Crypto exchange-traded products (ETPs) saw significant capital inflows over the past week, totaling $2.48 billion. The majority of these inflows went into Ether-based ETPs, which attracted approximately $1.4 billion, underscoring growing institutional confidence in Ether amid recent market volatility.

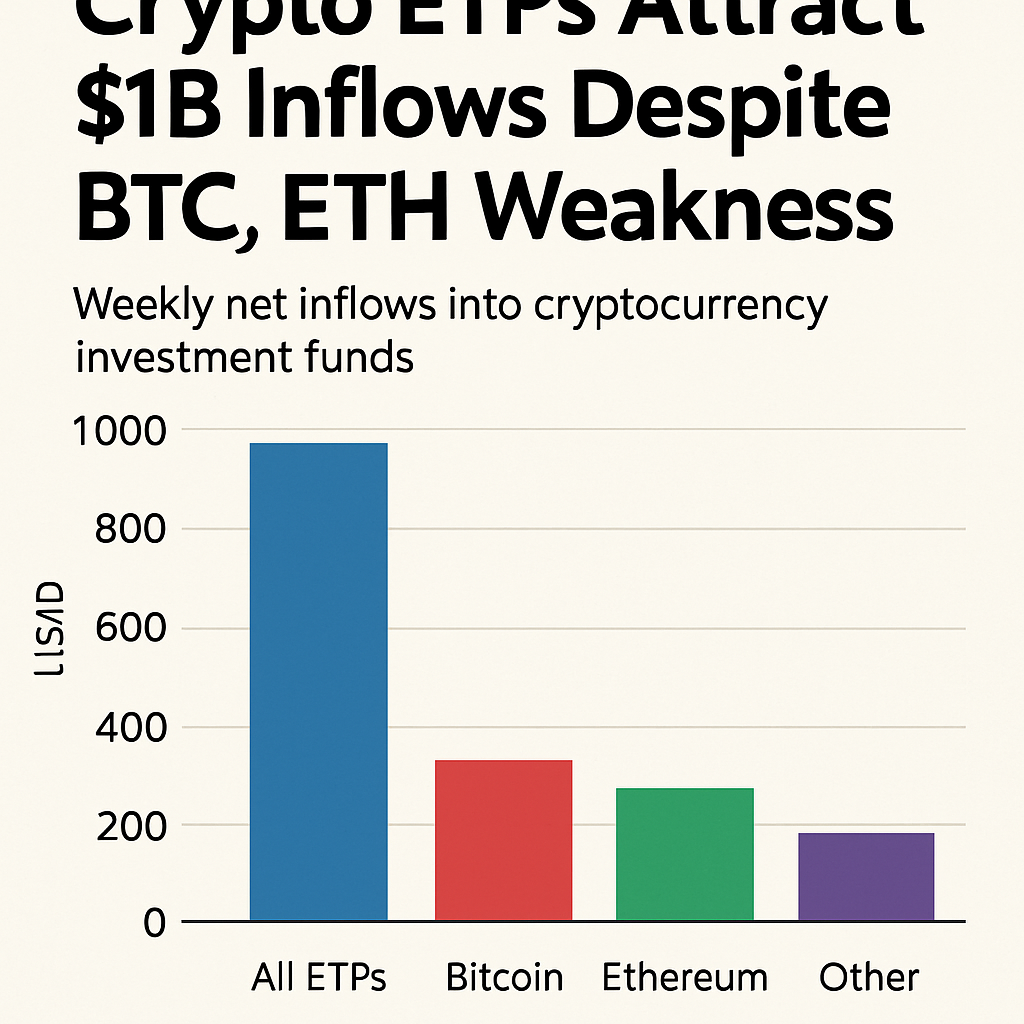

Bitcoin ETPs also recorded net inflows, though at a lower level, highlighting a continued appetite for regulated crypto exposure despite a modest pullback in Bitcoin prices. Observers note that inflows into both Bitcoin and Ether ETPs have been resilient, even as broader crypto markets face headwinds from macroeconomic pressures and profit-taking by short-term traders.

According to market data, the rise in Ether ETP inflows coincided with a renewed focus on Ethereum’s network upgrades and potential ETF approvals, which are expected to enhance liquidity and investor access. Some analysts view the inflow data as a positive signal for crypto asset adoption, suggesting that institutional investors are using ETPs to gain market exposure with reduced counterparty risk.

Overall, the inflow figures demonstrate sustained institutional demand for both leading cryptocurrencies, despite recent declines in on-chain activity and spot trading volumes. The data also reflects a broader trend of capital moving into regulated crypto products, as investors seek to balance risk and return in an uncertain market environment.

Comments (0)