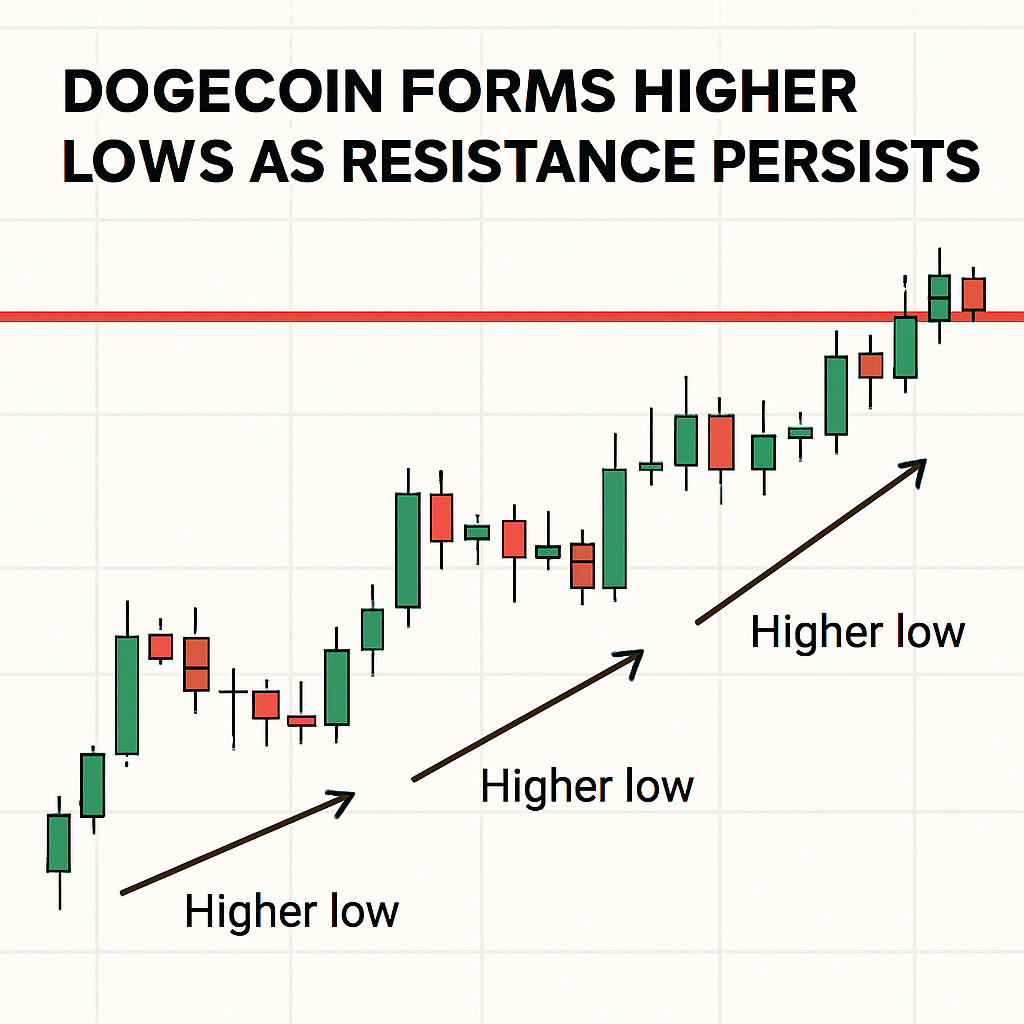

Dogecoin (DOGE) displayed a measured intraday consolidation on September 8, trading within a narrow band between $0.213 and $0.221. Buyers successfully defended the lower demand zone around $0.213–$0.214, triggering swift rebounds, while sellers maintained pressure near $0.220–$0.221, preventing any decisive breakout. Volume spikes on rebounds indicated renewed buying interest, but momentum faded into the session close, preserving a pattern of higher lows under persistent resistance.

Intraday Price Dynamics

The token’s price action adhered to a 3–4% swing range. Early in the session, DOGE dipped to lows of $0.213, where resting bids halted further decline and prompted a V-shaped recovery. Subsequent attempts to breach the $0.220 threshold encountered rejection, producing a cluster of wicks near the upper boundary. The closing hour saw subdued volume, suggesting that traders awaited a stronger catalyst to commit to continuation moves.

Technical Indicators and Patterns

- Support: $0.213–$0.214 remains the key demand zone, with a break below exposing $0.210–$0.212 and down to $0.205.

- Resistance: $0.220–$0.221 must be cleared and held for a potential advance to $0.224–$0.226 and $0.230.

- RSI: Oscillating around the mid-50s, indicating a neutral-to-bullish bias without overextension.

- MACD: Histogram converging toward a bullish crossover, consistent with accumulation on dips.

Volume Profile Analysis

Rebound bounces printed relative volume outperformance, suggesting demand absorption at support levels. Conversely, tests of resistance saw participation taper off, signaling a need for stronger buying sponsorship to overcome seller congestion. Traders will monitor volume expansion on any break above $0.221 to validate a continuation pattern rather than a false breakout.

Market Context and Correlations

Broader crypto market moves provided mixed signals. Bitcoin’s sideways trading offered limited directional cues, while meme-coin sector rotations were muted. Historical correlations indicate that a decisive BTC move often fuels renewed DOGE momentum; thus, attention to Bitcoin’s performance around key thresholds may inform DOGE’s near-term trajectory.

Trader Considerations

Key metrics for traders include order‐flow behaviors at identified zones, derivative market posture (funding rates, open interest), and sector breadth among meme assets. Persistent higher lows suggest underlying bullish interest, but failure to clear resistance could trigger mean reversion toward support. Participants are advised to await a clear volume-backed break above $0.221 or a test of lower support for defined risk entries.

In summary, Dogecoin’s controlled consolidation reflects a market awaiting renewed catalysts. The established higher‐low structure provides a bullish technical foundation, but conviction will depend on volume dynamics and intermarket linkages. A break above the $0.221 ceiling with expanding volume would mark a shift toward continuation, while repeated rejections maintain the range-bound status quo.

Comments (0)