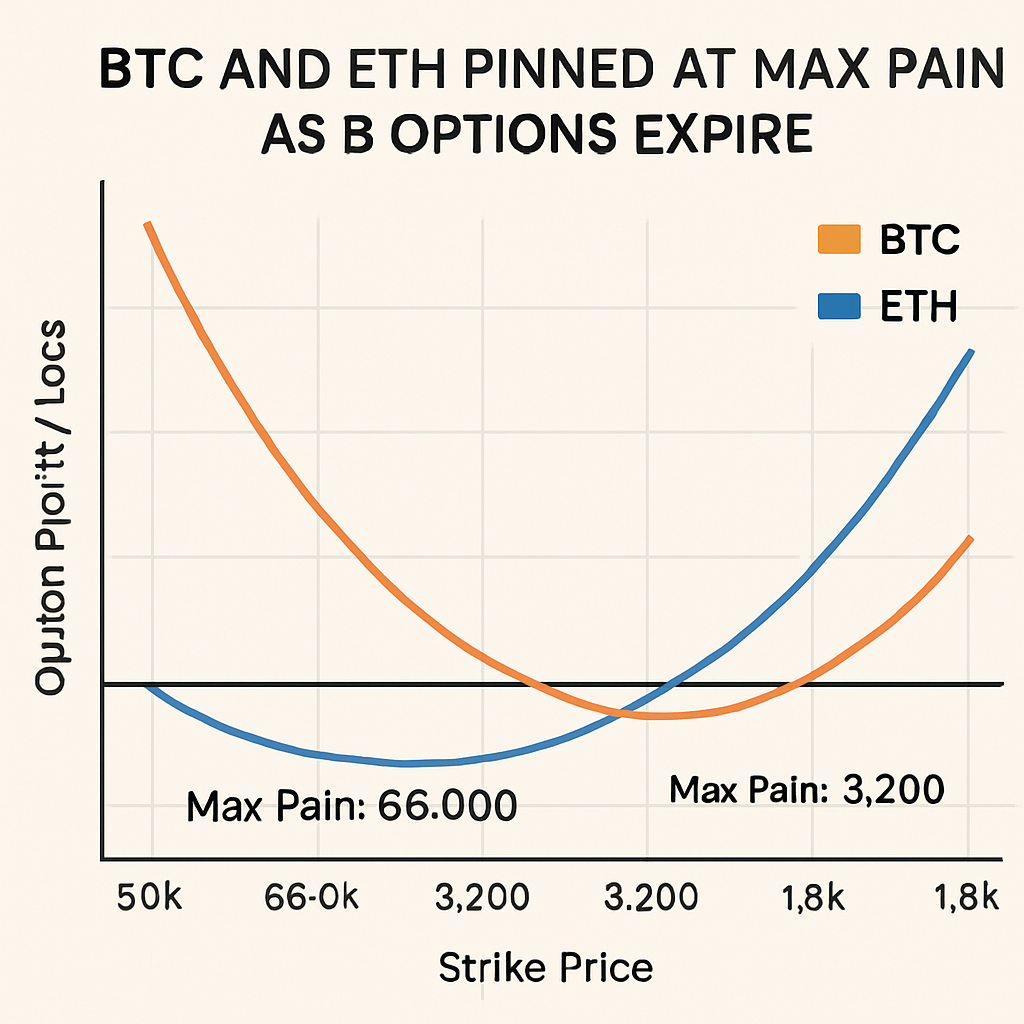

January 9, 2026 saw over $2.2 billion worth of crypto options on Bitcoin and Ethereum expire on Deribit, aligning spot prices near key max pain levels. Bitcoin call and put open interest converged at 10,105 contracts versus 10,633 puts, resulting in a put-to-call ratio of 1.05. Ethereum options showed 67,872 calls against 59,297 puts, equating to a 0.87 ratio indicating heavier upside positioning.

At 08:00 UTC, Bitcoin traded around $90,985, while Ethereum hovered near $3,113. The symmetrical structure of Bitcoin’s options market and asymmetric positioning in Ethereum have induced dealer hedging that suppresses directional volatility into settlement. Market makers have been adjusting delta and gamma exposure to remain hedged around the max pain strikes, effectively anchoring spot prices within tight ranges.

Volatility compression has been evident across major crypto assets, with the 30-day implied volatility for Bitcoin falling to 38% and Ethereum to 42%, down from 45% and 48% respectively earlier in the week. Traders anticipate that directional moves will re-emerge once hedging pressures dissipate post-expiry, potentially unlocking a significant breakout in either direction.

Key macro catalysts compound the crypto-specific dynamics. The U.S. nonfarm payroll report for December is scheduled for release at 13:30 UTC, with consensus expectations around a 73,000 jobs increase and a 4.5% unemployment rate. MarketWatch economists warn that stronger wage growth could jeopardize Federal Reserve dovish bias, raising bond yields and weighing on non-yielding assets like Bitcoin.

Later today, the U.S. Supreme Court will deliver a ruling on the legality of tariffs imposed under emergency presidential powers, which may affect global trade sentiment. Prediction markets lean toward a decision limiting tariff authority, posing potential headwinds for risk assets. Traders are positioning for mixed outcomes as policy and judicial developments intersect to shape crypto market momentum.

Analysis from Deribit underscores that post-expiry volatility often spikes when hedged positions unwind. Historical precedent from the December 2025 expiry shows a 7% intraday move in Bitcoin within 24 hours of options settlement. Ethereum’s reaction to max pain expiry has been slightly muted, but could exhibit sharper directional bias if ether maintains support above $3,100.

Overall, the confluence of options expiry, labor data and judicial rulings presents a complex risk environment. Traders and investors are advised to monitor implied volatility term structures and open interest shifts for signs of dealer rebalancing. Directional clarity may emerge later today or early Monday as the market digests these overlapping catalysts.

.

Comments (0)