NYSE developing 24/7 trading platform for tokenized securities

The New York Stock Exchange plans a separate blockchain-based venue for tokenized equities and ETFs, operating 24/7 with instant on-chain settlement and stablecoin funding. The platform would remain aligned with existing market structure rules and require regulatory approval. ICE is collaborating with Citigroup, BNY Mellon and other clearing members to support tokenized deposits across its global clearinghouses.

NYSE Develops Tokenized Securities Platform to Enable 24/7 Trading

The New York Stock Exchange announced plans to build a platform for trading and on-chain settlement of tokenized U.S. equities and ETFs, pending regulatory approval. The system will support round-the-clock trading, fractional shares, dollar-denominated orders, and instant settlement via tokenized capital and stablecoin funding, leveraging NYSE’s Pillar engine with blockchain post-trade infrastructure.

Morgan Stanley Files for Bitcoin and Solana ETFs

Morgan Stanley filed with the US SEC to launch ETFs linked to Bitcoin and Solana, marking a major bank’s entry into crypto products. The move follows recent regulatory updates that eased bank involvement in digital assets. ETFs aim to provide liquidity and simplified compliance.

Bitcoin and Ether ETFs See $200M Outflows Ahead of Christmas

Spot Bitcoin and Ether ETFs recorded combined net outflows of around $200 million on December 24, led by BlackRock’s IBIT with $91.37 million and Grayscale’s GBTC with $24.62 million. Ethereum ETFs saw $95.5 million in redemptions. Analysts attribute the declines to seasonal repositioning and thin holiday liquidity ahead of Christmas.

Coinbase to offer stock trading and event contracts

Cryptocurrency exchange Coinbase announced plans to enable stock trading alongside event contracts tied to real-world outcomes. The expansion, in partnership with prediction market platform Kalshi, aims to diversify revenue by reducing reliance on crypto trading. Tokenised stock offerings are slated for launch in coming months, targeting both existing users and new retail investors.

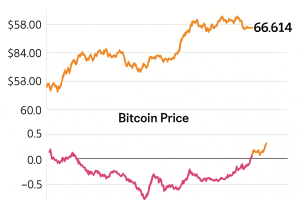

Bitcoin’s Coinbase Premium Index Turns Positive After Weeks

The Coinbase Premium Index, measuring the price spread between U.S. and global bitcoin markets, flipped positive for the first time in nearly a month as BTC traded near $91,000. Record stablecoin balances on Binance suggest potential inflows awaiting deployment.

Dogecoin ETF Debut Flops with Zero Net Creations

Grayscale’s Dogecoin ETF (GDOG) launched on NYSE Arca on Nov. 24, 2025, recording zero net inflows on its first day despite $1.4 million in secondary trading volume. The absence of new creations contrasts with successful staking-yield ETFs, raising concerns about institutional appetite for single-token meme funds amid a pipeline of over 100 planned launches.

Bitcoin Extends Recovery on Fed Cut Hopes as Grayscale’s XRP and Dogecoin ETFs Debut

Bitcoin extended gains following comments from Federal Reserve officials hinting at potential rate cuts, rising above $86,700. Simultaneously, the NYSE approved Grayscale’s XRP and Dogecoin exchange-traded funds, marking their market debut and signaling growing institutional access to altcoin derivatives.

Grayscale's DOGE, XRP ETFs to go live on NYSE Monday

Grayscale’s new Dogecoin (GDOG) and XRP (GXRP) spot ETFs will commence trading on NYSE Arca on Monday, providing regulated market access to these altcoins for U.S. investors. The GDOG and GXRP funds each hold respective underlying assets, joining a broader wave of altcoin ETF launches by major asset managers. Growing institutional demand for non-Bitcoin crypto exposure underpins the recent surge in altcoin ETP filings.

BlackRock Takes First Step Toward a Staked Ether ETF

BlackRock registered a preliminary filing for the iShares Staked Ethereum Trust ETF in Delaware, signaling intent to offer a yield-bearing ether product pending SEC clarity on staking inclusion. The move follows VanEck’s similar filing and prepares for the next phase of competition.

Crypto exchange Kraken submits confidential US IPO filing

Kraken confidentially filed a draft Form S-1 registration statement with the SEC to pursue a US IPO. The filing follows its recent $20 billion valuation and similar moves by Grayscale. The IPO remains subject to SEC review.

