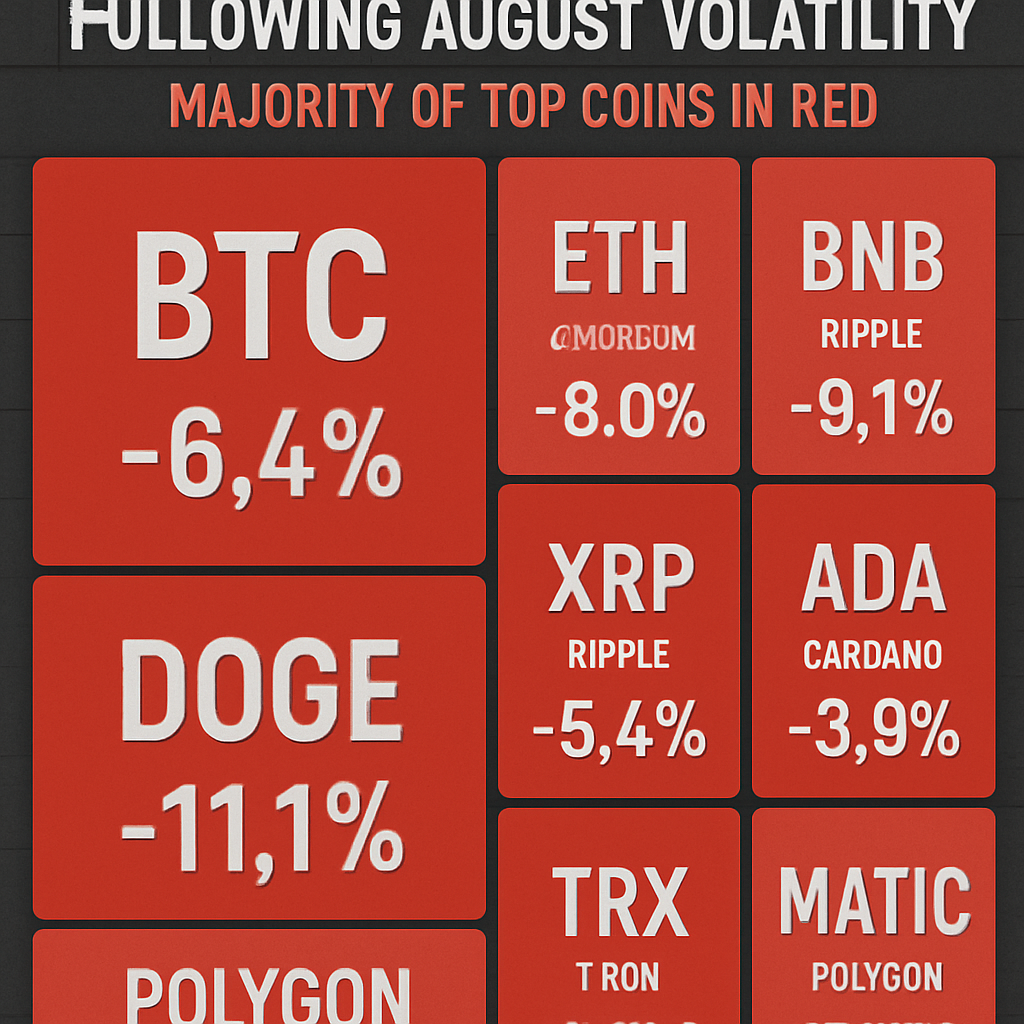

On August 25, 2025, the global cryptocurrency market experienced a pronounced downturn, with market capitalization contracting by 2.4% to approximately $3.96 trillion. A vast majority of the top 100 digital assets traded in negative territory, reflecting widespread profit-taking and caution among investors. Bitcoin retraced from recent highs to trade near $111,800, marking a 3.18% decline, while Ethereum dipped 4% to around $4,556.

Trading activity remained robust, with aggregate volume across spot and derivatives markets hovering near $187 billion over the 24-hour period. The market pullback followed a volatile weekend fueled by macroeconomic commentary from Federal Reserve Chair Jerome Powell and large whale transactions that imparted abrupt sell pressure. Notably, Bitcoin’s weekly advance of 19% has now given way to a short-lived retracement, illustrating the market’s sensitivity to leveraged positions.

Institutional flows into spot exchange-traded funds revealed divergent trends: Bitcoin ETFs observed net outflows of $23.15 million, marking their first exit in days, while Ethereum ETFs attracted $341.16 million in inflows, driven by bullish positioning among larger investors. Analysts suggest this rotation may reflect shifting preferences toward higher-yielding altcoin exposure amid persistent funding cost squeezes in Bitcoin markets.

Sector performance showed resilience in select protocols: Cardano’s ADA traded marginally down 2.5% amid announcements of new government partnerships in Latin America, while BNB and Solana held declines at 3.6% and 4.1% respectively, supported by active development updates. Conversely, meme tokens like PEPE and SHIB underperformed, tumbling 10.7% and 3.4% as traders retreated from speculative positions.

On-chain metrics indicated a net decrease in active addresses, suggesting short-term pullback in network usage. Miner revenue also dipped by 6% as transaction fees normalized following prior congestion events. Funding rates across perpetual futures contracts turned slightly negative, pointing to increased bearish positioning by traders anticipating further corrections.

Market commentators caution that near-term catalysts remain centered on U.S. monetary policy signals. With the Federal Reserve expected to convene in early September, traders are closely monitoring rate-cut prospects versus persistent inflationary pressures. Political developments, including regulatory guidance on stablecoin frameworks, may further influence investor sentiment.

Despite the correction, long-term fundamentals persist, with network usage metrics for major smart-contract platforms continuing to expand. Institutional treasuries collectively hold over $215 billion in Bitcoin, underscoring deepening adoption among corporate and sovereign entities. Many analysts view the current pullback as a potential accumulation opportunity ahead of renewed macro-driven rallies in late Q3 and Q4.

Comments (0)