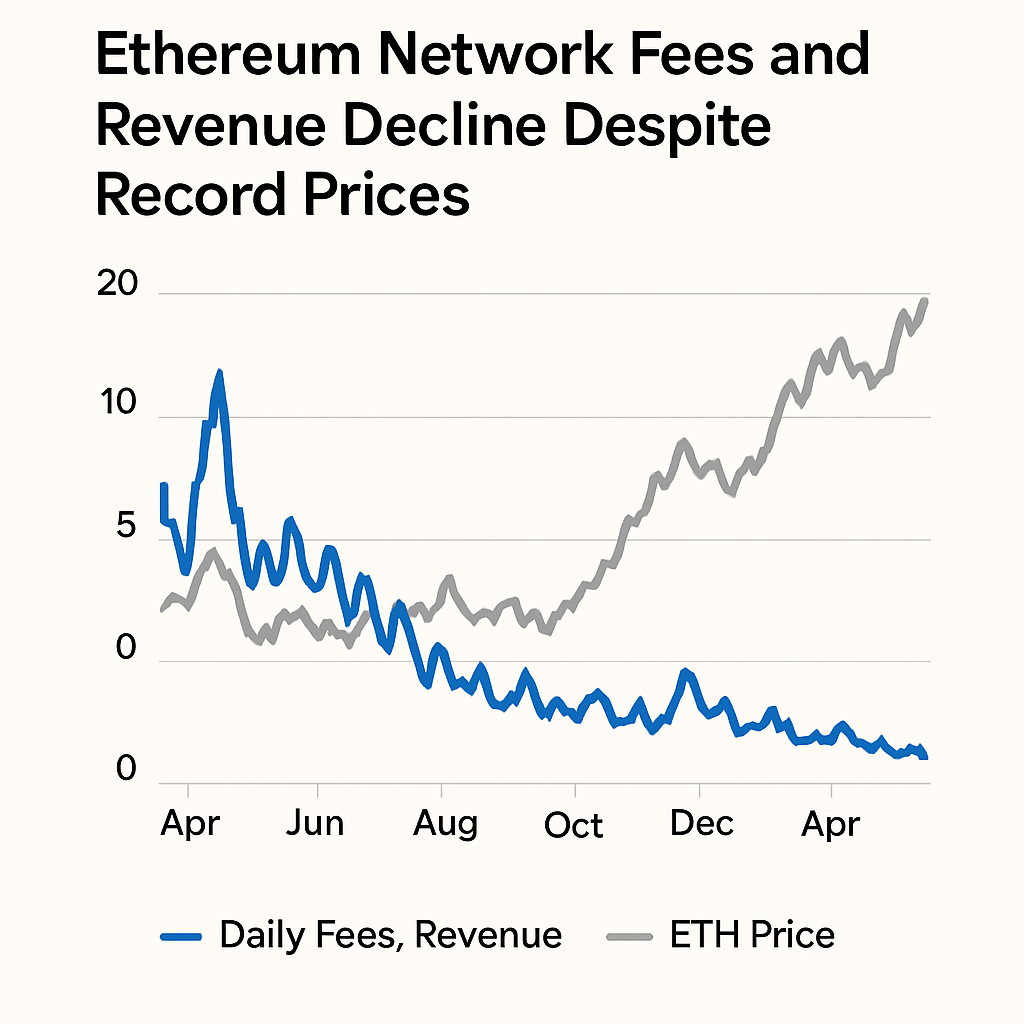

August 2025 delivered record-high Ether (ETH) prices, with the token surging to an all-time intraday peak of $4,957 on August 24, driven by institutional inflows and yield-bearing staking demand. However, key on-chain metrics paint a contrasting picture of network health: revenue for ETH holders, derived from burned transaction fees that accrue to existing token holders under the EIP-1559 protocol, declined by roughly 44% month-over-month.

Data compiled by Token Terminal revealed that Ethereum fee revenue totaled $14.1 million in August, a significant contraction from the $25.6 million recorded in July. The decline occurred against a backdrop of heightened layer-2 adoption and reduced base-fee components, resulting from the Dencun network upgrade implemented in March 2024. That hard fork introduced EIP-4844, which optimized data availability and lowered transaction fees for rollup operators, effectively streamlining settlement processes for emerging scaling solutions.

Network fee volume also experienced a downturn, with gross fees dropping from $49.6 million in July to $39.7 million in August. Analysts attribute the reduction to a shift in transaction throughput toward layer-2 rollups, where higher transaction speeds and minimal fees incentivize activity. As decentralized applications integrate off-chain batch processing, the base chain is reserved for final settlement, dampening fee pressure at the protocol level. This paradigm shift underscores the evolution of Ethereum from a general-purpose computing platform to a hybrid architecture balancing security and scalability.

Revenue contraction has sparked debate over the sustainability of on-chain yield dynamics. Critics highlight risks to validator economics as staking yields pivot from fee-driven payouts toward emission-based rewards. Market forecasts indicate that annual yield rates for staked ETH may compress further if transaction volume remains concentrated off-chain. Proponents counter that expanded staking products and institutional demand for liquid staking derivatives will mitigate revenue shortfalls by offering diversified yield sources.

Institutional participants are reportedly exploring bespoke staking products and liquidity-layer innovations, leveraging smart custody and compliance frameworks. Leading Ethereum public treasury entities have raised over $40 million in strategic funding rounds this year, underscoring continued confidence in network fundamentals. While fee-burn metrics may decelerate, broader ecosystem maturation—characterized by modular architecture, cross-chain interoperability and decentralized governance experimentation—remains a focal point for stakeholders.

Comments (0)