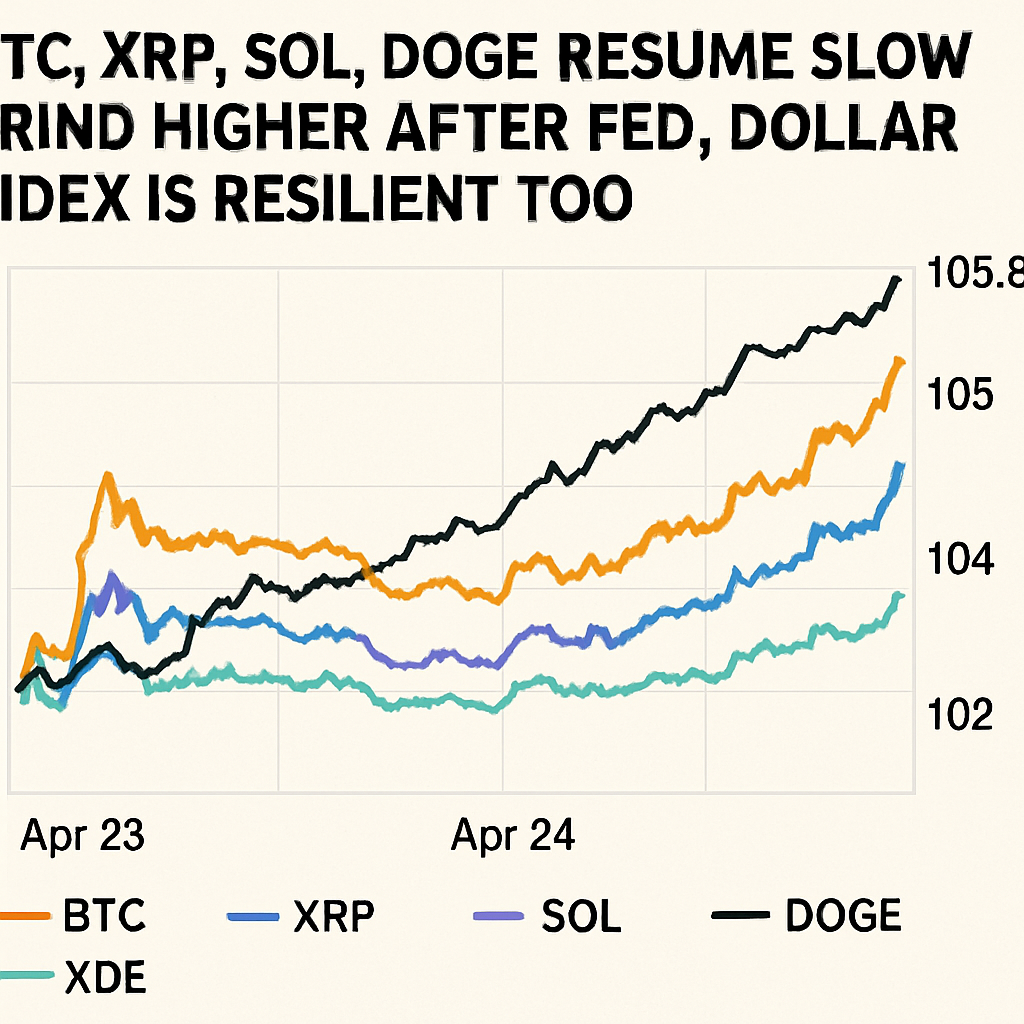

On Sept. 18, major cryptocurrencies regained momentum after the Federal Reserve’s decision to reduce the benchmark rate by 25 basis points to 4.00%. Bitcoin led the charge, climbing back above $117,900 and marking its highest level since mid-August. Ethereum’s ether token followed with a 2.7% gain as it navigated a contracting triangle pattern, while dogecoin, solana and XRP advanced between 3% and 5%, supported by optimism around new derivatives listings.

Analysts attribute the renewed grind higher to dovish Fed signal strength, which imbued risk assets with fresh buying interest. Matt Mena, crypto research strategist at 21Shares, highlighted that rapid easing prospects embedded in the Fed’s dot plot projections created an asymmetrical opportunity for bitcoin. He suggested that while the initial 25 bps cut provided the spark, the projected pace of future cuts may set the stage for new all-time highs by year-end.

Technical charts reveal that bitcoin’s breakout from $117,000 resistance spurred a volume surge, confirming bullish sentiment. Solana’s SOL token briefly challenged $246 amid anticipation of CME options trading beginning Oct. 13. XRP futures options on CME are set to debut the same day, lifting the prospect of institutional participation in altcoin derivatives markets.

Despite macro tailwinds, the U.S. dollar displayed resilience, with the DXY index rebounding to 97.30. The dollar’s recovery reflects lingering concerns over quantitative tightening and elevated inflation risks, which could temper further upside in crypto. Market makers are reportedly increasing tail-risk hedges in block trades, indicating cautious positioning against rapid market reversals.

BloFin, a crypto financial platform, noted a rise in short-dated put spread orders on bitcoin, signaling demand for protection against extreme downside. Such strategies suggest sophisticated participants are actively managing interest rate and market volatility risk, even as the broader market remains constructive.

Going forward, crypto traders will monitor FX markets and Federal Reserve communications for clues on the durability of easing expectations. A sustained dollar rally could limit crypto gains, while further dovish developments may reignite broader risk appetite. The current equilibrium between easing optimism and dollar strength underscores the complex interplay of factors shaping digital asset trajectories.

Comments (0)