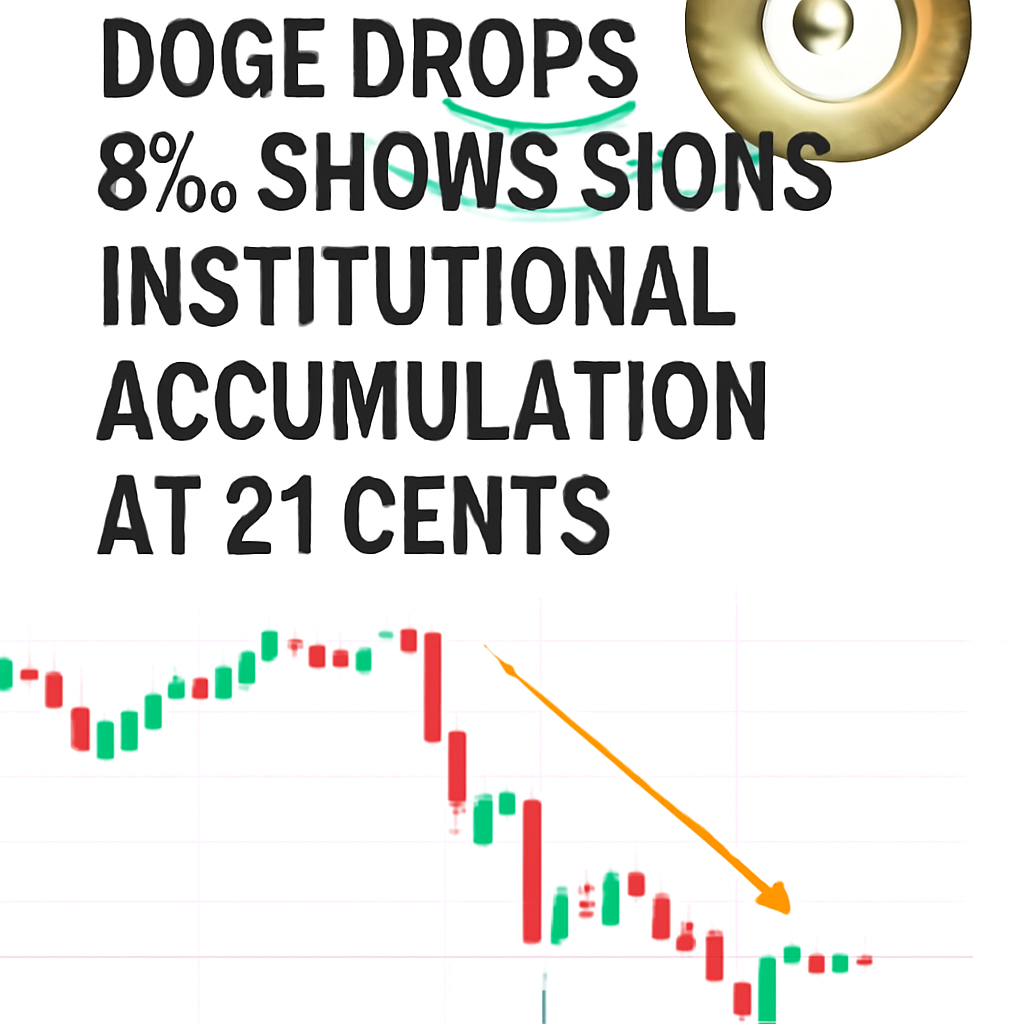

Dogecoin (DOGE) plunged 8% over a 24-hour span, trading from a high of $0.23 to a low of $0.20, before stabilizing at $0.21. The sharp downturn was accompanied by a volume surge to 1.25 billion tokens—over three times the daily average—pointing to forced liquidations across leveraged positions in the final hours of July 31 and early August 1.

Amid the sell-off, on-chain data indicates that institutional and whale-tier wallets accumulated approximately 310 million DOGE, suggesting that larger market participants viewed the dip as a buying opportunity. Notably, Bit Origin disclosed the addition of 40 million DOGE to its corporate treasury as part of a $500 million diversification strategy, reinforcing institutional interest in the memecoin during periods of market stress.

Technical patterns reveal that $0.23 acted as a rigid ceiling, rejecting upward attempts, while $0.21 emerged as a short-term support level tested multiple times. The formation of a potential base at this price band, combined with narrowing intraday ranges, signals a possible exhaustion of selling pressure. Traders are monitoring whether DOGE can hold above $0.20 in subsequent sessions and whether continued accumulation by large holders can underpin a recovery rally. Broader market sentiment, macroeconomic cues and memecoin-specific developments will dictate the next phase of price action for the token.

Comments (0)