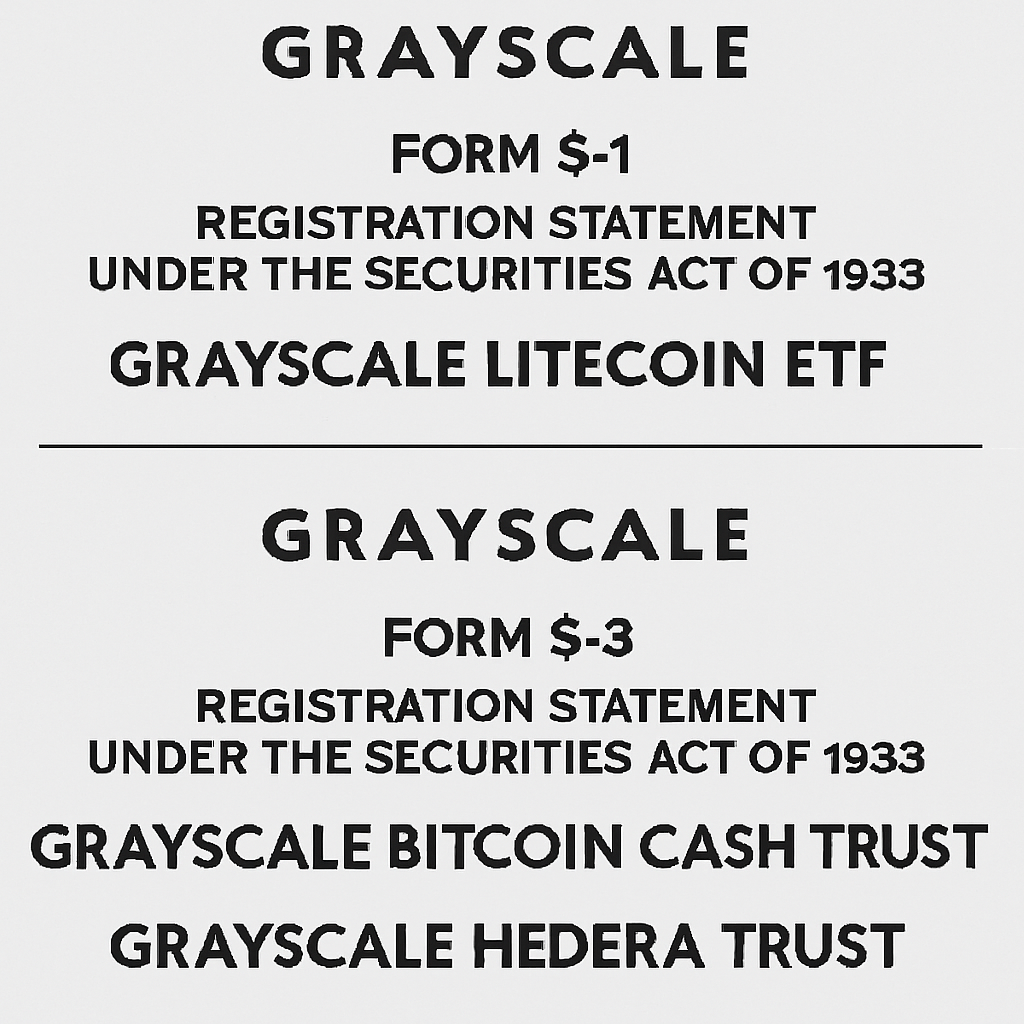

Grayscale, a leading digital-asset manager, filed three new registration statements with the U.S. Securities and Exchange Commission on Sep 9, 2025. The first, an S-1 registration, seeks approval for an exchange-traded fund tracking Litecoin, marking the firm’s entry into single-asset ETFs beyond bitcoin and ether. Simultaneously, Grayscale lodged S-3 shelf registrations for funds tied to Bitcoin Cash and Hedera Hashgraph, signaling an aggressive push to broaden its suite of crypto-linked investment vehicles.

The filings arrive one day after Grayscale renewed its bid to convert the Grayscale Chainlink Trust into a full ETF structure under an S-3 registration. Industry observers note that these coordinated filings underscore a growing consensus among fund sponsors that the SEC will gradually green-light additional spot crypto ETFs later this year. Should these applications succeed, they would join the existing roster of spot bitcoin and ether ETFs, which launched in early 2024 and have since attracted tens of billions in inflows.

The strategic timing of the filings may leverage momentum from favorable legal outcomes and shifting regulatory leadership. Under Chair Paul Atkins, the SEC has delayed decisions on a broad slate of crypto ETF proposals, prompting speculation about an eventual approval wave. Grayscale’s moves also follow high-profile applications from Fidelity Investments, VanEck, and other major asset managers, all vying to secure first-mover advantage in emerging crypto fund categories.

Industry executives emphasize that diversified ETF offerings could catalyze mainstream adoption by allowing investors to gain regulated exposure to various digital assets through familiar brokerage accounts. Such products also aim to address lingering concerns over custody, transparency, and market integrity, as asset managers commit to third-party custodial arrangements, daily NAV disclosures, and robust audit practices. Analysts predict that broader ETF approvals may drive additional institutional demand, further integrating digital assets into traditional investment frameworks.

For now, Grayscale and its peers await final SEC action. Market participants are closely watching subsequent developments, including statements from SEC staff, comment periods, and potential guidance on listing and trading protocols. A favorable outcome could reshape the investment landscape by enabling a new generation of single-asset and multi-asset crypto ETFs, each designed to meet rising demand from retail and institutional investors seeking regulated digital exposure.

Comments (0)