Background and Market Context

On August 23, 2025, Dogecoin experienced a striking surge of 11%, pushing its price to a peak of $0.24. This breakout was accompanied by trading volume nearly doubling the monthly average, underscoring increased institutional participation. The rally followed dovish signals from the U.S. Federal Reserve and the launch of the first state-backed stablecoin in Wyoming, both of which lifted sentiment across crypto markets.

Key Developments

Earlier in the week, the Fed indicated a softer stance on crypto banking regulations, easing compliance burdens for digital asset firms. Wyoming’s stablecoin initiative demonstrated growing acceptance of blockchain-based payment solutions at the state level. Additionally, Thumzup, a Trump-linked entity, acquired Dogecoin mining firm Dogehash for $50 million, creating what executives claim to be the largest DOGE mining operation. Whale wallets have accumulated over 680 million DOGE tokens this month, further validating institutional flows into the token.

Technical Analysis

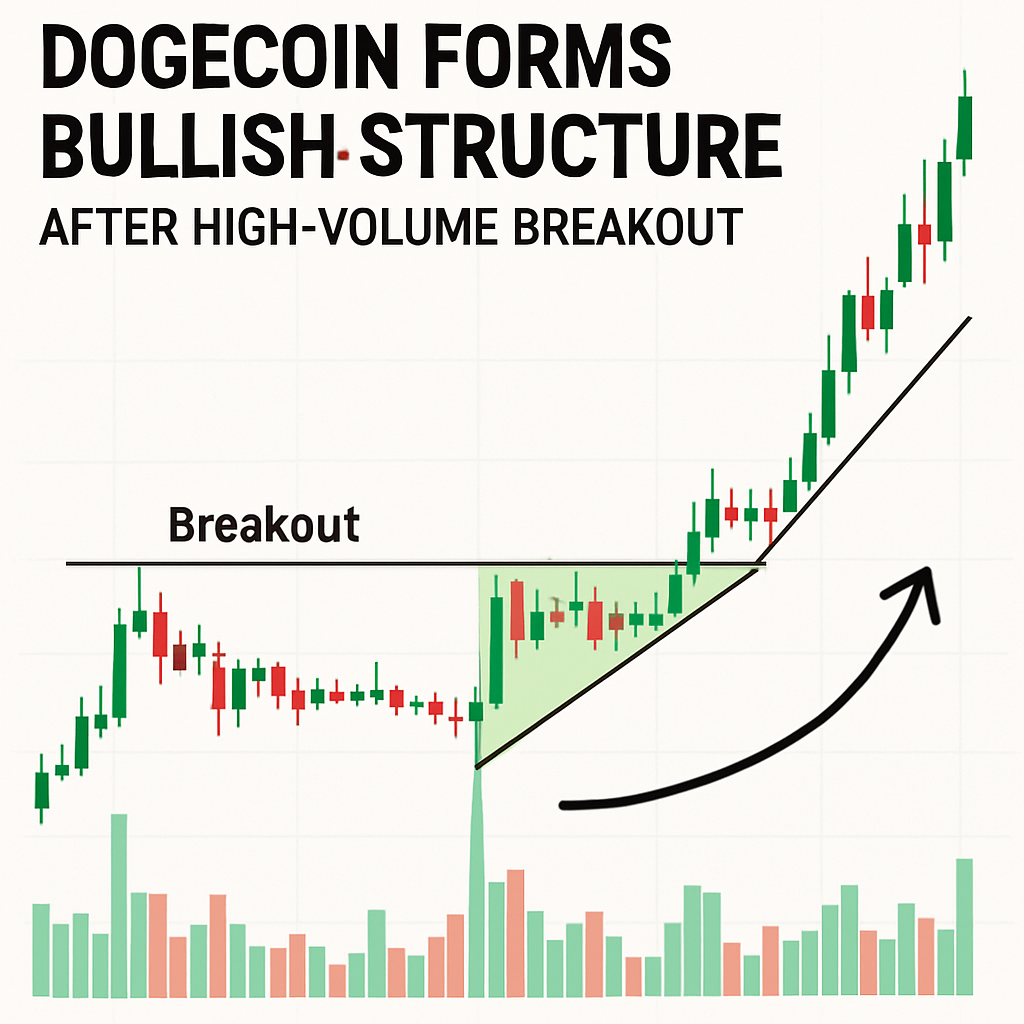

Chart analysis reveals a clear bullish structure characterized by consecutive higher lows and sustained buying pressure. Support now holds at $0.21, confirmed by a successful intraday retest, while resistance has been established at the $0.24 psychological level. Volume spikes reached 4.27 billion tokens at the breakout point, nearly 97% above the 30-day average, indicating strong demand from larger players.

Moving forward, a decisive close above $0.24 may pave the way for targets at $0.26 and beyond, while failure to hold current support could see a retest of $0.21. Traders are monitoring open interest and whale accumulation patterns for signals of trend continuation or potential profit-taking.

Implications and Outlook

The recent Dogecoin breakout highlights the evolving role of meme tokens in institutional portfolios. Enhanced regulatory clarity and state-level stablecoin programs have broadened the market’s risk appetite. If momentum sustains, DOGE could attract further capital from both retail and institutional investors seeking high-beta exposures amidst a bullish macro backdrop.

In summary, Dogecoin’s technical structure and fundamental catalysts align in favor of continued upside, provided key support levels remain intact. Market participants will closely watch volume dynamics and broader altcoin performance to gauge the sustainability of this rally.

Comments (0)