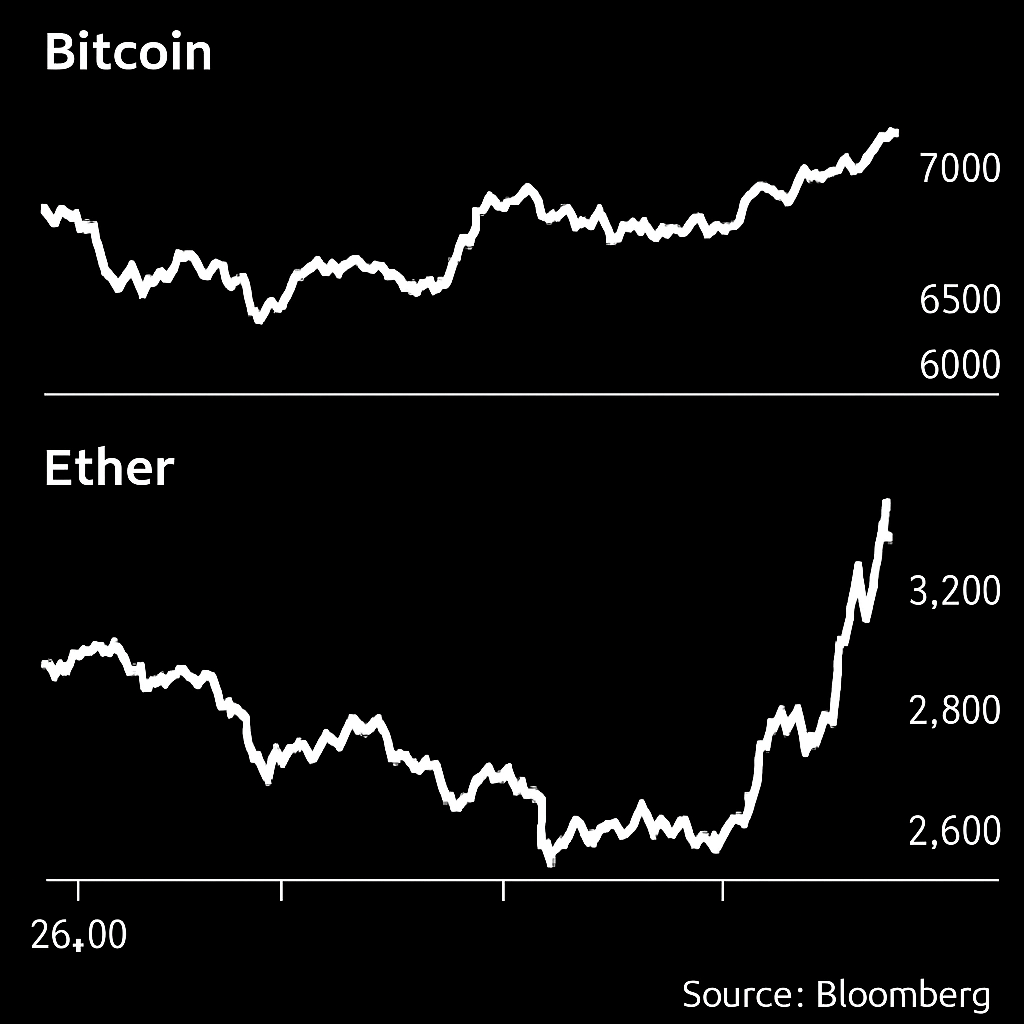

Crypto markets opened the week with a notable divergence in volatility levels. Ether (ETH) led the charge, posting a 21% gain over the past seven days and triggering a spike in implied volatility across short-dated options. BTC implied volatility remained near historic lows, while ETH’s term structure inverted, indicating heightened uncertainty about future price swings. Market participants attributed the divergent volatility patterns to a combination of fresh inflows into both Ether and Bitcoin exchange-traded funds and a stream of pro-crypto regulatory developments at the federal level.

Ether’s rally was fueled in part by record-breaking ETF inflows. According to CoinDesk Data, U.S.-listed Ether ETFs absorbed over $231 million in net new capital on Monday alone, lifting total monthly inflows past $5 billion. The surge in demand followed the SEC’s approval of in-kind creation and redemption mechanisms for spot ETH ETFs, which market makers said would improve liquidity and reduce tracking error. Fund issuers reported an uptick in institutional orders after announcing lower expense ratios and expanded authorized participants, signaling growing confidence in Ether as a mainstream investment vehicle.

Technical traders highlighted several bullish indicators on Ethereum’s charts. The asset held above its 50-day exponential moving average on the four-hour timeframe and formed an inverse head-and-shoulders pattern that many said pointed to a test of the $4,500 level. 24-hour trading volume exceeded $150 billion across major venues, reflecting an active marketplace driven by both spot and derivatives traders. On the derivatives side, open interest in Ether perpetual futures climbed to a new high of $7.8 billion, with funding rates moving into positive territory as longs outnumbered shorts.

Bitcoin (BTC) also registered gains, rising 3% to hover near $122,000, just shy of its all-time high of $123,218 set earlier this year. The comparatively muted BTC volatility was attributed to robust liquidity in the spot futures market and ongoing institution-driven demand for spot Bitcoin ETFs. Market analysts noted that while BTC’s short-dated options remained underpriced relative to historical ranges, ETH’s options market priced in a 45% chance of a 10% drawdown over the next 30 days—a level not seen since the early months of 2025.

Broader equity markets joined the rally. The S&P 500 and Nasdaq Composite reached intra-day record highs amid strong corporate earnings and easing concerns about U.S. interest rates. Several high-profile equity strategists cited the Fed’s dovish outlook and likely September rate cut as key drivers for risk asset performance. Crypto traders echoed these views, suggesting that softer macro conditions would continue to support higher digital asset valuations.

Looking ahead, participants identified several catalysts to watch: Tuesday’s U.S. consumer price index release, which could influence rate-cut expectations; developments around the next Fed chair nomination; and the progress of spot ETF approvals for other digital assets. Meanwhile, on-chain metrics pointed to rising whale activity, with a cluster of addresses accumulating over 120,000 ETH since late July. The confluence of on-chain inflows, ETF demand and regulatory clarity created a bullish backdrop for Ether and Bitcoin, setting the stage for further gains if momentum holds.

Comments (0)