Introduction

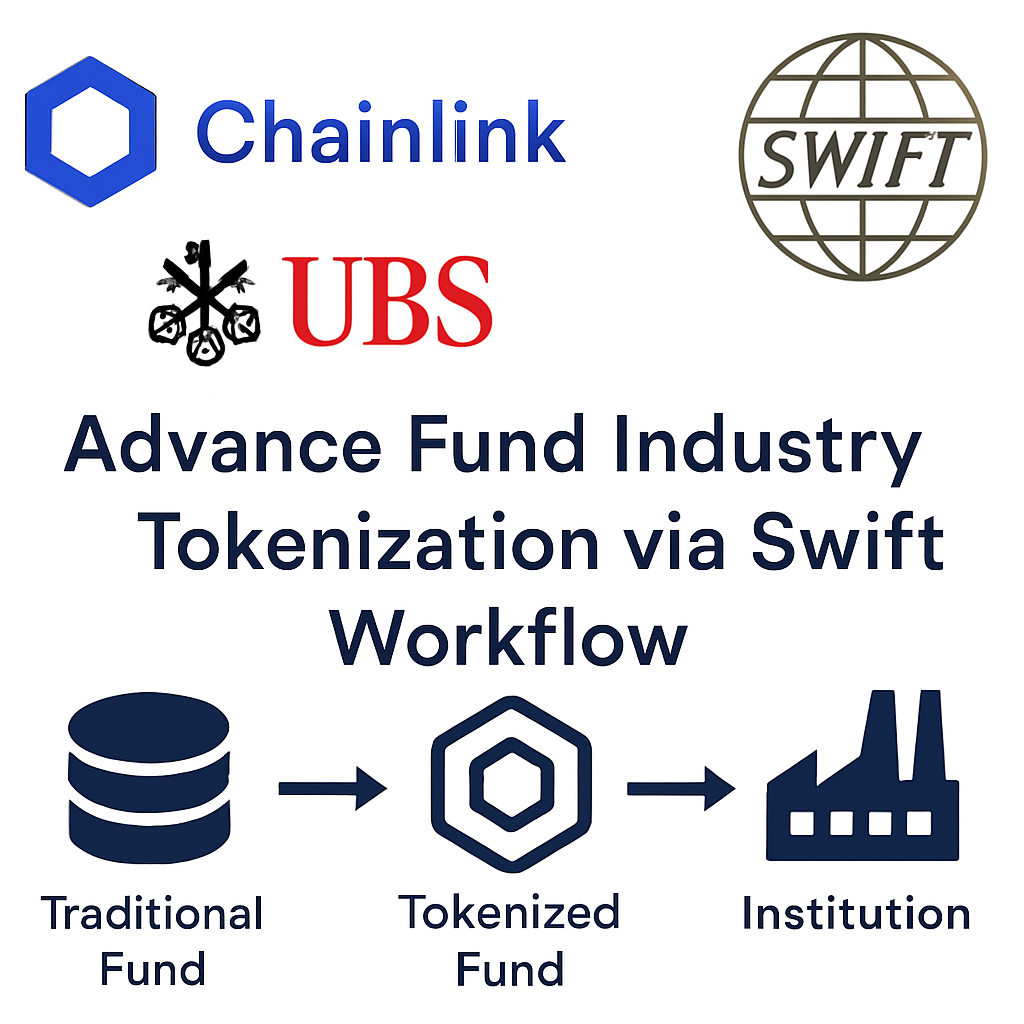

Chainlink and UBS have launched a joint pilot to connect traditional fund management processes with blockchain infrastructure. The initiative leverages Chainlink’s Runtime Environment (CRE) to interpret ISO 20022 messages received over Swift and convert them into on-chain actions. This proof of concept aims to demonstrate how tokenized investment funds can be integrated into existing financial messaging systems used by banks worldwide.

Pilot Structure and Objectives

The pilot was structured to simulate real-world fund subscription and redemption workflows. UBS transmitted subscription and redemption requests through its standard Swift environment. Chainlink’s CRE received the ISO 20022-compliant messages, extracted relevant parameters, and invoked smart contract functions on behalf of UBS. The solution aims to provide banks with the ability to manage tokenized fund positions using familiar interfaces, without requiring extensive modifications to their back-office systems.

Technical Workflow

Step 1: UBS generates an ISO 20022 message containing subscription or redemption details and sends it via Swift.

Step 2: Chainlink CRE subscribes to Swift messages and performs field-level parsing and mapping to smart contract ABI definitions.

Step 3: The Runtime Environment triggers the Chainlink Digital Transfer Agent smart contract, executing the intended operation on the blockchain.

Step 4: Transaction status and confirmations are returned to UBS through Swift notifications, completing the cycle.

Benefits and Implications

This pilot addresses key operational challenges by:

- Minimizing integration complexity for banks

- Leveraging existing messaging infrastructure

- Enabling real-time tokenized fund operations

- Reducing counterparty and settlement risk

Successfully bridging Swift with blockchain networks has the potential to accelerate institutional adoption of tokenized assets and unlock efficiencies across the global fund industry.

Regulatory and Security Considerations

Both parties adhered to stringent compliance and security standards. Chainlink CRE incorporates cryptographic attestation and message authenticity validation to ensure data integrity. UBS conducted comprehensive risk assessments, validating that the pilot did not expose sensitive client information. On-chain transactions are subject to smart contract audit and bank security protocols.

Future Roadmap

Based on pilot results, Chainlink and UBS plan to expand the scope of tokenized fund offerings and explore additional asset classes. Potential next steps include multi-chain interoperability, integration with custodial services, and scaled production deployments involving multiple financial institutions and asset managers.

Conclusion

The successful demonstration of Swift-to-blockchain integration represents a significant milestone in institutional tokenization. By simplifying fund subscription and redemption processes, the pilot lays the groundwork for broader adoption of real-world asset tokens. Continued collaboration and refinement of the CRE solution could reshape the way asset managers and banks manage large-scale fund operations in a tokenized environment.

Comments (0)