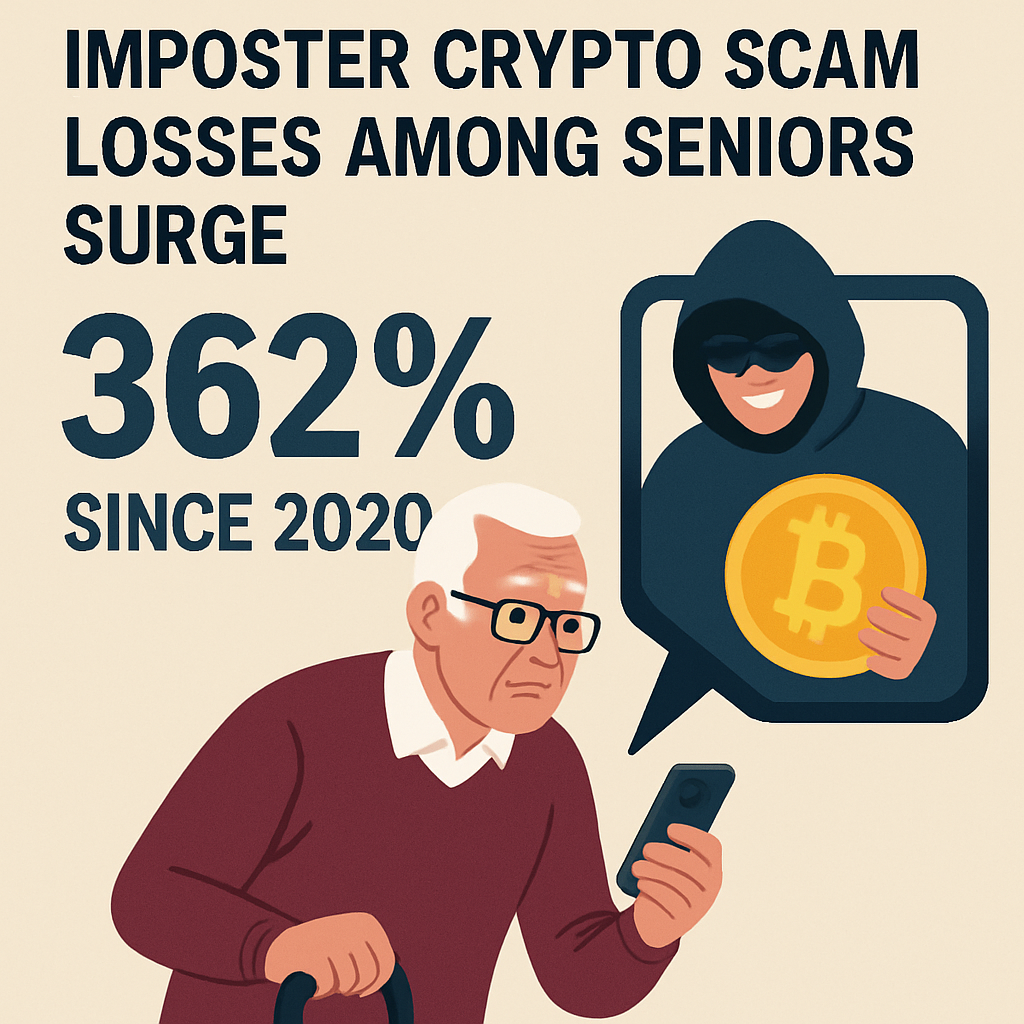

The U.S. Federal Trade Commission has issued a stark warning regarding a sharp increase in losses among senior citizens due to imposter cryptocurrency scams. According to data released by the FTC, reported financial damage from such schemes has jumped 362% since 2020, with total losses exceeding $150 million over the past 12 months.

Imposter scams typically involve fraudsters posing as legitimate crypto influencers, exchange representatives, or government officials who claim to offer insider access, guaranteed returns, or assistance with digital asset management. Seniors, often seeking to diversify retirement portfolios or capitalize on market momentum, have become prime targets.

FTC analysts identified several common tactics: unsolicited calls or messages urging victims to transfer funds to purported “secure” digital wallets, fake customer support lines requesting login credentials, and fraudulent investment seminars marketed as risk-free opportunities. In many cases, scammers exploit fears of missing market rallies or promise exclusive access to pre-listing tokens undergoing initial coin offerings.

Between January 2024 and July 2025, the average reported loss per victim climbed from $3,600 to $7,900. The FTC stressed that actual figures are likely higher due to underreporting, as many victims feel embarrassed or unaware of reporting channels.

In response, the FTC is collaborating with state attorneys general to enhance public outreach, implement targeted educational campaigns, and coordinate law enforcement actions against cross-border scam networks. The agency also encourages financial institutions and cryptocurrency platforms to adopt stronger identity verification processes and real-time transaction monitoring to flag suspicious account activity.

“Seniors deserve protection from high-tech fraud schemes that prey on their savings,” said FTC Chair Lina Khan. “We are redoubling efforts to spread awareness, improve detection, and hold perpetrators accountable at every level.”

Consumer advocates recommend that investors independently verify any unsolicited offers, avoid sharing private keys or passwords, and consult trusted financial professionals before transferring funds. They also urge platforms to provide clear, on-screen warnings about the risks of transferring assets to unfamiliar wallets.

As cryptocurrency adoption grows, regulators and industry stakeholders alike face mounting pressure to balance innovation with consumer safety. The FTC’s latest findings serve as a reminder that elevated vigilance remains essential to safeguard vulnerable populations in an evolving digital finance landscape.

Comments (0)