Uniswap Governance Approves 100M UNI Burn and Protocol Fee Activation

The Uniswap community has passed the UNIfication proposal with 125.34 million votes in favor, exceeding the 40 million vote quorum. The approved changes include a one-time burn of 100 million UNI tokens from the treasury and activation of protocol-level fee switches after a two-day timelock. This marks a major shift from interface-level monetization toward direct economic capture at the protocol layer, reducing circulating supply and aligning Uniswap’s incentives with token-holders.

XRP holders can now earn yield without selling tokens

Flare Network has launched earnXRP, a fully on-chain vault that allows XRP holders to deposit FXRP and earn compounded returns in XRP via staking, liquidity provision, and carry trades, eliminating token sales and complex strategies.

1inch Unveils Protocol Letting Multiple DeFi Strategies Share the Same Capital

1inch launched Aqua, a liquidity protocol enabling a single wallet to support multiple DeFi strategies simultaneously without locking funds on any platform. Aqua taps assets on demand to boost capital efficiency and a developer SDK is now available. Full front-end release is expected in early 2026.

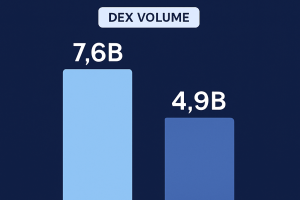

Grayscale calls Solana 'crypto’s financial bazaar': does data back it up?

Grayscale positions Solana as crypto’s financial bazaar, citing user counts, fees and developer growth. On-chain metrics confirm Solana’s leadership in active addresses and DEX volume, though fee baselines and centralization require context for institutional risk assessment.

Tether to Launch Open-Source Wallet Development Kit This Week

Tether confirmed that it will release a fully open-source Wallet Development Kit (WDK) this week, including iOS and Android starter wallets. The WDK features non-custodial support, multiple mnemonic backup options, and a comprehensive DeFi module covering USDT, USDT0, lending, swapping, and asset management.

AAVE Sees 64% Flash Crash as DeFi Protocol Endures Largest Stress Test

Decentralized lending protocol AAVE underwent a 64 percent flash crash on major exchanges, triggering $180 million in collateral liquidations within one hour. Smart contract safeguards prevented protocol insolvency, but rates and incentives are under review to bolster risk thresholds.

Gold-Backed Tokens Hold Firm Amid $19B Crypto Rout with Overbought Signals

Gold-backed tokens PAXG and XAUT recorded under-1% losses during a $19 billion crypto liquidation, outperforming major cryptocurrencies. Gold’s eight-week rally has pushed prices into overbought territory, raising the prospect of a near-term consolidation.

Hyperliquid Launches Based Streams Live Trading Platform

Hyperliquid rolled out Based Streams, a decentralized live-streaming platform that integrates real-time trading overlays, chat and tokenized donations via its Hypercore protocol. The feature debuted at 12:30 UTC with @LH_0302 opening 500 blind boxes on camera. Creators can now monetize and reward viewers seamlessly.

Hyperliquid Launches Based Streams Live Trading Platform

Hyperliquid rolled out Based Streams, a decentralized live-streaming platform that integrates real-time trading overlays, chat and tokenized donations via its Hypercore protocol. The feature debuted at 12:30 UTC with @LH_0302 opening 500 blind boxes on camera. Creators can now monetize and reward viewers seamlessly.

Aave Governance Token Dips Below Key Support Level After 5% Plunge

Aave’s governance token (AAVE) fell 5% to trade just below the $270 support mark, driven by high-volume selling as the overall market weakened. Technical models indicate bearish momentum, with failed recovery attempts confirming sustained pressure. The broader CoinDesk 20 Index was down over 4% during the session.

Grayscale Integrates Staking into Ethereum ETFs

Grayscale has enabled staking for its Ethereum Mini Trust (ETH) and Ethereum Trust (ETHE) ETFs, allowing holders to earn rewards as reinvested gains or cash payouts. The firm also extended staking to its Solana Trust ahead of its prospective uplisting.

Stablecoins Could Draw $1 Trillion in Deposits from Emerging Market Banks

Standard Chartered analysts predict stablecoins may siphon $1 trillion from banks in vulnerable emerging markets over three years as depositors favor capital preservation and access. This represents about 2% of total deposits in countries like Egypt and Turkey.