Singapore Exchange to launch bitcoin and ether perpetual futures

SGX’s derivatives arm will launch bitcoin and ether perpetual futures on November 24, offering 24/7 trading without expiry exclusively for accredited and institutional investors. The move seeks to meet demand for hedging and speculative instruments amid growing crypto market momentum.

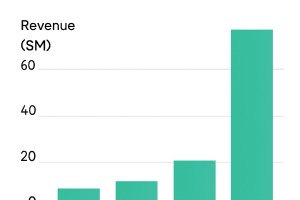

Robinhood’s Crypto Trading Revenue Soared 339% in Q3

Crypto trading revenue jumped 339% year-over-year to $268 million in Q3 on record $80 billion trading volume. Adjusted EPS reached $0.61 versus $0.53 estimates and total net revenue hit $1.27 billion. Shares dipped 2% after hours despite strong growth.

Bitcoin Whales Quietly Embrace BlackRock’s IBIT ETF After SEC Rule Change

Large Bitcoin holders have converted over $3 billion into spot ETFs like BlackRock’s IBIT following an SEC rule permitting in-kind creations and redemptions. This trend signals a shift from self-custody toward institutionalized exposure.

Coinbase signs $375 million deal for crypto investment platform Echo

Coinbase has agreed to acquire Echo in a $375 million cash-and-stock transaction. The deal will integrate Echo’s fundraising tools into Coinbase’s platform, enabling private and public token sales via the Sonar product. Plans include later support for tokenized securities and real-world assets.

Binance compensates users $283M after stablecoin depeg chaos

Binance announced a $283 million compensation for users affected by the depeg of three Binance Earn assets during last Friday’s market crash. The payout covers futures, margin and loan collateral losses incurred between 21:36 UTC and 22:16 UTC. New risk controls and pricing logic updates are being implemented to prevent recurrence.

Binance to Compensate Users Affected by Crash in Wrapped Ether, Staked Solana and Ethena’s USDe

Binance announced it will compensate users who suffered losses from a severe crash in wrapped tokens wBETH, BNSOL and USDe after infrastructure stress impeded market makers, causing large price dislocations. The exchange will review cases individually and adopt conversion-ratio pricing for wrapped assets.

UK to Lift Four-Year Ban on Bitcoin ETNs for Retail Investors

The UK Financial Conduct Authority will lift its ban on crypto exchange-traded notes (ETNs) referencing Bitcoin and Ethereum on October 8, 2025, allowing retail investors to access regulated crypto exposure. Experts call the move symbolic without direct spot products but expect it to spur market development.

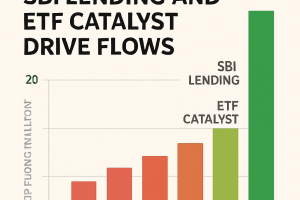

XRP Gains 3% as SBI Lending and ETF Catalyst Drive Flows

XRP rose 3% to above $3.00 amid expanded institutional lending by SBI Holdings and pending ETF approval speculation. Short-term floor identified near $2.99, with resistance capping at $3.10. Seven XRP ETF applications remain under SEC review ahead of mid-October deadlines.

Bullish to launch bitcoin options trading with major industry partners

Bullish will launch bitcoin options trading on October 8, offering European-style contracts settled in USDC with tenors from three weeks to three months. The product leverages a unified margin system and will be supported by leading market makers.

Bitcoin Options Tied to BlackRock’s IBIT Are Now Wall Street’s Favorite

Open interest in BlackRock’s IBIT bitcoin options reached nearly $38 billion after Friday’s expiry, overtaking Deribit’s $32 billion. The shift reflects growing institutional appetite on regulated venues, with IBIT and Deribit now capturing almost 90% of global BTC options market share.

KuCoin Appeals C$19.6M Canadian AML Penalty Over Reporting Failures

KuCoin appealed a C$19.6 million fine by FINTRAC for alleged failures in reporting large cryptocurrency transactions and suspicious activity, disputing its classification as a Foreign Money Services Business. The exchange denies wrongdoing and plans a federal court appeal. This action follows prior US regulatory scrutiny of crypto exchanges.

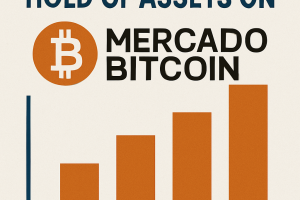

Corporate Clients Hold 10–15% of Assets on Mercado Bitcoin

Brazilian exchange Mercado Bitcoin reports that corporate clients, mainly SMEs, account for 10–15% of assets under custody, holding BTC and stablecoins for conservative treasury management. This trend is reducing market volatility and may spur broader enterprise adoption in Brazil.

