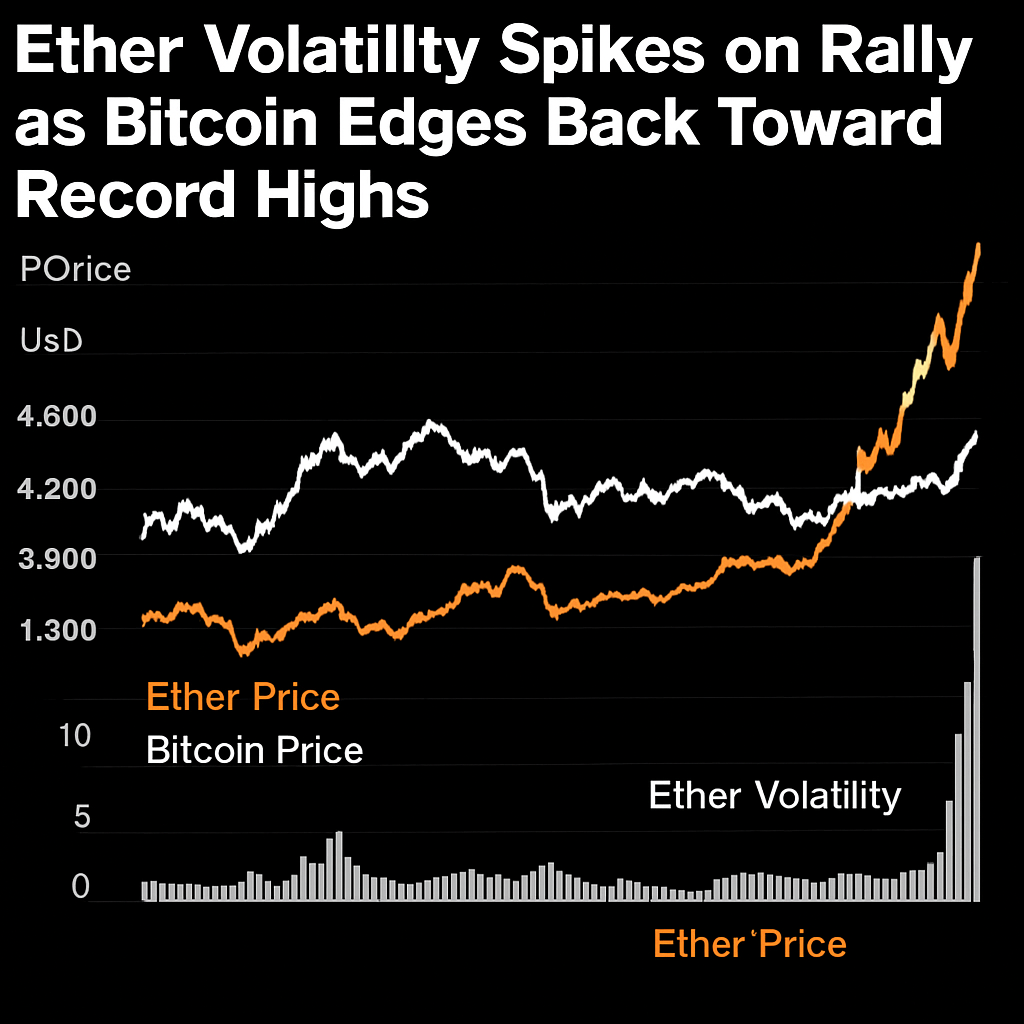

Market volatility for ether surged as the asset’s price rallied past $4,300, while bitcoin continued its advance toward all-time highs. Implied volatility for ether, tracked by on-chain and derivatives metrics, increased from multi-year lows near 26% to readings above 37%. This rise suggests that option traders now anticipate larger price swings in ether over the coming month.

The Deribit Ether Volatility Index (DVOL-ETH), modeled after traditional volatility benchmarks, reflects the market’s collective view of expected volatility. A spike in this index often precedes significant directional moves, as implied volatility tends to rise in anticipation of event-driven catalysts. In this case, heavy inflows into ether spot ETFs combined with pro-regulatory announcements have heightened trader interest.

Bitcoin’s performance has mirrored these dynamics. Bitcoin implied volatility (BVOL-BTC) has also ticked higher, albeit more modestly, moving from deeply compressed levels to values that suggest a return of risk appetite. This convergence reflects renewed institutional interest across major market participants, as options desks and quantitative funds position for anticipated macro events, including upcoming CPI and PPI releases and Federal Reserve policy updates.

On-chain derivatives data indicates that open interest in ether futures and options has climbed by 12% in the past week, reflecting elevated participation. Trading volume in ether perpetual futures on major venues reached record daily peaks, while underlying spot volume maintained strong support. These factors underscore growing engagement from both speculative and hedging participants.

Technical analysis highlights key support and resistance levels for ether. Support exists near $4,000, where significant limit buy orders have been observed, while resistance near $4,500 coincides with prior multi-year highs. Volatility expansion may drive price through these levels, but traders should remain cautious as rapid moves can trigger liquidity imbalances in leveraged instruments.

Overall, the rise in ether volatility alongside bitcoin’s bullish momentum signals a market in flux, balancing robust demand with heightened uncertainty. Continued monitoring of volatility metrics, ETF inflows, and macro developments will be essential for aligning risk management strategies and capital deployment plans in the current market environment.

Comments (0)