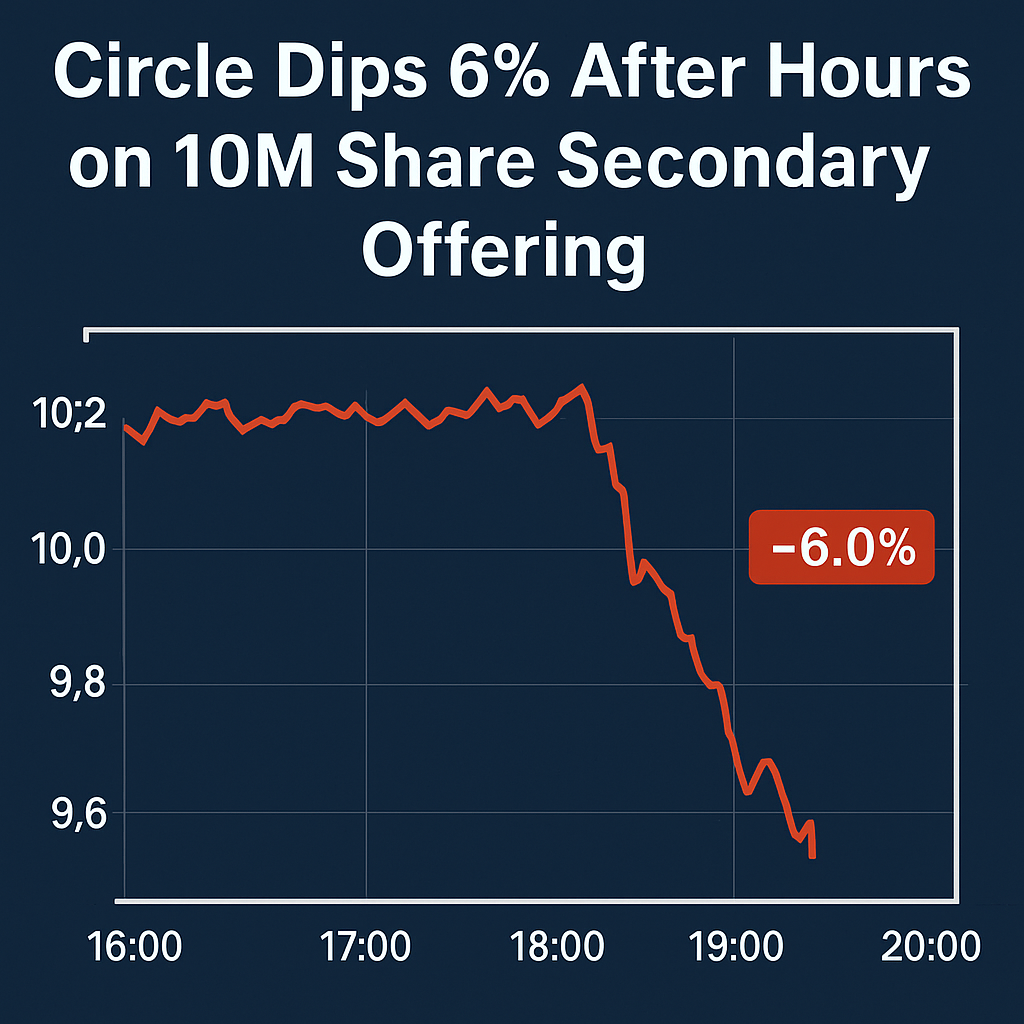

Circle, the issuer of the USDC stablecoin, launched a secondary offering of 10 million Class A shares after market close, with insiders selling 8 million shares. The announcement prompted a 6% decline in Circle’s stock price during after-hours trading.

The sale structure comprises 2 million new shares issued by the company and 8 million shares offered by existing stakeholders. The underwriters’ option extends up to 1.5 million additional shares. Circle filed an S-1 registration statement with the U.S. Securities and Exchange Commission to formalize the transaction.

Earlier in the day, Circle disclosed a net loss of $428 million for the second quarter, reflecting elevated operating expenses and strategic investments, including its recently launched Layer-1 blockchain project, Arc. The Q2 results also highlighted growth in USDC circulation but underscored ongoing integration costs for protocol development.

Circle’s stock has traded between $154 and $160 in after-hours sessions since the IPO, which saw the price surge from its $31 listing price to a record high of $299. The post-offering decline represents a near 50% drawdown from peak levels but maintains a five-fold increase relative to the IPO price.

Market analysts suggest the secondary sale offers liquidity to early investors and may stabilize trading volumes, but also raises concerns over insider exits and valuation pressures. Shareholders will monitor the utilization of proceeds, particularly funding for infrastructure and compliance initiatives.

The offering follows a broader trend of digital asset companies accessing public markets to finance expansion, with Coinbase and MicroStrategy among recent examples. Observers note that secondary share sales can recalibrate investor expectations, especially when issuers report sizeable quarterly losses amidst evolving regulatory landscapes.

Comments (0)