Aave Breaks Resistance as DeFi Market Hits Record $219B Size

Aave’s native token rebounded by 2% to $287.10 after breaking key resistance levels, contributing to a 6% weekly gain. The broader DeFi market reached a record $219 billion in total value locked, with Aave deposits topping $74 billion.

Tether Plans Tokenized Gold Treasury Firm with Antalpha Funding

Tether is working with Antalpha to raise at least $200 million for a digital asset treasury focused on tokenized gold. The firm plans to stockpile XAUT, a gold-backed token, under custody in Swiss vaults. The move builds on Tether’s expanding asset strategies.

Crypto for Advisors: Is Bitcoin Lending Back?

A pilot resurgence in institutional crypto lending is underway with stricter collateral rules post-2022 crash. DeFi transparency and regulated CeFi services offer renewed trust for wealth managers.

Sui Blockchain to Host Native Stablecoins Backed by Ethena and BlackRock’s Tokenized Fund

SUI Group, Ethena and the Sui Foundation announced two new native stablecoins, USDi and suiUSDe, on Sui blockchain. USDi will be backed by BlackRock’s tokenized BUIDL fund and suiUSDe will use synthetic backing via digital assets. Launch planned later this year to boost on-chain liquidity and protocol utility.

Societe Generale’s Crypto Arm Deploys Euro and Dollar Stablecoins on Uniswap, Morpho

SG-FORGE, Societe Generale’s digital assets unit, has listed its EURCV and USDCV stablecoins on Ethereum-based Morpho and Uniswap. The move enables 24/7 lending, borrowing, and spot trading, with Flowdesk providing liquidity and MEV Capital managing vault collateral.

Maple Finance to Tie Into Elwood to Bring Institutional Credit Strategies On-Chain

Maple Finance and Elwood Technologies have partnered to integrate institutional execution, portfolio, and risk management tools with Maple’s on-chain lending platform, aiming to streamline digital asset credit markets.

Curve Finance founder launches Bitcoin yield protocol

Michael Egorov, founder of Curve Finance, launched Yield Basis, a decentralized protocol designed to deliver sustainable Bitcoin yield on-chain while eliminating impermanent loss. The launch includes capped liquidity pools, a vote-escrow governance model (veYB), and targets institutional demand backed by $5 million in funding.

Bitget Launchpool adds 0G with over 1.7M token rewards

Bitget launched 0G token support in its Launchpool campaign with 1,766,670 0G in rewards. Trading for the 0G/USDT pair began on September 22 at 10:00 UTC, with withdrawals from September 23 at 11:00 UTC. Campaign runs through September 25, enabling users to lock BGB or 0G to earn rewards.

Stablecoin Adoption Set to Surge After GENIUS Act, Hit $4T Volume

Survey of 350 executives by EY-Parthenon indicates stablecoin use is rising among firms due to regulatory clarity from the GENIUS Act and cost savings. Forecast suggests stablecoins could handle 5–10 percent of cross-border payments by 2030, valued at $2.1–$4.2 trillion.

Bitcoin Hyper Presale Raises $200,000 in 24 Hours

Bitcoin Hyper presale attracted $200,000 in its first 24 hours and has now surpassed $15 million in total fundraising. The wrapped token aims to bridge Bitcoin liquidity into a PayFi-compatible layer-2 environment, enabling rapid settlement and DeFi integration. Investors remain focused on security audits and tokenomics amid broader market volatility.

World Liberty Financial Token Holds Steady as Community Backs Buyback-and-Burn Plan

World Liberty Financial token WLFI remains stable near $0.20 after community approved directing all protocol-owned liquidity fees toward a buyback-and-burn model. Market cap stands at $5.4 billion with daily trading volumes around $480 million. Vote passed with 99.48% support and will run until September 19.

Scroll DAO to Pause Governance Structure Amid Leadership Shake-Up

Scroll DAO governance will be paused following leadership resignations and confusion over live proposals. Co-founders announced a redesign toward greater efficiency while existing proposals remain active but without execution timelines. Delegates with significant voting power continue to participate off-chain.

Sky joins bidding war to launch Hyperliquid’s USDH stablecoin

Sky protocol, co-founded by Rune Christensen, has submitted a proposal to support Hyperliquid’s planned USDH stablecoin, offering a 4.85% yield and customizable compliance features. It joins four other major bids for stablecoin issuance governance.

Hyperliquid Advances Plan to Launch Proprietary Stablecoin

Decentralized exchange Hyperliquid announced plans to introduce USDH, its own U.S. dollar stablecoin, via an on-chain governance vote. The move aims to reduce reliance on USDC, capture reserve yield revenues, and support trading volume exceeding $398 billion per month.

