Dogecoin has exhibited one of the strongest performances among major cryptocurrencies over the past week, gaining roughly 40% in value and outpacing the broader market’s 8% average increase. This surge has reignited investor interest in the top memecoin and prompted analysis of its technical and on-chain indicators.

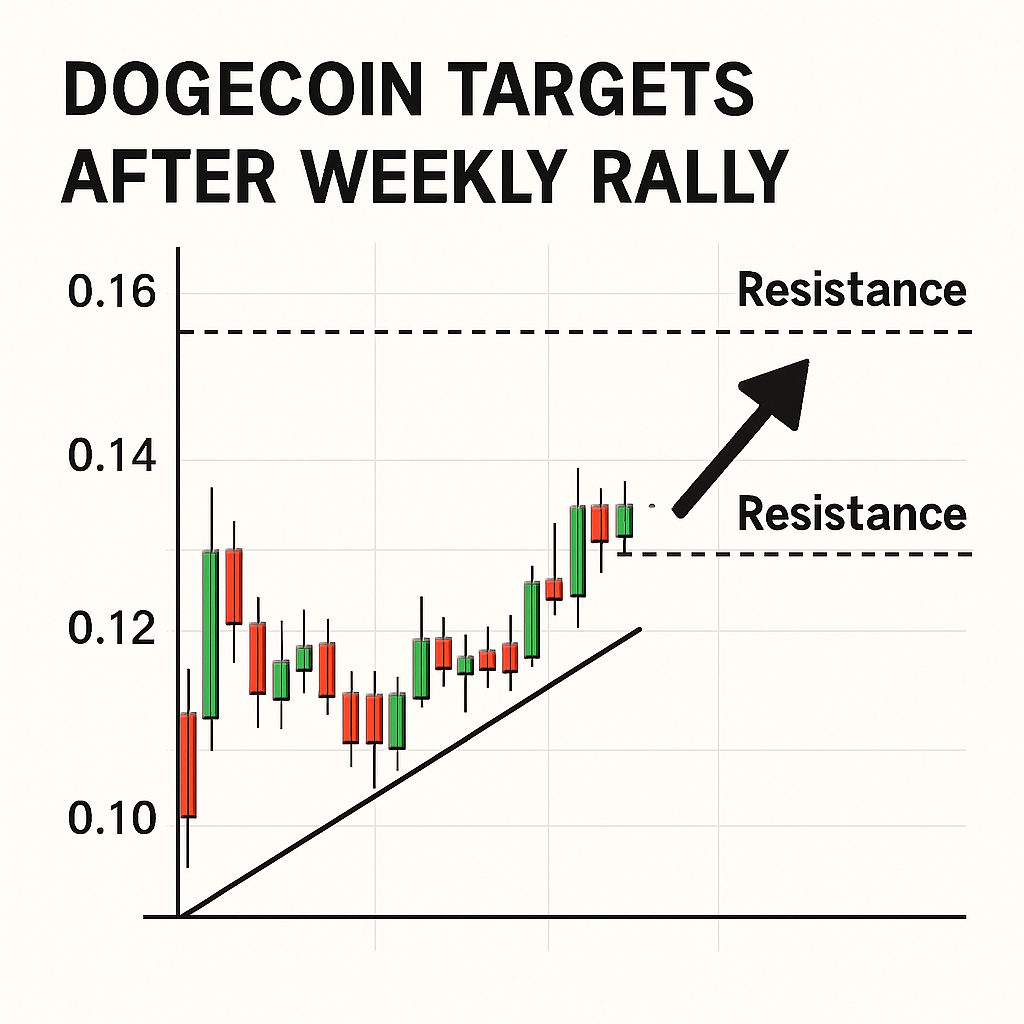

On the weekly price chart, DOGE formed a classic symmetrical triangle pattern over several months, which typically signals consolidation followed by a decisive directional breakout. During the most recent trading sessions, price action pierced the upper trendline of the triangle, accompanied by a tripling of average weekly trading volumes. Such volume expansion is a hallmark of a genuine breakout, as it reflects a substantial shift in market participation.

Technical targets for the triangle breakout are often calculated by measuring the maximal vertical height of the pattern and projecting it upward from the breakout point. In Dogecoin’s case, this calculation points toward a potential rally toward $0.60, representing nearly 95% upside from the current trading range around $0.31.

Supporting the bullish thesis, the Relative Strength Index (RSI) on the daily timeframe remains below the overbought threshold of 70, suggesting that momentum still has room to expand before encountering significant selling pressure. Meanwhile, on-chain metrics show steady outflows of DOGE from centralized exchanges, indicating increased holder confidence and reduced likelihood of large sell orders triggering a reversal.

Community sentiment and social-media mentions have also been robust. Activity around Dogecoin-related hashtags and discussion threads on major crypto forums has increased by over 50% relative to the previous week. While elevated social engagement can sometimes presage exhaustion rallies, in this instance the narrative remains focused on speculative momentum rather than fear of missing out.

Market depth data on leading order-book exchanges reveal that substantial buy orders are clustered between $0.45 and $0.50, establishing a ladder of support that could facilitate progressive upward moves. Should DOGE navigate through the interim resistance around $0.40, the path toward $0.60 may become clearer to short-term traders and longer-term speculators alike.

Risk considerations include the potential for a retracement to the 50-week exponential moving average near $0.227 if volume contracts or broader market conditions turn risk-off. Additionally, regulatory developments and macro volatility remain wildcard factors that could temper Dogecoin’s trend.

Overall, Dogecoin’s breakout from a long-standing consolidation pattern, coupled with reinforcing volume and on-chain signals, positions it for a notable rally toward $0.60. Traders should monitor key support levels and volume behavior to gauge the sustainability of the current upswing.

Comments (0)