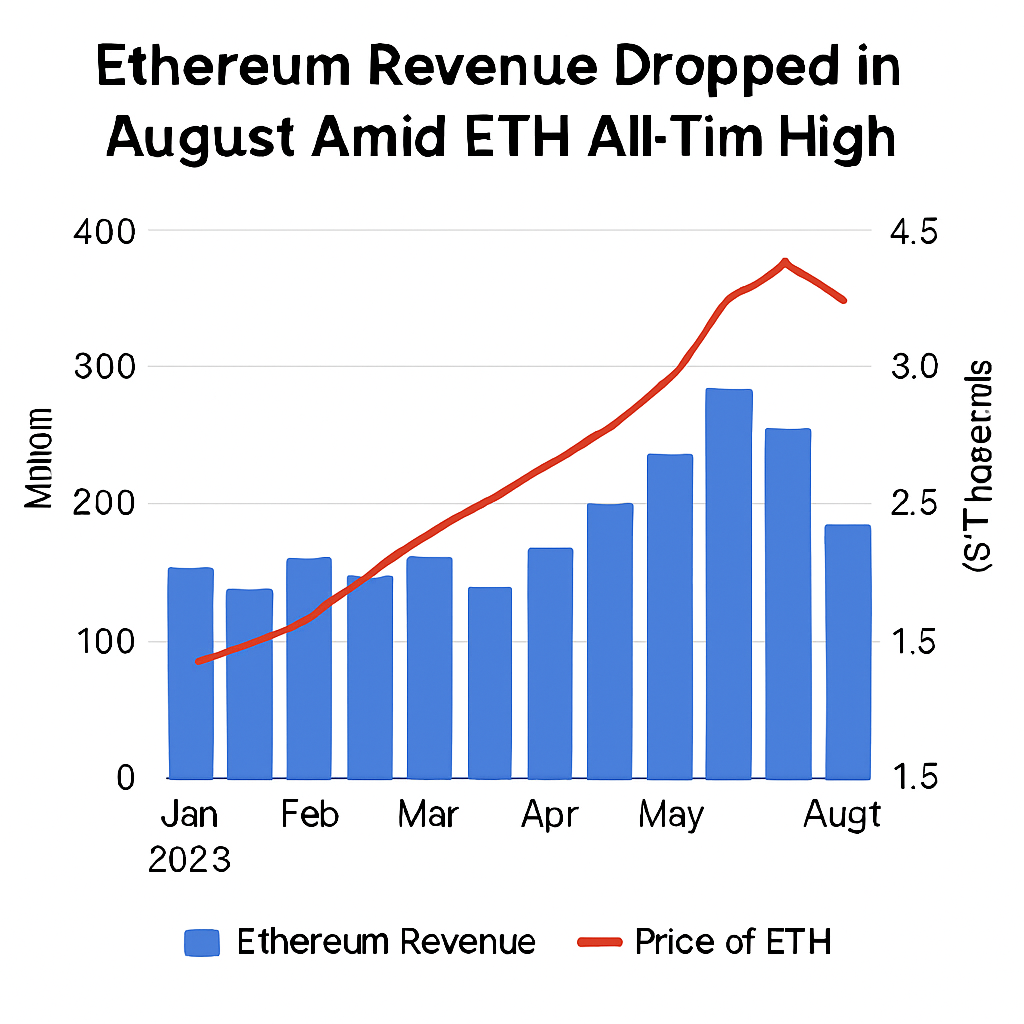

Ethereum network revenue, which represents the share of transaction fees burned and distributed to ETH holders, experienced a significant 44% decline in August 2025 despite the token’s record-breaking price performance.

Data from Token Terminal indicates that August revenue fell to approximately $14.1 million, down from $25.6 million recorded in July—a stark contrast given Ether’s 240% rally since April.

On August 24, Ether achieved an all-time high of $4,957, driven by institutional demand and growing interest in layer-1 staking yield, yet onchain metrics revealed a divergence between price momentum and fee-based revenue streams.

Monthly network fees, a critical component of Ethereum’s economic model post-EIP-1559, also contracted by about 20%, decreasing from $49.6 million in July to $39.7 million in August.

Industry observers attribute much of the fee reduction to the Dencun upgrade implemented in March 2024, which significantly lowered gas costs for layer-2 rollup transactions and constrained layer-1 usage.

As rollup adoption accelerated, onchain transaction volume shifted off the mainnet, leading to reduced base-layer activity and fewer fee burns contributing to network revenue.

This shift has sparked debate about Ethereum’s long-term sustainability, with critics questioning whether lower fees undermine the incentive structure for validators and token holders.

Proponents counter that lower transaction costs facilitate broader adoption, supporting higher throughput and enabling new use cases such as microtransactions and high-frequency DeFi operations.

Institutional entities, including treasury companies and staking service providers, continue to emphasize ETH’s yield-bearing features as a source of predictable returns, even as fee revenue wanes.

Bitwise CIO Matt Hougan highlighted that staking ETH transforms it into an income-generating asset analogous to corporate dividends, reinforcing investor appetite for long-term ETH positions.

Etherealize, an advocacy firm promoting Ethereum to public markets, secured a $40 million capital infusion in September to expand institutional education and public treasury services.

Yet, some analysts warn that a prolonged decline in fee revenue could increase reliance on staking yields and require adjustments to protocol parameters to maintain validator participation.

Ethereum’s governance community is monitoring the impact of EIP-4844 and future scaling proposals, which aim to balance throughput improvements with sustainable tokenomics.

At the same time, competition from alternative layer-1 blockchains offering lower costs and different consensus models has intensified, prompting Ethereum developers to prioritize roadmap commitments.

Market data reveals a 15% increase in active layer-2 transactions in August, reflecting user preference for cost-effective settlement layers and highlighting the evolving multi-chain landscape.

Ethereum’s total value locked across DeFi protocols remained resilient, yet fee-driven revenue models now face the challenge of aligning with broader ecosystem growth.

Looking ahead, proposed network adjustments, such as proto-danksharding upgrades, seek to further reduce data costs while preserving security and decentralization.

The outcome of these developments will shape Ethereum’s role as a foundational layer for decentralized finance, Web3 applications, and emerging enterprise solutions.

Long-term stakeholders emphasize that sustainable network economics depend on a balanced approach combining staking rewards, fee structures, and ongoing protocol innovation.

As the ecosystem evolves, Ethereum’s ability to maintain security, decentralization, and economic incentives will determine its position within the global digital asset landscape.

Comments (0)