DeFi lending jumps 72% on institutional RWA adoption

DeFi lending volumes surged 72% in August as institutional demand for real-world asset collateral grows, according to Binance Research. Stablecoins backed by tokenized bonds and commercial paper underpinned much of the increase. Protocols offering RWA mortgages and asset-backed tokens attracted significant capital flows.

Lido Launches GG Vault for One-Click DeFi Yield Access

The Lido Ecosystem Foundation introduced GG Vault, a new product that automates allocation of ETH, WETH, stETH and wstETH deposits across multiple DeFi protocols. The Vault integrates Uniswap, Aave, Euler, Balancer and other platforms under a single interface. The launch aims to simplify yield generation and support validator diversity.

Trump-Linked World Liberty Team Floats Buyback-and-Burn Plan as WLFI Sinks

WLFI governance team has proposed a buyback-and-burn mechanism using protocol-owned liquidity fees to repurchase and destroy tokens, aiming to reduce supply and restore confidence as WLFI trades down 24% on debut and faces alternative community staking proposals.

Trump's World Liberty Financial tokens begin trading

Some digital tokens backing the Trump family’s World Liberty Financial venture began trading on Monday after a vote by early investors allowed up to 20% of holdings to become tradable. Listings launched on Binance, OKX and Bybit following secondary market preparations.

DeFi will outlast government and corporate walled garden efforts, says Fold CEO

Fold CEO Will Reeves argued that decentralized finance protocols will endure attempts to impose traditional financial controls, predicting that permissionless networks will ultimately prevail despite identity and custody regulations.

Binance Integrates Mitosis (MITO) Across Trading Platforms

Binance has launched the Mitosis (MITO) Layer 1 token across its Earn, spot, and futures platforms. Deposits opened on Aug 29 and trading commenced at 15:30 UTC with pairs USDT, USDC, BNB, FDUSD, and TRY, plus up to 50x leverage on perpetual contracts. A 15 million MITO airdrop is set for BNB holders.

Seazen Group Launches Institute to Tokenize Real-World Assets

Seazen Group created Seazen Digital Assets Institute in Hong Kong to evaluate tokenization of intellectual property and asset income into blockchain-traded tokens. Plans include issuing tokenized private debt and NFTs of commercial properties before year end to enhance liquidity and reduce issuance costs.

Bitcoin-First Startup Secures $50M in Series Funding

Portal to Bitcoin, a protocol for trust-minimized cross-chain trading, has raised $50 million led by Paloma Investments, bringing total funding to $92 million. New capital will support expansion of BitScaler for native Bitcoin scaling without third-party custodians.

Finastra Integrates USDC Settlement into $5T Global Cross-Border Payments Hub

Finastra will integrate USDC into its Global PAYplus payments hub, which processes $5 trillion in daily cross-border flows, aiming to reduce costs and accelerate settlement. The integration highlights growing institutional interest in stablecoin-based transfers. The rollout will begin under existing regulatory frameworks.

Hyperliquid’s HYPE Hits Record High Above $50 on Trading Boom, Token Buybacks

Hyperliquid’s native token HYPE surged 8% in 24 hours to a new all-time high above $50 driven by record derivatives volume and an automated on-chain buyback mechanism. The protocol booked $105 million in August fees, fueling sustained buy pressure. ByteTree analysts highlight strong fundamentals but warn of valuation and upcoming token unlock risks.

AAVE Leads Top 40 Cryptocurrencies With 19% Surge in One Day

AAVE rallied 18.7% to $355.29 amid its V3 launch on Aptos and dovish Fed signals. Aptos deployment included audits, bug bounty and initial asset caps. WLFI exposure was cited as an undervalued catalyst.

Lido and Ethena Rally Over 10% as Traders Snap Up Staking Tokens

Lido’s staked ether token and Ethena’s synthetic yield token both surged more than 10% amid broader market optimism. Traders cited attractive yields, reduced funding costs, and anticipation of protocol upgrades as drivers. Volume spiked significantly on DeFi platforms.

MetaMask Introduces mUSD Stablecoin Backed by Dollar Equivalent Assets

MetaMask has launched mUSD, a new dollar-pegged stablecoin on Ethereum and Linea, with plans for a linked debit card for on-chain payment. The token aims to enhance on-chain utility through low fees and regulatory compliance.

