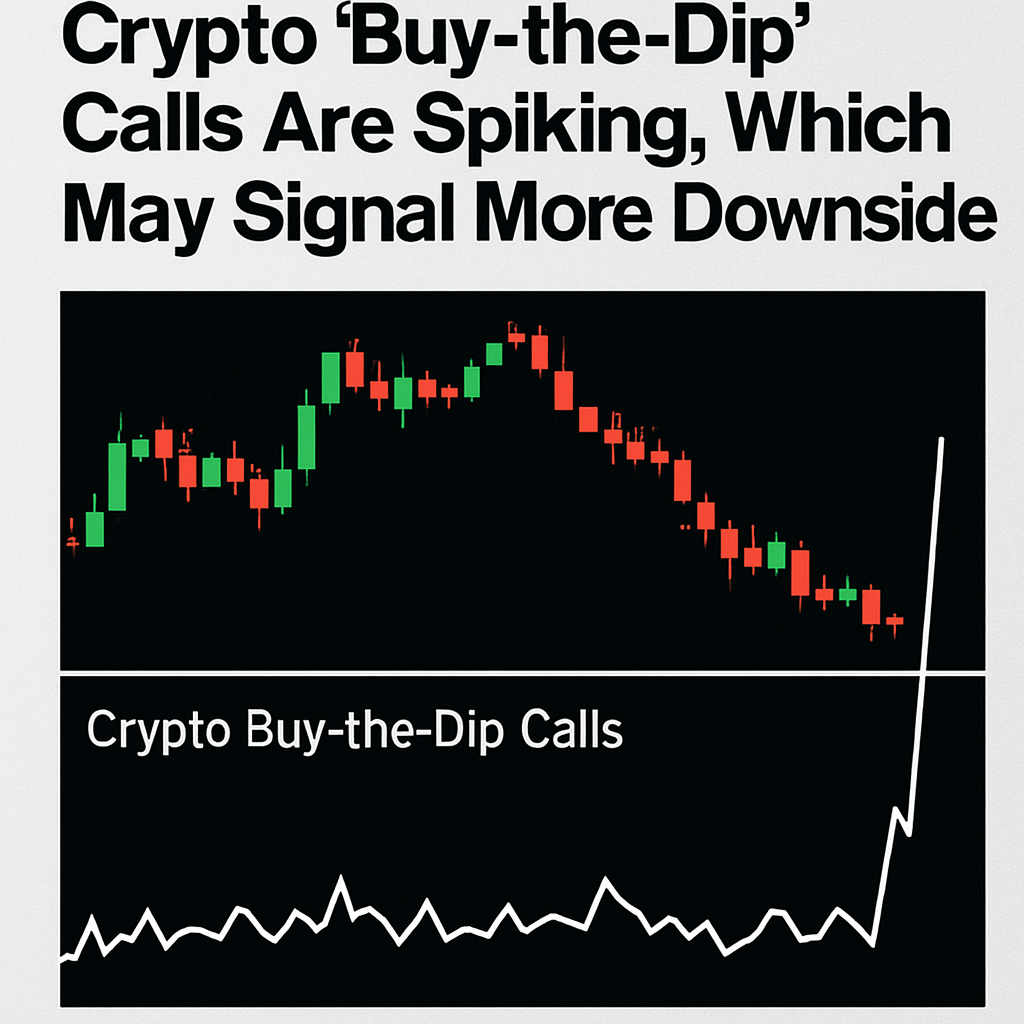

Social Sentiment Analysis

Data from sentiment platform Santiment show a marked increase in “buy the dip” mentions across social channels after Bitcoin’s 5% pullback over seven days. Santiment analyst Brian Quinlivan warns that heightened dip-buying calls often coincide with market overconfidence, potentially leading to deeper declines before a true bottom forms.

Fear & Greed Index

The Crypto Fear & Greed Index recently dipped into “Fear” territory at 39 and has recovered to 48 (“Neutral”) amid mixed trader expectations. Historically, periods of widespread fear are more reliable indicators of near-term market bottoms than bullish sentiment spikes.

Altcoin Season Signals

Despite bearish chatter, some traders anticipate a forthcoming altcoin rally. CoinMarketCap’s Altcoin Season Index shifted to “Altcoin Season” at a score of 60, fueled by on-chain data showing oversold conditions among top altcoins. Trader Ak47 notes potential tailwinds from an expected Fed rate cut and pending altcoin ETF approvals this fall.

Market Context

Bitcoin currently trades around $108,748, down roughly 5% over the past week, while total crypto market capitalization stands at $3.79 trillion, off 6.18%. CME’s FedWatch Tool indicates an 86.4% probability of a Fed rate cut in September, a typical bullish catalyst for risk assets.

Conclusion

While dip-buying chatter suggests retail eagerness, history cautions that peaks in bullish sentiment can precede further downside. Traders should weigh sentiment extremes alongside technical and macro indicators before positioning for a sustained rally.

Comments (0)