Kraken in talks to raise funds at $20 billion valuation

Crypto exchange Kraken is in advanced talks to raise funds at a valuation of about $20 billion with $200–300 million from a strategic investor, Bloomberg reported. The potential round follows a $500 million fundraising at a $15 billion valuation earlier this year.

Kraken Secures $500M Funding at $15B Valuation

Kraken reportedly raised $500 million at a $15 billion valuation, reinforcing its financial position amid IPO speculation. The round aligns with earlier reports of a move toward public listing, as the exchange readies an S-1 filing with the SEC.

Ourbit SuperCEX Launches Puzzle League Registration with $2 Million Prize Pool

Registration opened for the quarterly Puzzle League on September 23, featuring gamified trading events and a record $2 million prize pool. The event runs through October 13 and includes Mystery Box challenges and a Futures Team Showdown. Rewards cover USDT allocations, trading incentives, and referral bonuses.

Bankrupt FTX estate to distribute $1.6B to creditors on September 30

FTX’s bankruptcy estate will release $1.6 billion to verified creditors beginning September 30, marking the third major payout since the November 2022 exchange collapse. U.S. customer claims will recover 40%, dotcom users 6% and unsecured debts 24%.

Bitcoin ETF Inflows Reverse as Fed’s Hawkish Outlook Triggers Market Caution

Spot bitcoin ETFs saw their first daily outflows in over a week, losing $51.28 million after the Federal Reserve signaled fewer future rate cuts. The outflow halted a seven-day inflow streak that totaled nearly $3 billion, though assets under management remain above $150 billion. Ethereum ETFs also registered redemptions of $1.89 million amid cautious market sentiment.

SEC, Winklevoss Twins Resolve Lawsuit Over Gemini Earn Program

The U.S. Securities and Exchange Commission agreed to settle charges that Gemini failed to register its Earn crypto lending program before offering it to retail investors. The settlement, subject to SEC approval, will resolve the lawsuit and pauses further court deadlines, following Gemini’s recent $425 million IPO.

Spot BTC ETFs attract $642M, ETH adds $406M amid ‘rising confidence’

Spot Bitcoin ETFs attracted $642 million and Ether ETFs $406 million on Friday amid rising institutional demand. Fidelity’s FBTC and BlackRock’s IBIT led Bitcoin inflows; BlackRock’s ETHA and Fidelity’s FETH drove Ether inflows. The flows reflect renewed confidence and align with BlackRock’s exploration of blockchain-based tokenized ETFs.

Forward Industries Closes $1.65B Deal to Build Solana Treasury

Forward Industries secured a $1.65 billion PIPE transaction led by Galaxy Digital, Jump Crypto and Multicoin Capital to establish a Solana-focused corporate treasury. Board appointments include Kyle Samani as chairman and observers from Galaxy and Jump. Pre-market trading saw a 15 percent share price increase.

CoinShares Bitcoin Mining ETF Hits Record High as AI Stocks Rally

CoinShares Bitcoin Mining ETF (WGMI) reached a record $33.13 following an AI-driven rally in tech stocks. Nebius Group’s GPU supply deal with Microsoft and Oracle’s upgraded cloud forecast fueled mining stock performance. Fund assets under management rose to $175.7 million.

SEC Delays Decision on Grayscale’s Hedera Trust Amid Expanded ETF Filings

SEC pushes listing decision on Grayscale’s Hedera Trust to November while Grayscale simultaneously files updated registration statements for its Bitcoin Cash and Litecoin trusts under Form S-3. Bank of New York Mellon, Coinbase and Nasdaq’s Arca exchange feature prominently in planned launches and ETF review extensions.

Grayscale Files S-1 for Litecoin ETF and S-3 for Bitcoin Cash and Hedera ETFs

Grayscale submitted an S-1 registration for a Litecoin ETF and S-3 filings for Bitcoin Cash and Hedera ETFs on Sep 9, 2025, expanding its potential crypto fund lineup amid ongoing SEC delays. The filings follow a recent bid to convert its Chainlink Trust and come as Fidelity and VanEck also await regulatory approval.

