Introduction

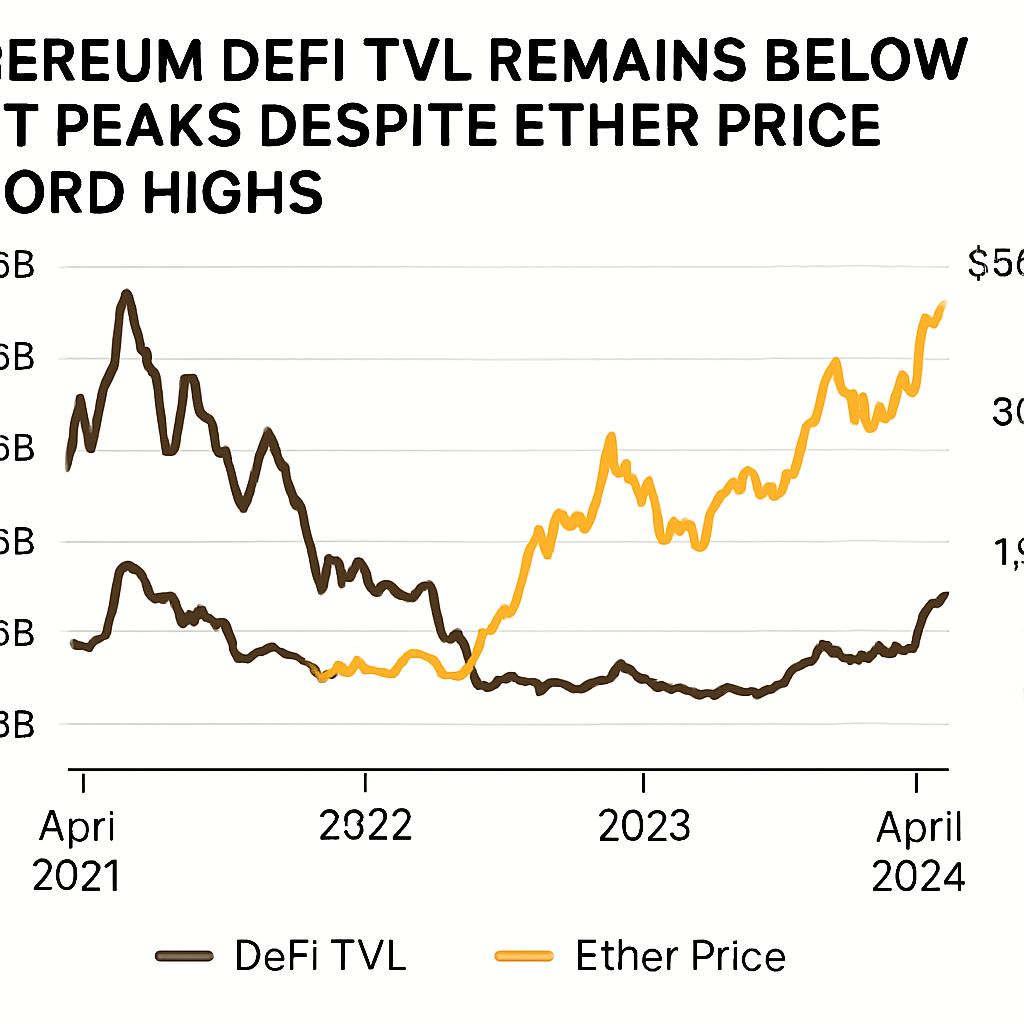

Ether achieved a fresh all-time high at $4,946 earlier this week, yet the underlying strength of decentralized finance (DeFi) appears muted. Total value locked (TVL) across Ethereum-based DeFi protocols has plateaued at roughly $91 billion, failing to reach the previous peak of $108 billion recorded in November 2021.

Historical Context

During the so-called “DeFi Summer” of 2020 and 2021, yield farming and liquidity mining initiatives drove an unprecedented rush of capital into platforms such as MakerDAO, Aave, Compound and Curve Finance. Those protocols offered double- and triple-digit annual percentage yields, prompting both retail and institutional actors to stake large token volumes to secure high returns. TVL served as a key growth metric, with the figure climbing steeply as demand for decentralized lending, trading and staking solutions intensified.

Current TVL Dynamics

By contrast, the present cycle has seen more efficient capital deployment via liquid staking and layer 2 scaling solutions. Liquid staking services like Lido have concentrated billions of dollars of ether without requiring direct deposits into multiple smart contracts, effectively inflating collateral efficiency while reducing raw TVL metrics. Meanwhile, layer 2 networks such as Arbitrum and Optimism have captured significant portions of DeFi liquidity, with Coinbase-backed Base alone holding $4.7 billion in TVL.

Institutional Versus Retail Activity

Data indicates that institutional inflows represent the primary price catalyst this cycle. Net assets in ether-based exchange-traded products jumped from $8 billion in January to over $28 billion by this week. In contrast, retail DeFi activity remains at levels not seen since before Ethereum’s previous price peak in mid-2021. Daily active addresses engaging in DeFi transactions have declined relative to historical norms, and decentralized exchange (DEX) volumes have yet to return to their former highs.

Structural Shifts in DeFi Ecosystem

Multiple factors have driven structural shifts in capital allocation. First, liquid staking protocols offer streamlined access to staking rewards without locking tokens directly into yield farms, resulting in smaller TVL footprints. Second, emerging non-Ethereum chains and sidechains have lured users with lower transaction fees and faster finality, dispersing liquidity across ecosystems. Third, heightened regulatory scrutiny of on-chain lending platforms has tempered risk appetite among decentralized finance participants.

Expert Perspectives

“Despite ETH reaching record new highs, its TVL remains below past records due to a combination of more efficient protocols and infrastructure, as well as increased competition from other chains amid a lull in retail participation,” noted a blockchain research director. Reclaiming TVL peaks may require a resurgence in user engagement, broader adoption of native yield opportunities, and balancing efficiency improvements with incentives for robust on-chain liquidity.

Outlook and Implications

For Ethereum bulls, hope centers on renewed on-chain experimentation, which could draw capital back into DeFi and narrow the gap between protocol usage and token valuation. Until that materializes, Ethereum’s price rallies may lean on thinner foundations, exposing the network to potential corrections if institutional inflows wane. The disconnect between Ether’s market cap and actual DeFi activity underscores how this cycle differs fundamentally from prior price surges.

In summary, the record high Ether price reflects significant macro and institutional demand, but decentralized finance metrics paint a more cautious picture of network health. Stakeholders will monitor whether robust scaling solutions and incentive mechanisms can reignite grassroots engagement, thereby driving both TVL growth and sustainable value accrual within the Ethereum DeFi ecosystem.

Comments (0)