Dogecoin (DOGE) has exhibited heightened trading activity amid renewed ETF speculation, driving a 4% advance over the past 24 hours with significant volume spikes. Price action formed a series of lower highs within the $0.214–0.223 range, signaling distribution as institutional bids supported the $0.214 level. Overnight sessions saw volumes exceed 400 million DOGE tokens, indicating corporate desk participation in resistance tests near $0.223.

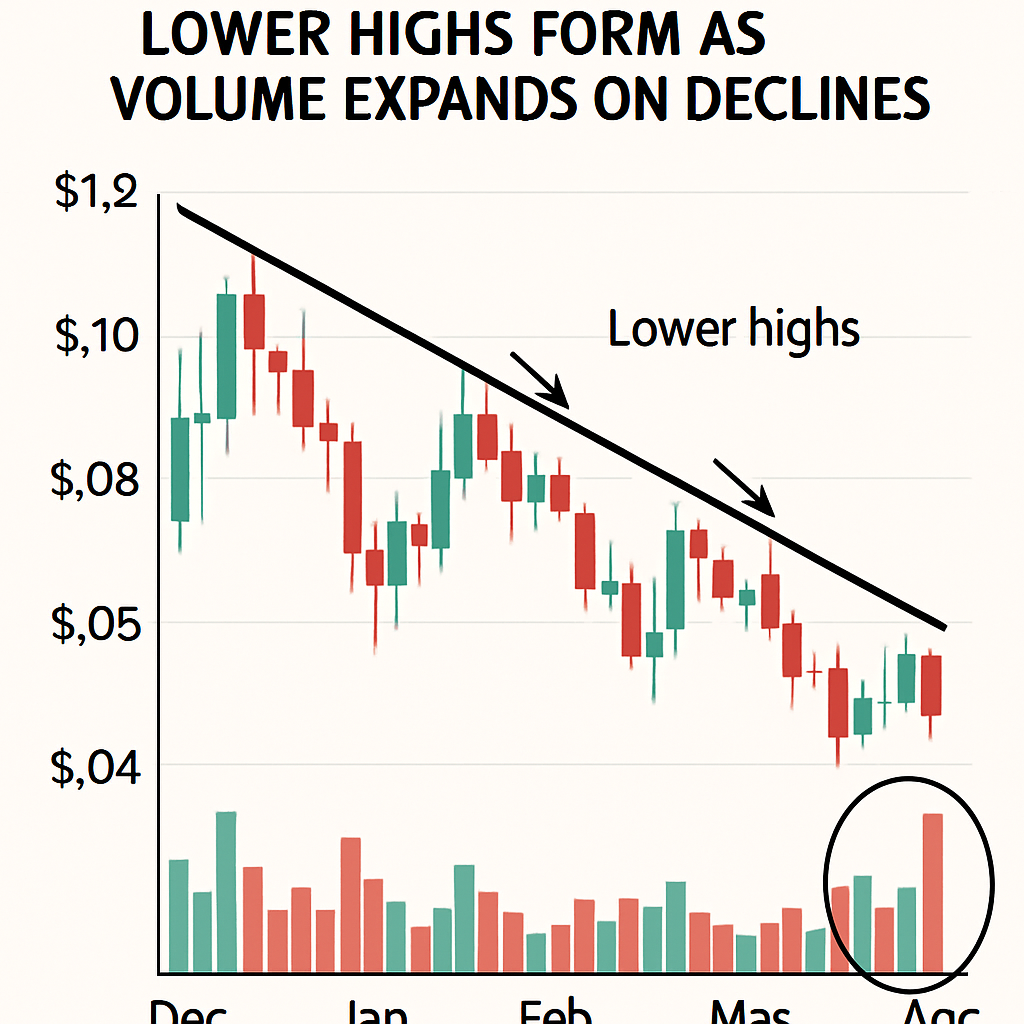

Analysts remain divided on Dogecoin’s near-term trajectory. One camp warns of a downside breakdown toward the $0.17 Fibonacci support level, citing the expanding volume on declines typical of a distribution phase. Conversely, optimistic scenarios project a rebound to $1.00–$1.40 if historical pattern repeats materialize, driven by renewed retail interest and broader risk-on sentiment aligned with Ethereum outperformance.

Key technical factors include confirmed support at $0.214, established through repeated institutional bids, and resistance at $0.223, where profit-taking intensified. Momentum indicators show contracting RSI levels, while MACD histograms remain slightly negative, reflecting waning bullish momentum. Volume profiles highlight accumulation nodes around $0.215 and peak volume near the $0.218 mid-range, offering potential pivot points for intraday strategies.

On-chain data corroborates the technical narrative. Whale address activity has surged, with large DOGE transfers to exchanges and OTC desks preceding volume expansions. Prediction markets on Polymarket have increased ETF approval odds from 51% to 71%, suggesting that regulatory clarity could catalyze renewed accumulation. Funding rate data across major perpetual swap venues exhibits modest increases, reflecting balanced leverage between longs and shorts.

Traders are monitoring key catalysts, including SEC commentary on ETF filings, macroeconomic developments influencing risk appetite, and whale movement patterns tracked by blockchain analytics firms. A confirmed break above $0.223 could trigger short-covering and attract momentum buyers, while a failure to hold $0.214 may invite deeper corrections toward multi-month lows. Effective risk management through defined entry and exit points remains critical amid this heightened uncertainty.

In summary, Dogecoin’s price structure exhibits mixed signals: expanding volumes on declines caution against sustained rallies, yet resilient support and ETF optimism leave room for potential upside. Market participants should closely observe volume-weighted average price (VWAP) dynamics, on-chain transfer metrics, and emerging regulatory news to navigate DOGE’s evolving technical landscape.

Comments (0)