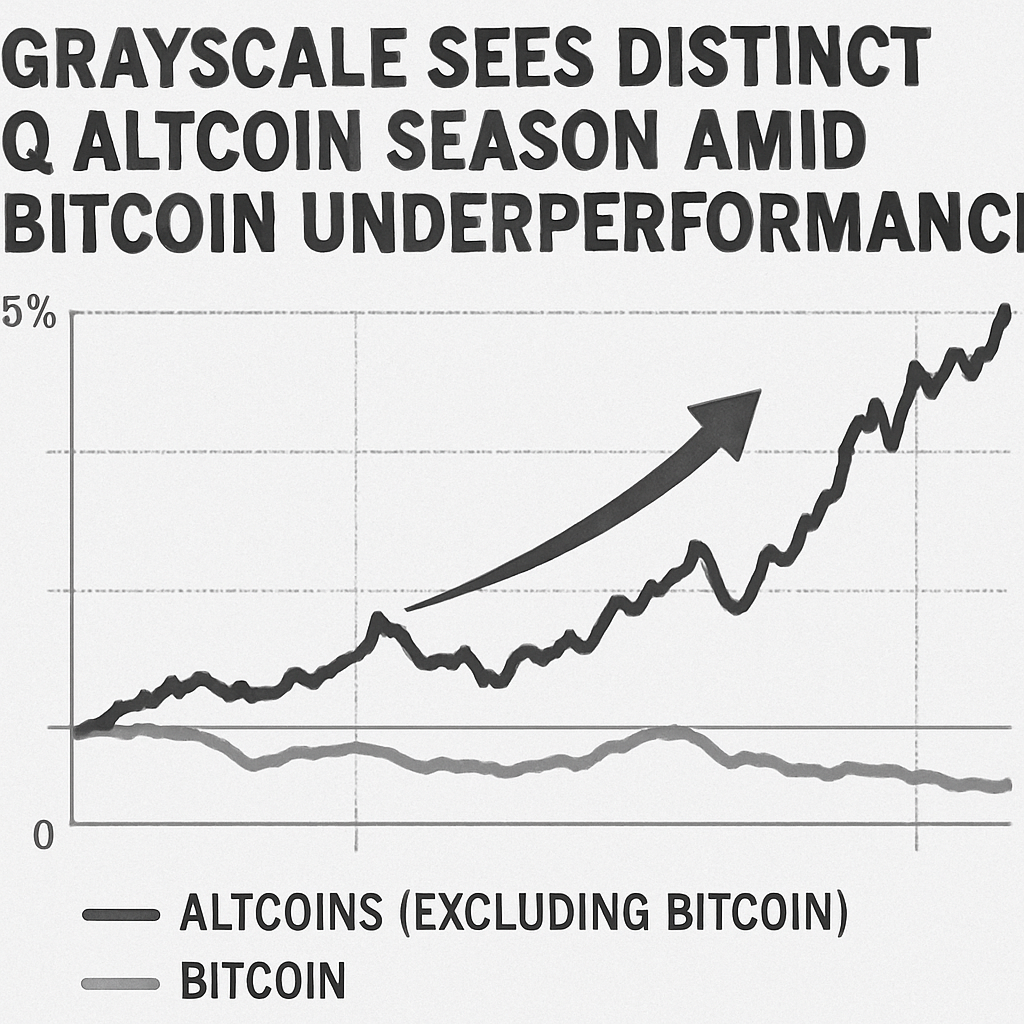

Grayscale Investments has identified the third quarter of 2025 as a “distinct” altcoin season, marked by relative underperformance of Bitcoin and a targeted surge in select alternative tokens. According to the firm’s Q3 report, Bitcoin dominance fell as investors rotated capital into decentralized finance (DeFi) protocols, smart-contract platforms and emerging Layer-2 scaling solutions. This pattern differed from historical altseasons, where broad-based altcoin gains occurred mainly during periods of peak Bitcoin bull markets.

DeFi tokens were particular standouts, benefiting from increased on-chain activity, yield-farming incentives and liquidity aggregation tools. Protocols offering cross-chain interoperability and programmability, such as prominent Layer-1 networks and their Layer-2 extensions, saw average 30-day volume growth exceeding 25%. Meanwhile, memecoin markets stabilized, with fewer instances of speculative pump-and-dump cycles due to tighter community governance and token-burn mechanisms.

Grayscale attributes this shift to more sophisticated institutional strategies, including algorithmic risk parity frameworks and on-chain analytics for yield optimization. Market participants also cited broader macroeconomic factors, such as stablecoin regulation clarity and growing fiat-to-crypto on-ramp services, which facilitated direct exposure to select altcoins. Analysts expect this nuanced altseason dynamic to continue into Q4, with performance contingent on both technical upgrades—such as major protocol hard forks—and evolving regulatory treatments across key jurisdictions.

Comments (0)