Exclusive: Winklevoss-Founded Exchange Gemini Taps Nasdaq as Investor

Gemini Space Station has secured a $50 million strategic investment from Nasdaq ahead of its New York IPO. The agreement grants Nasdaq clients access to Gemini custody and staking services and integrates institutional clients with Nasdaq’s Calypso platform. Gemini expects to begin trading under ticker GEMI.

Transparency in Action: CoinEx Confirms 100% Reserve

CoinEx published its Proof of Reserve report showing full backing of user deposits across major assets as of September 8, 2025, 07:00 UTC. Reported reserves include BTC at 101.3%, ETH at 100.05%, and stablecoins above 108%. The disclosure reinforces CoinEx’s commitment to transparency and asset security.

Gemini exchange secures Nasdaq as strategic investor

Gemini Space Station has lined up Nasdaq to invest $50 million in its upcoming IPO via a private placement, securing strategic support ahead of its New York listing this week. The partnership grants Nasdaq clients access to Gemini’s custody and staking services. Trading expected under the ticker “GEMI” on Friday.

Robinhood Stock Jumps 15% on S&P 500 Inclusion; Strategy Slips as Analysts/Saylor Downplay Snub

Robinhood shares climbed 15% after being added to the S&P 500 index effective September 22, while Strategy’s (MSTR) stock dipped following its exclusion despite meeting eligibility. Analysts and Saylor remained unbothered by the index decision.

Backpack Launches Regulated Perpetuals Exchange in Europe Post-FTX EU Deal

Backpack Exchange launched its European arm under MiFID II with perpetual futures offering up to 10x leverage. The Cyprus-based platform completed the FTX EU acquisition, began customer fund restitution and plans expansion to Japan. CEO emphasizes daily proof-of-reserves attestations.

Binance to List OpenLedger (OPEN) Following HODLer Airdrop

Binance has announced the listing of OpenLedger’s OPEN token after featuring it in its HODLer Airdrops program. Eligible users who staked BNB in specified products during the snapshot period will receive retroactive OPEN rewards. Trading for OPEN is set to begin on Binance soon.

Michael Saylor’s Strategy Snubbed by S&P 500 Amid Robinhood Surprise

Strategy (MSTR) failed to secure inclusion in the S&P 500 despite meeting all criteria, causing a 3% after-hours drop in its stock. Robinhood (HOOD) was unexpectedly added, lifting its shares by 7%. Changes take effect on September 22, reshaping crypto-linked equity exposure.

U.S. Bancorp revives crypto custody service for institutions

U.S. Bancorp has resumed its cryptocurrency custody offerings for institutional clients following an SEC accounting rule repeal. The service, originally launched in 2021 and paused in 2022, now supports spot Bitcoin ETFs. NYDIG will serve as sub-custodian while U.S. Bank handles client relationships and regulatory compliance.

First Dogecoin ETF ‘Coming Soon’: REX-Osprey Teases US Launch

REX Shares announced a forthcoming Dogecoin ETF, DOJE, under the ETF Opportunities Trust. The fund seeks to mirror DOGE’s performance through direct holdings and derivatives via a ‘40-Act open-end structure. Approval hinges on effective registration and exchange listing.

Grayscale’s new ETF targets income from Ethereum’s changing tides

Grayscale launched the Ethereum Covered Call ETF (ETCO) to generate income via a covered call strategy on existing Ethereum trusts. The fund distributes biweekly dividends and aims to enhance yield while mitigating downside volatility. Initial assets under management exceed $1.4 million.

U.S. Bank Resumes Bitcoin Custody and Adds ETF Support

U.S. Bank restarted institutional bitcoin custody services after a pause in 2022, now offering support for spot bitcoin ETFs. NYDIG will act as sub-custodian for digital assets under the bank’s Global Fund Services. The relaunch follows enhanced regulatory clarity and demand from fund managers.

Ondo Finance Unveils Tokenized U.S. Stocks and ETFs on Ethereum

Ondo Finance launched Ondo Global Markets on Sept. 3, offering tokenized shares of over 100 U.S. stocks and ETFs on Ethereum. Backed by U.S.-registered broker-dealers, the tokens grant on-chain transferability while preserving full equity rights. The platform targets non-U.S. investors and plans expansion to Solana and BNB Chain.

