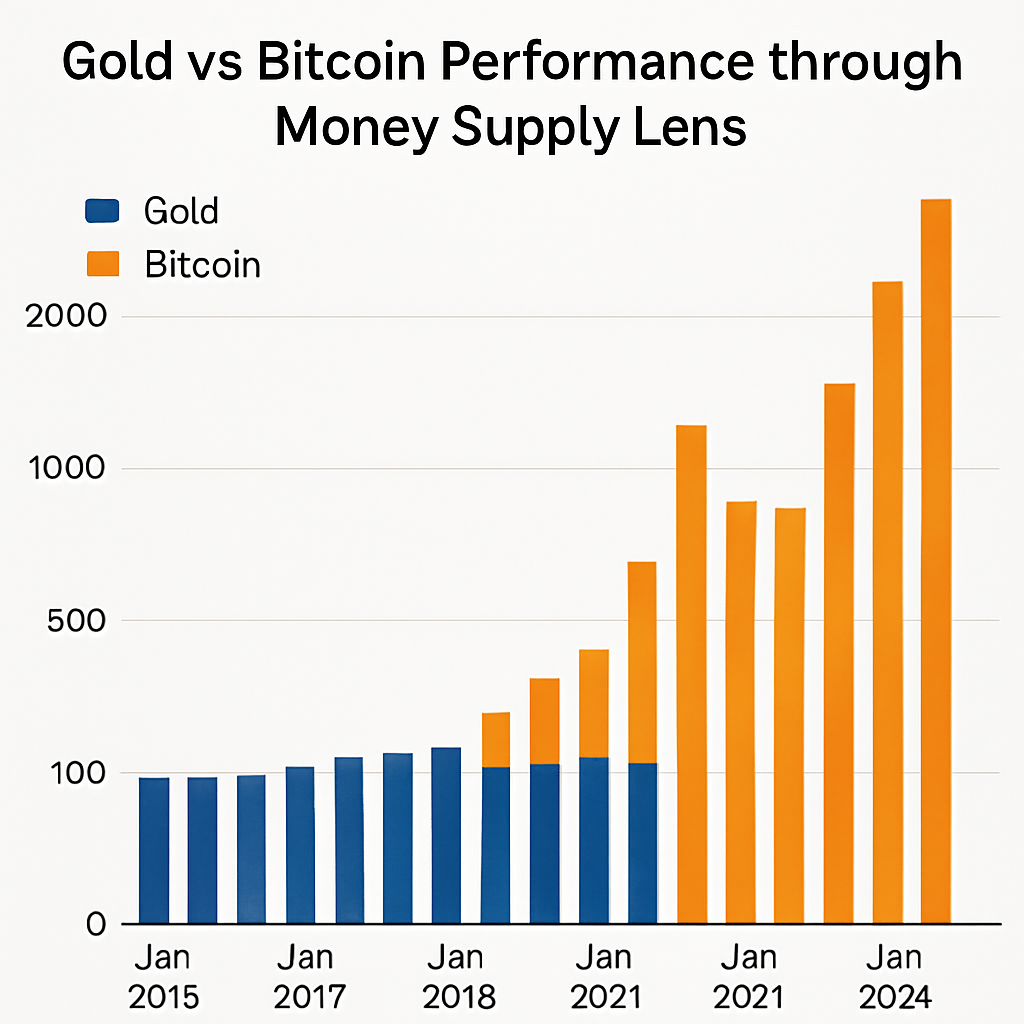

An in-depth comparison of gold and bitcoin against a broad measure of U.S. money supply (M2) highlights distinct performance patterns. Gold, despite a 38 percent year-to-date increase, remains below its 2011 peak when adjusted for money supply, reflecting a muted response to recent inflationary pressures. In contrast, bitcoin has consistently reached new all-time highs relative to M2 during each bull cycle, including the latest surge in September, demonstrating its ability to outpace money creation.

Historical data shows gold’s relative peak in 1980 when inflation and monetary expansion drove demand for traditional safe-haven assets. Since then, gold’s adjusted value drifted lower amid shifts toward digital assets and changes in central bank policies. Bitcoin’s performance defies this pattern, exhibiting sensitivity to monetary policy shifts, ETF inflows, and growing corporate treasury allocations. Its relative high versus M2 underscores its emerging role as a hedge and a speculative growth instrument in an era of aggressive monetary accommodation.

Key metrics reveal that bitcoin’s dominance has oscillated alongside money supply growth, signaling investor preference for a programmable, decentralized store of value compared to physical bullion. This divergence may influence asset allocation strategies, with gold serving as a hedge against prolonged inflation and bitcoin offering asymmetric upside in a low-yield environment. As central banks navigate policy normalization, the interplay between traditional and digital stores of value will shape risk-off and risk-on positioning across diversified portfolios.

Comments (0)