentum traders could target gains above $123,000, viewing a sustained break as confirmation of continued price discovery.

Outlook

Market participants will monitor the gap for signs of retracement or continuation. A gap fill could trigger short-term volatility, while a lack of backfill may signal a strong bullish environment. Contextual factors, including upcoming macroeconomic data, will influence the gap’s behavior.

Comments (0)