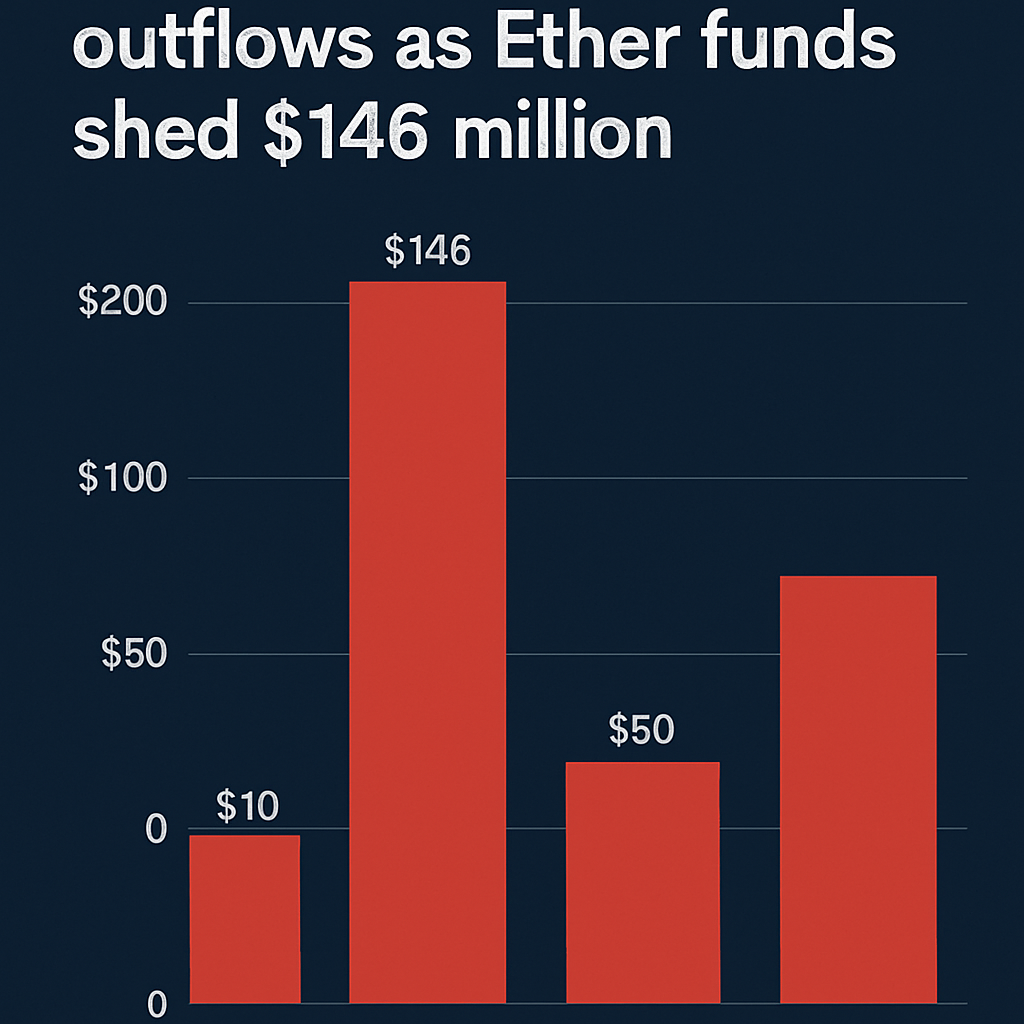

Week-to-date data from CoinShares revealed that publicly traded crypto investment products experienced $352 million in cumulative outflows in the first days of September 2025. Trading volumes declined by 27 percent compared with the prior week, marking the weakest weekly figure since mid-August. Analysts attributed the slowdown to profit-taking at recent highs and broader macroeconomic uncertainty as US interest rate policy showed signs of easing.

Ether-linked funds bore the brunt of the outflows, with $912 million leaving products tracking Ether. This represented the largest weekly withdrawal from Ether funds since their US launch, as institutional investors rotated out of riskier digital assets. In contrast, Bitcoin-based products received $524 million in net inflows, driven by continued corporate treasury allocations and renewed demand for Bitcoin as a store of value.

Regional dynamics varied: US-listed products accounted for $440 million of outflows, while German-listed funds saw $85 million in net inflows, reflecting divergent investor preferences in different markets. CoinShares noted that despite recent outflows, cumulative inflows in 2025 still outpace the same period in 2024, signaling that overall sentiment for digital asset exposure remains positive.

Commenting on the trend, Jillian Friedman of Symbiotic protocol suggested that Ether fund outflows were “risk-asset plays,” driven by a combination of profit-taking at all-time highs and anticipation of Federal Reserve rate cuts. Market observers warned that renewed outflows could pressure Ether prices if the rotation away from Ether continues.

ETF flow patterns remain an important barometer of institutional sentiment. The recent divergence between Bitcoin and Ether flows underscores evolving asset preferences within the digital asset ecosystem. Continued monitoring of fund flows will be critical for assessing near-term market dynamics and the potential for renewed inflows ahead of major economic data releases.

Comments (0)