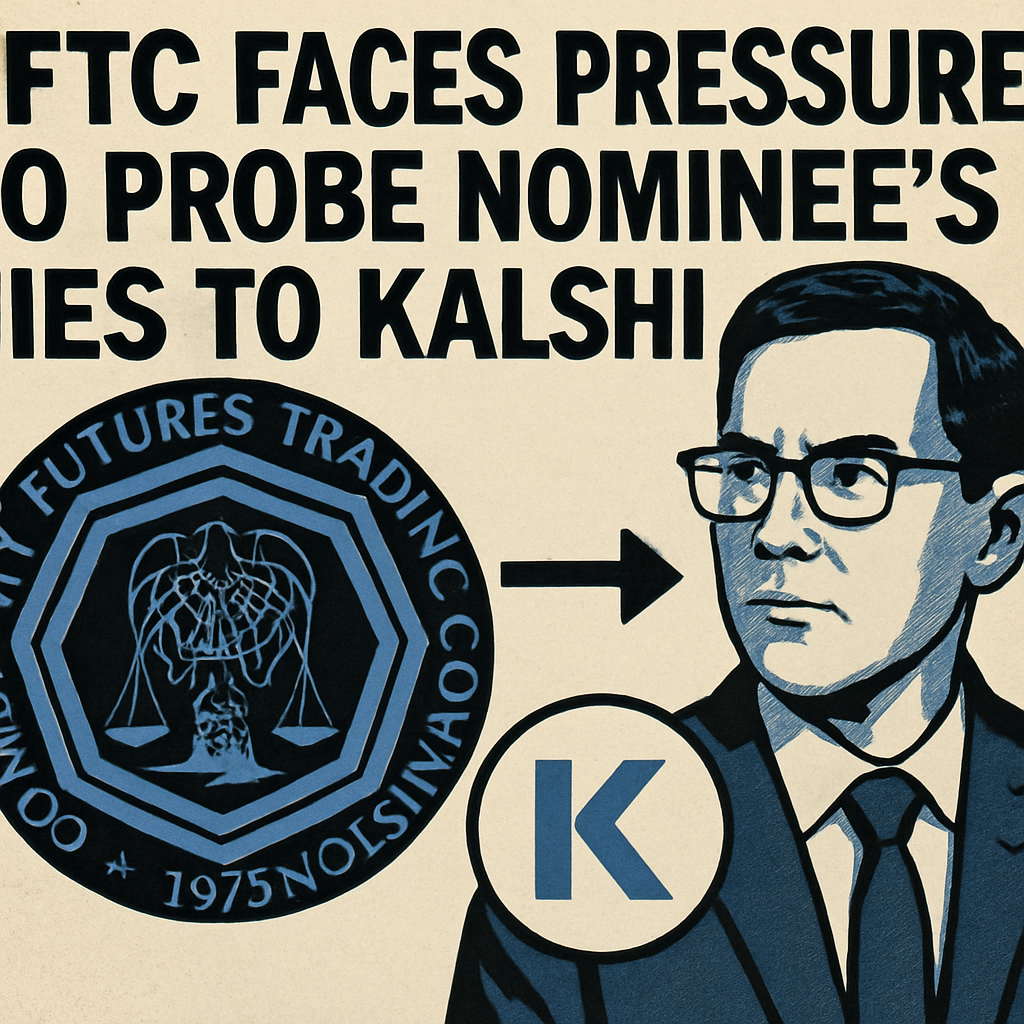

The Commodity Futures Trading Commission (CFTC) is under congressional scrutiny following calls from Representative Dina Titus to examine ethical and conflict-of-interest issues related to one of its nominees. Titus cited nominee Brian Quintenz’s previous advisory role at Kalshi, a Washington-based prediction market company, as a potential impediment to unbiased regulatory oversight.

Background and Allegations

Kalshi operates a platform that lists event-based contracts, including those tied to financial, economic and geopolitical outcomes. Quintenz served as a member of Kalshi’s advisory board, a position that, according to critics, may compromise the perception of regulatory fairness if he were to oversee products similar to those offered by the company.

In her formal request, Representative Titus highlighted potential conflicts arising from Quintenz’s past affiliations. “Regulator integrity is paramount to protecting market participants,” she asserted, urging the CFTC to disclose any communications between the nominee and the exchange regarding product design, listing criteria and fee structures.

Regulatory Implications

The CFTC’s mandate covers a broad spectrum of derivative and commodity markets. By enabling spot crypto contracts on registered futures exchanges, the agency has moved into nascent digital asset territory, increasing the significance of adjudicator impartiality.

Quintenz’s potential confirmation raises questions about overlap between personal business interests and public duty. Ethics experts note that even informal advisory roles can erode public trust if not properly managed, necessitating transparent recusals or divestiture commitments.

Industry Reaction

Market observers and industry trade groups have expressed mixed views. Some argue that Quintenz’s practical experience with innovative exchange models could inform effective rule-making. Others contend that strict separation between personal ventures and regulatory responsibilities is essential for maintaining market integrity.

Next Steps

The CFTC is expected to review the request and determine whether to initiate an internal ethics inquiry or policy clarification. Depending on the outcome, the commission may require the nominee to submit additional disclosures or implement formal recusal agreements for matters involving Kalshi.

As the nomination process unfolds, stakeholders will watch closely to assess how the commission balances expertise with ethical safeguards. The decision could set a precedent for managing potential conflicts within an evolving regulatory landscape encompassing digital assets and innovative financial instruments.

Comments (0)