Dogecoin (DOGE) posted a late-session rally on August 30–31 after falling 5% in 24 hours amid broad risk-asset weakness and significant whale activity. The token declined from $0.23 to $0.21 during the 24-hour window from August 28 at 09:00 UTC to August 29 at 08:00 UTC, a 3% range reflecting macro uncertainty and liquidations among retail holders.

On-chain data revealed that an unknown whale transferred 900 million DOGE (approximately $200 million) to Binance wallets between August 24 and 25, triggering volatility and an 8% drop in futures open interest. Mid-session flows of 626.3 million tokens cemented $0.21 as immediate support, where consolidation near the floor suggested stabilization after heavy selling.

Despite retail distribution, institutional demand remained evident, with whales accumulating 680 million DOGE during August and hashrate climbing above 2.9 petahashes per second, underscoring network security at record levels. Technical indicators pointed to a neutral-to-bearish bias: an RSI near 45, bearish MACD divergence, and a tight $0.21–$0.23 consolidation phase.

Key Levels and Outlook

- Support: $0.21; breach risks extension to $0.20.

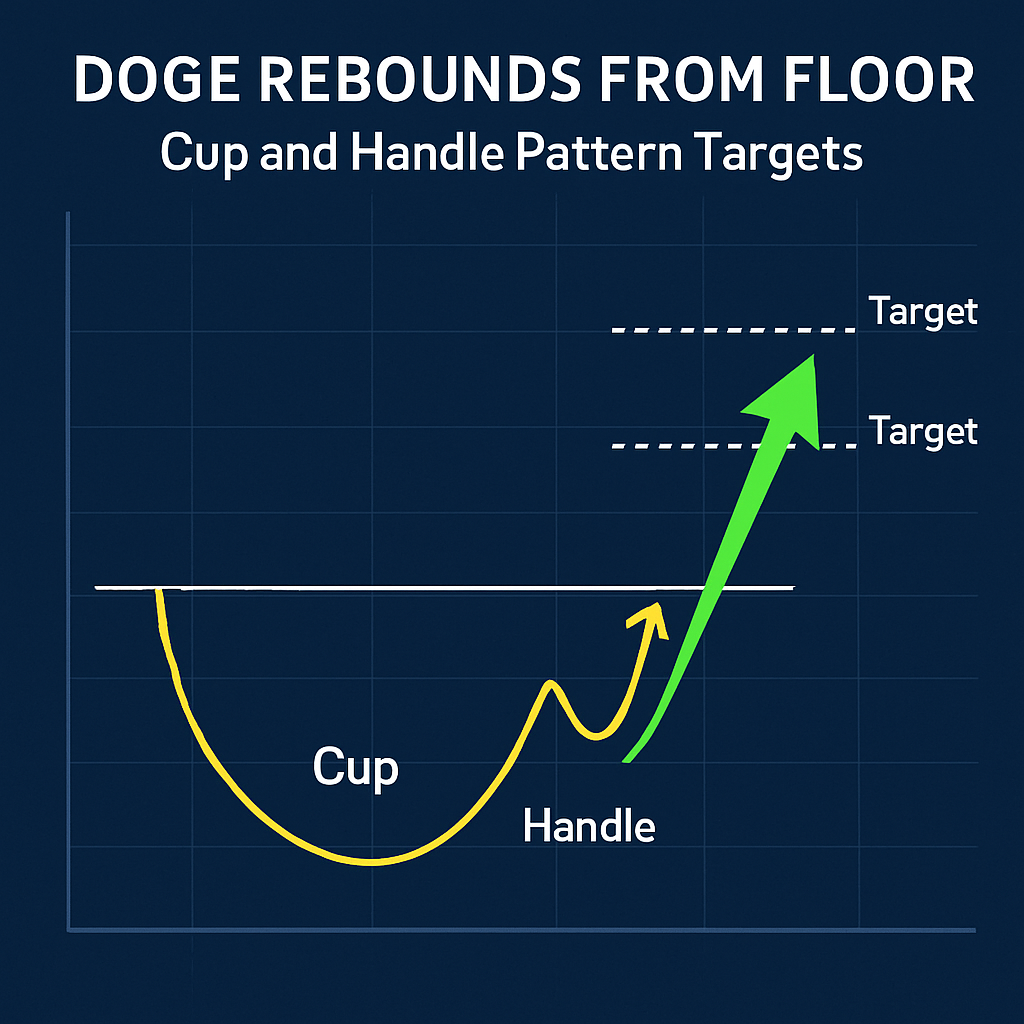

- Resistance: $0.23; breakout above $0.23 could target $0.25–$0.30.

- Volume: Elevated flows signal ongoing institutional distribution.

Traders will watch whether $0.21 can hold under continued whale selling, as well as futures open interest trends for signs of leveraged demand returning.

Comments (0)