Bitcoin bull and billionaire files for $250M SPAC targeting DeFi, AI

Early Bitcoin investor Chamath Palihapitiya has filed to raise $250 million via SPAC American Exceptionalism Acquisition Corp A. The vehicle will target decentralized finance, AI, energy and defense sectors. SEC registration was submitted Monday.

Centrifuge tops $1B TVL as institutions drive tokenized RWA boom

Blockchain infrastructure platform Centrifuge has surpassed $1 billion in total value locked, joining BlackRock’s BUIDL and Ondo Finance in the tokenized real-world asset sector. CEO Bhaji Illuminati credits institutional deployments and strong onchain allocator demand for the milestone.

Memeagent launches $CHAD token presale to power AI-driven campaign protocol

Memeagent.io opened its $CHAD token presale on Aug 14, offering participants an early allocation in the protocol’s AI-powered campaign issuance network, aiming to enhance engagement through programmatic memecoin creations.

Nasdaq-listed firm slumps 50% on BONK memecoin treasury play

Safety Shot Inc. announced a $25 million treasury allocation into BONK tokens via preferred share issuance, triggering a 50 percent drop in its stock as investors reacted to the high-volatility memecoin strategy.

Tokenized Equities Need ADR Structure to Protect Investors

Ankit Mehta argues that tokenized equity markets should adopt an ADR-style framework to ensure legal clarity, shareholder rights, and custodial safeguards. Depository receipts could bridge traditional securities and blockchain, offering a scalable, compliant model.

Institutional Frenzy Pushes Ethereum DEX Volumes Above Solana

Ethereum DEX volumes surged to $24.5 billion over 48 hours, eclipsing Solana’s $10 billion, fueled by record spot ETF inflows and institutional demand. Uniswap led with $8.6 billion traded, while staking tokens like Lido’s LDO jumped 65% on favorable SEC guidance.

Coinbase Revives Stablecoin Funding Program to Bolster DeFi Liquidity

Coinbase Asset Management relaunched its Stablecoin Bootstrap Fund to provide USDC and EURC liquidity across Aave, Morpho, Kamino and Jupiter. The initiative aims to support emerging and established DeFi protocols amid a $200 billion ecosystem under rapid growth.

Binance Alpha Lists WAI Token with Exclusive Airdrop

Binance Alpha opened trading for the AI-driven World3 (WAI) token on August 12 at 08:00 UTC. Active users can claim an exclusive WAI airdrop based on Binance Alpha Points to incentivize early participation.

Summon.fun Main Coin Launchpad to Debut on Sui Blockchain

Summon.fun is launching this month as the primary coin launchpad on the Sui blockchain, enabling instant meme coin token creation and offering a professional Web3 studio. Expansion to Solana is planned within weeks.

Ethena Labs’ USDe hits $10 B TVL in 500 days

USDe became the fastest stablecoin to reach $10 billion in total value locked, accomplishing the milestone in just 500 days. The rise follows the GENIUS Act’s ban on stablecoin yields, driving capital toward DeFi protocols for yield generation.

Pendle’s TVL Hits Record $8.3B After Launch of Boros Yield Platform

Pendle’s total value locked reached $8.27 billion following the debut of its Boros yield-trading platform, enabling traders to go long or short on funding rates. Initial deposits included over 283 WETH and 6.4 WBTC, while active addresses surged to 1,428. PENDLE token gained 45%, outperforming the CoinDesk 20 index.

SharpLink Raises $200M to Expand Ethereum Treasury to $2B

SharpLink Gaming completed a $200 million direct offering at $19.50 per share with four institutional investors. Proceeds will fund additional ETH purchases to boost the company’s holdings above $2 billion, making it one of the largest corporate ETH treasuries.

Pendle Launches Boros Platform for Betting on BTC and ETH Funding Rates

Pendle launched Boros on Arbitrum, allowing speculation on Bitcoin and Ether funding rates through Yield Units. The platform caps open interest at $10 million and supports up to 1.2× leverage. Planned expansions include additional token listings and liquidity integrations.

Retail XRP Holders Can Now Tap DeFi on Flare, No Seed Phrase Needed

Flare Network launched Luminite, a seedless wallet that enables XRP holders to wrap tokens into FXRP via FAssets and access DeFi protocols without managing seed phrases. Authentication uses passkeys, biometrics or email, simplifying on-ramp to staking, swaps and bridging. The move broadens XRP’s utility by adding smart-contract compatibility to a previously non-programmable asset.