Crypto Exchange OKX Fined $2.6M in Netherlands for Failing to Register With Dutch National Bank

The Dutch National Bank imposed a €2.25 million fine on Aux Cayes Fintech Co. (OKX) for operating without mandatory registration from July 2023 to August 2024. The penalty was reduced in recognition of remediation efforts and migration of Dutch users to a fully MiCA-licensed entity. The action underscores stricter enforcement ahead of full MiCA enforcement.

Gemini Prepares $2.22B Valuation in U.S. IPO Filing

Gemini, the crypto exchange founded by the Winklevoss twins, filed for a U.S. IPO targeting up to $317 million at a valuation near $2.22 billion. The offering will list on Nasdaq under ticker GEMI with Goldman Sachs and Citi lead underwriters.

Gemini Seeks Up to $317 Million in US IPO

Gemini, founded by the Winklevoss twins, plans to sell 16.67 million shares at $17–$19 each, aiming to raise up to $317 million. The IPO filing indicates a valuation range of $1.9–$2.22 billion based on diluted shares. Net proceeds will fund strategic investments and product expansion.

Binance Unlocks 5x Leverage with LINEAUSDT Perpetual Contract

Binance Futures launched a perpetual LINEA/USDT contract offering up to 5x leverage on September 1, enabling long and short positions without expiration. The contract supports multiple order types amid growing demand for high-potential tokens. Analysts caution leveraged risks and recommend risk management measures.

Binance First Exchange to List Trump-Linked WLFI Token

World Liberty Financial (WLFI) token, linked to the Trump family, gained tradable status with spot pairs against USDT and USDC on Binance. Deposits are live and withdrawals will begin Tuesday. Quizzes are required before trading.

Bitcoin tumbles below $116K in market plunge for leveraged longs

A sudden market downturn liquidated over $585 million in leveraged crypto longs as Bitcoin fell below $116 000. CoinGlass data shows more than 213 000 positions were closed, with Ether and Dogecoin also suffering significant losses.

Block (BLOCK) Token to List on Gate.io Today

The Block (BLOCK) token will list on Gate.io on Aug 30, expanding its exchange availability. Gate.io is known for high trading volumes and global reach. This listing may enhance liquidity and trading volumes for BLOCK amid broader market weakness.

Amplify Files XRP Option Income ETF With $12B in AUM

Amplify Investments has filed with the SEC to launch an XRP Option Income ETF managing $12.6 billion in AUM. The fund will invest at least 80 % in XRP-related instruments, generate income via covered call strategies, and list on Cboe BZX in November.

92 crypto-related ETPs in the works: ‘Floodgates to open soon’

Ninety-two crypto exchange-traded products are awaiting US SEC approval, covering assets from Solana to Dogecoin. BlackRock leads with significant inflows into its Bitcoin and Ethereum ETFs, while pending filings include funds for altcoins, liquid staking and trust conversions.

Hyperliquid’s HYPE Token Hits All-Time High Above $50

Hyperliquid’s HYPE token reached a fresh all-time high above $50, propelled by record derivatives volume and an automated buyback mechanism. Over $105 million in August trading fees funded buybacks that curtailed circulating supply. Analysts praised fundamentals but flagged high valuation and scheduled unlocks as risks.

XPL Futures on Hyperliquid See $130M Wiped Out Ahead of Token Launch

Over 80% of open interest on Hyperliquid’s XPL futures collapsed from $160 million to $30 million in under ten minutes as a massive whale long triggered cascading liquidations ahead of Plasma’s token launch.

Massive $14.6B BTC and ETH Options Expiry Skews Toward Bitcoin Put Protection

More than $14.6 billion of Bitcoin and Ether options are set to expire this Friday, with Bitcoin puts dominating open interest, reflecting a preference for downside hedging. Ether options display a more balanced distribution. Max pain levels sit at $116,000 for BTC and $3,800 for ETH, suggesting focal price zones.

Bitwise Files S-1 to Launch Spot Chainlink ETF

Bitwise Asset Management submitted an SEC S-1 registration statement for a spot Chainlink (LINK) ETF. The proposed ETF aims to track LINK’s market price, with Coinbase Custody Trust as custodian and Coinbase as execution agent, pending a national exchange listing.

Bitget Releases August 2025 Proof of Reserves with 188% Reserve Ratio

Bitget published its August 2025 Proof of Reserves report, confirming a 188% aggregate reserve ratio across major assets. The report shows reserves of 28,022.72 BTC against 7,681.36 BTC in liabilities, and significant overcollateralization in USDT, USDC and ETH, underlining industry‐leading transparency.