Price Action

Dogecoin (DOGE) traded in a $0.011 range between $0.23 and $0.21 over a 24-hour window leading into Aug. 31, 2025, representing a 5% decline amid broader risk-asset sell-off. The most significant move occurred between 07:24 and 08:23 GMT on Aug. 29 when DOGE fell 0.57% on a 27.36 million volume spike, establishing $0.21 as immediate support.

Whale Flows and Institutional Demand

An anonymous whale moved 900 million DOGE to Binance on Aug. 24–25, fueling concerns of distribution and triggering a drop in DOGE futures open interest by 8%. Despite this transfer, on-chain data show 680 million DOGE accumulated by large addresses in August, indicating sustained institutional buying that may underwrite prices at current levels.

Technical Analysis

- Support: $0.21 floor proven by consolidation near session close.

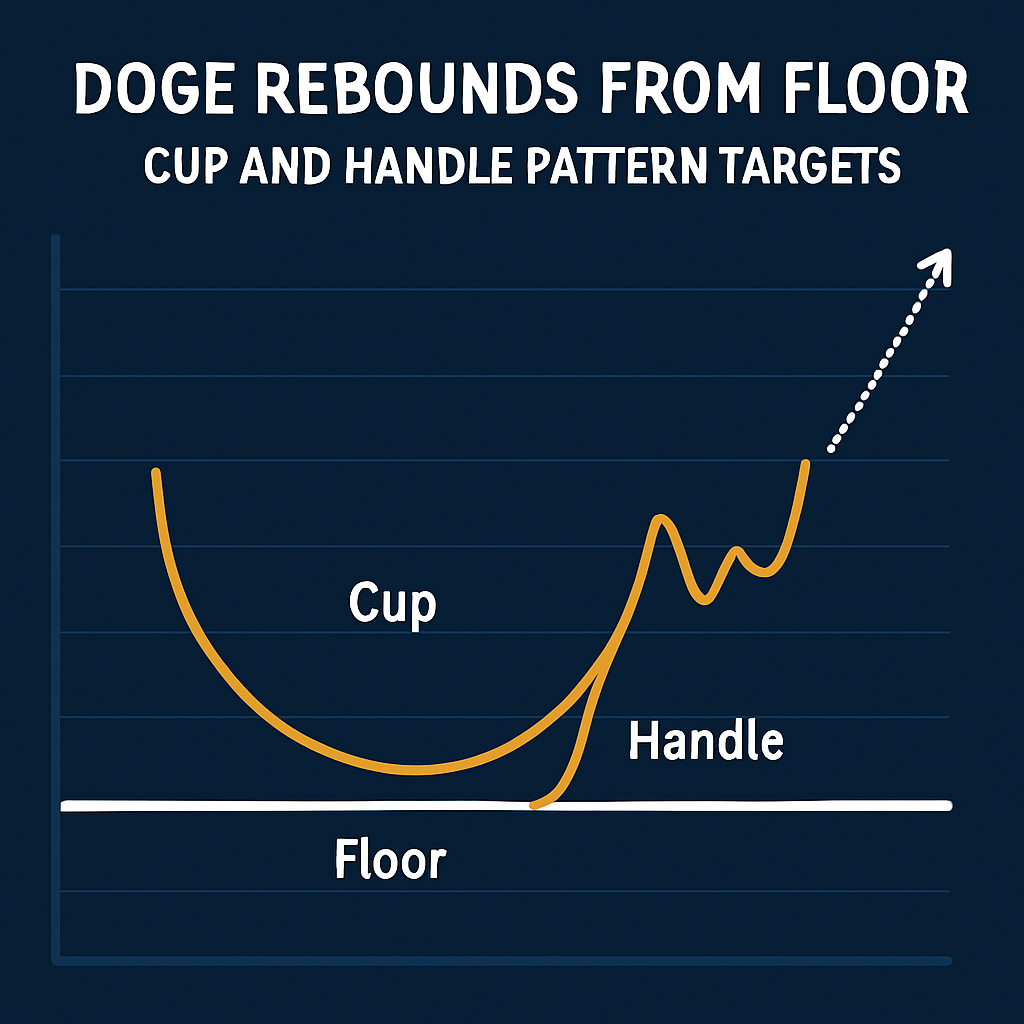

- Resistance: $0.23 short-term cap, next barrier at $0.30 target from cup-and-handle formation.

- Momentum: RSI near 40 midline, edging toward neutral-to-bearish bias; MACD histogram retains bearish divergence.

- Pattern: Late-session rally formed a cup-and-handle shape, implying potential breakout above $0.23 and run toward $0.30 if volume confirms.

Outlook and Risks

Key levels to watch include $0.21 support; breach risks drop to $0.20. A confirmed breakout above $0.23 opens path to $0.25–$0.30. Traders will monitor futures open interest trends and further whale flows to gauge leveraged demand. Sudden liquidity squeezes or macro shifts could trigger sharp reversals.

Conclusion

Dogecoin’s consolidation at $0.21 alongside robust on-chain accumulation suggests a potential rebound if institutional demand persists. Technical patterns point to upside targets near $0.30, but traders should remain vigilant for renewed selling pressure if key support fails.

Comments (0)