Price Action

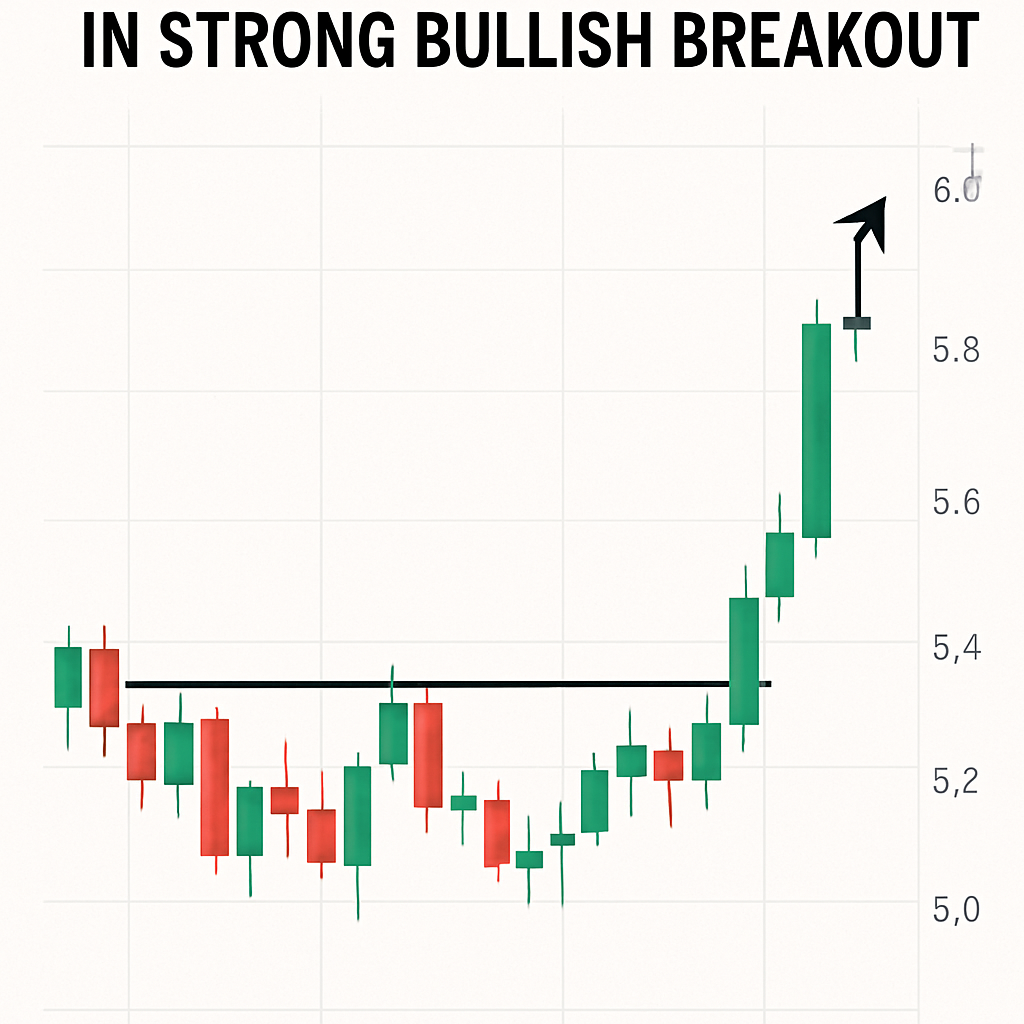

DOT surged 4% over the past 24 hours, escalating from $3.65 to $3.80, marking a strong bullish breakout. The move took place on trading volumes nearly three times the 24-hour average of 1.83 million units, with peak volume of 5.29 million coinciding with the breakout between 10:00 and 11:00 GMT.

Technical Analysis

Support has consolidated at $3.68 after a series of higher lows over the preceding 18 hours. Resistance formed at $3.80, where profit-taking emerged on elevated volume. A descending channel observed during the final trading hour was broken decisively when price closed above the channel with strong volume confirmation.

Institutional Flows

On-chain data and trading records indicate that institutional investors were the primary catalysts, with reported block trades and large order book fills on major venues. The rationale appears tied to rotation from large-cap assets into high-beta altcoins amid bullish sentiment shifts triggered by dovish Fed commentary and market optimism.

On-Chain Metrics

Polkadot’s staking rate dipped to 49.17% in the last week, reflecting increased liquidity unlocking and redeployment into spot markets. Network lockup dynamics have influenced circulating supply, with recent validator nominations and undelegations impacting token availability.

Market Context

The breakout comes amid a broader crypto market rebound, with the CoinDesk 20 index up 3.7% in the past 24 hours. Bitcoin and Ethereum also posted gains above 2%, contributing to risk-on demand. Polkadot’s unique parachain model and planned protocol upgrades have garnered renewed attention from developers and investors.

Outlook

Key levels to watch include support at $3.68 and resistance at $3.80. A sustained close above $3.80 could target $4.00 and $4.20, aligned with Fibonacci extension levels. Conversely, a failure to hold $3.68 may lead to retest of the 50-day moving average around $3.50. Indicators such as on-chain liquidity flows, staking inflows, and open interest in DOT derivatives will serve as directional signals for market participants.

Comments (0)