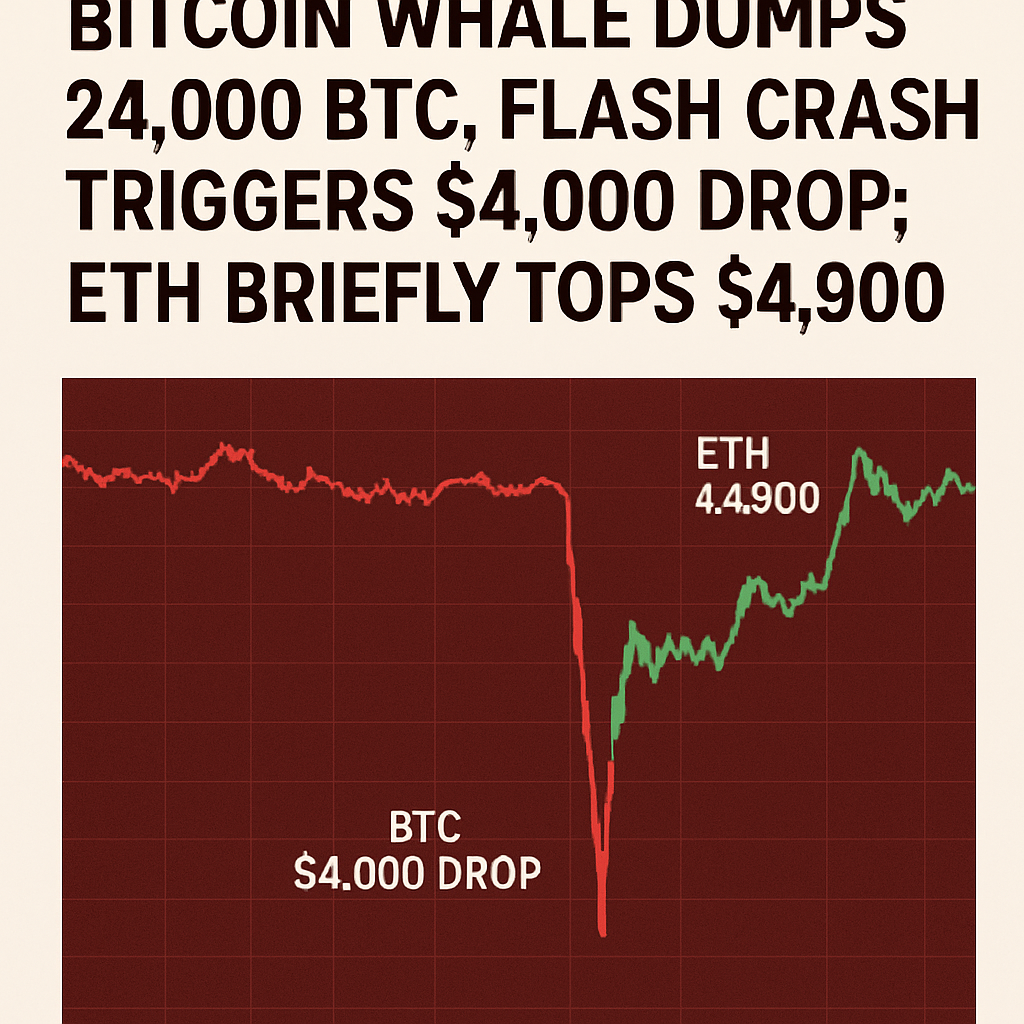

Over the early hours of August 25, 2025, a large institutional holder offloaded 24,000 BTC—worth over $2.7 billion at the time—into spot markets, triggering a sudden flash crash that sent Bitcoin from around $117,000 to below $110,000 within minutes. Blockchain analytics platforms reported $273 million in long positions liquidated in Bitcoin futures and nearly $296 million in Ethereum liquidations as leveraged traders were forced out of their positions.

Earlier, Federal Reserve Chair Jerome Powell’s comments at the Jackson Hole Symposium hinted at potential interest rate cuts, igniting a brief rally in risk assets. Bitcoin responded by climbing toward $117,200 and Ethereum by topping a new historical high of $4,954. However, the whale’s sell order intensified downward momentum. Price discovery resumed at lower levels as algorithms and stop-loss orders cascaded across exchanges.

Within 24 hours of the incident, aggregate crypto liquidations surpassed half a billion dollars, highlighting the fragility of leveraged market structures under abrupt selling pressure. Spot Bitcoin exchange-traded funds saw net outflows extend to a sixth consecutive session, totaling approximately $1.19 billion, while Ethereum ETFs recorded $925.7 million in net redemptions despite two days of inflows earlier in the week.

Crypto-related equities also felt the shock. Shares of Coinbase, Robinhood, and MicroStrategy declined by 2.6%, 1.5%, and 4.3%, respectively, reflecting diminished risk appetite among institutional investors. Volatility metrics spiked, with the Bitcoin 30-day realized volatility index reaching multi-month highs.

Technical analysts pointed to critical support zones in the $109,000–$111,000 range, suggesting that sustained trading below this band could signal further retracement toward $105,000. Conversely, a rebound above $115,000 would be required to stabilize bullish momentum ahead of September’s anticipated rate decision.

Despite the turbulence, long-term holders remained largely unmoved, with on-chain data showing minimal transfer volumes to exchanges from major cold wallets. Market observers noted that while the flash crash inflicted short-term pain, it may have purged excessive leverage and set the stage for renewed accumulation at discounted levels.

The incident underscores the persistent impact large block trades can exert on digital asset markets and highlights ongoing debates over market structure reforms, including minimum block trade reporting requirements and broader liquidity provisions to mitigate similar events in the future.

Comments (0)