Gold has emerged as 2025’s standout asset, climbing over 33% this year, compared to bitcoin’s roughly 11% advance and a 12% rise in major equity indices. This performance has driven the BTC-XAU ratio—measuring the ounces of gold required to purchase one bitcoin—to its lowest level since late 2021, currently near 31.2 ounces, down from 40 ounces at the end of 2024. The pronounced divergence reflects persistent economic concerns, elevated government debt burdens, and dovish central bank expectations that have bolstered safe-haven demand for precious metals.

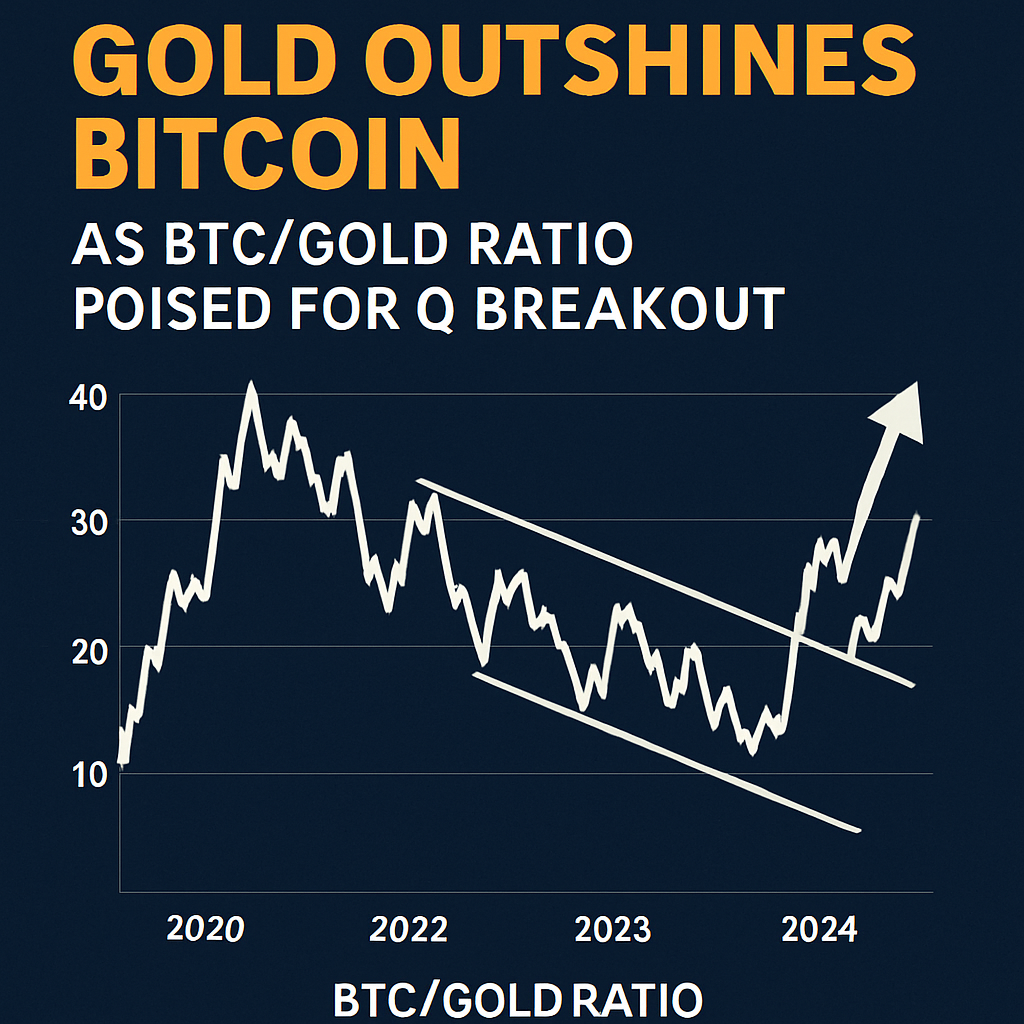

Technical analysis of the BTC-XAU ratio reveals a long-term ascending triangle pattern that has evolved since early 2017. The horizontal resistance near previous peaks around 40 ounces and the rising support line from multi-year cycle lows define a consolidation phase that often precedes strong directional moves. Historical breakouts in this ratio coincided with significant bull runs in bitcoin, notably in late 2020 and early 2021, following protracted consolidation periods. The current setup suggests that a decisive move above the 40-ounce threshold could materialize in the fourth quarter of 2025 or early 2026.

Macro factors underpinning gold’s performance include a retreat in government bond yields across major Western economies, driven by elevated fiscal deficits and subdued growth projections. Real yields on nominal government debt have turned negative in several jurisdictions, enhancing gold’s appeal as a non-yielding asset. Simultaneously, a softer U.S. dollar has amplified dollar-denominated commodity returns. Investment flows into gold ETFs and central bank purchases have further cemented gold’s status as a core store of value.

Bitcoin’s comparatively muted advance is attributable to mixed risk sentiment and rotational flows into yield-bearing digital asset strategies, such as DeFi protocols and staking derivatives. While bitcoin remains a hedge against monetary debasement, its correlation with equity markets and crypto-native volatility has limited its refuge appeal during recent equity drawdowns. Yet, the structural case for bitcoin as “digital gold” persists, supported by transparent supply issuance schedules and growing institutional adoption through spot ETF vehicles.

Looking forward, key indicators include central bank policy communications, fiscal funding pressures, and technical developments within both gold and bitcoin ecosystems. A sustained decline in bond yields or material currency debasement could reinforce gold’s narrative, while renewed rotational buying in digital asset safe havens may brighten bitcoin’s outlook. The evolution of the BTC-XAU ratio will remain a critical barometer of market regime shifts, with a potential breakout offering insights into relative asset performance over the coming quarters.

Comments (0)